In order to achieve key strategic objectives for Dunedin, the Council owns a number of Council Controlled Organisations (CCOs). These CCOs manage facilities, assets and/or deliver significant services on behalf of the Council and the wider Dunedin community. There are three kinds of CCOs – Council Controlled Trading Organisations (CCTOs); not-for-profit CCOs; and non-trading CCOs. Each of the trading CCOs prepares a “Statement of Intent” which sets out its mission, objectives and performance targets for each financial year.

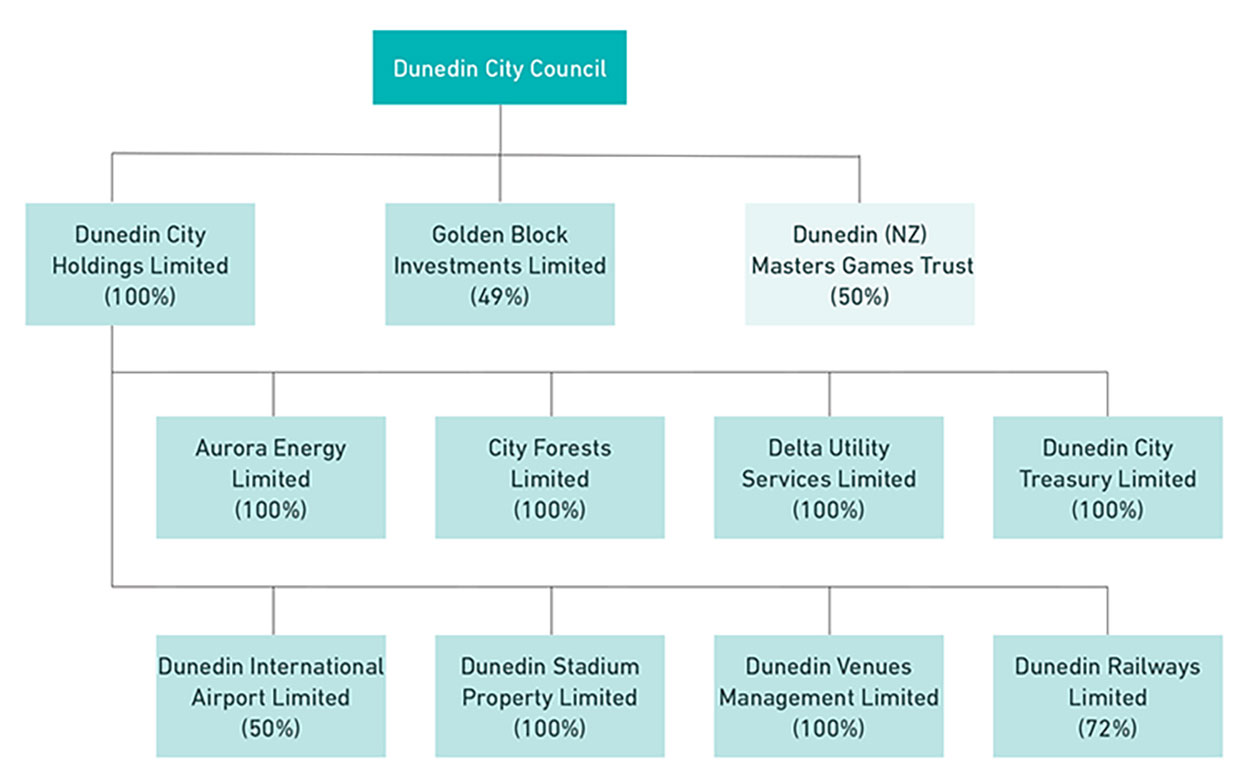

The following diagram illustrates the current structure and ownership of the CCOs.

Dunedin City Holdings Limited and subsidiaries

Dunedin City Holdings Limited (DCHL) is the parent company of many of the Council Controlled Trading Organisations and has the primary role of monitoring the operating performance of its subsidiary and associated companies to ensure each company provides the maximum advantages in all respects to the Council.

The Statement of Intent for DCHL identifies specific objectives and performance targets for 2021/22. The following table sets out the key financial targets for DCHL.

| Interest and dividends provided to DCC | |

|---|---|

| 2020/21 | $ 5.9 million |

| 2021/22 | $ 5.9 million |

| 2022/23 | $ 5.9 million |

Every year, all DCHL’s subsidiary companies prepare a Statement of Intent (SOI). DCHL reviews each SOI and then makes recommendations to Council that they be accepted. It should be noted that each CCTO has financial, social, and environmental performance measures.

The following table lists DCHL’s subsidiary and associated companies and outlines their main activities.

| Nature and scope of activities | Objectives | Key performance measures* |

|---|---|---|

| Aurora Energy Limited | ||

| The company undertakes activities related to the ownership, development and strategic management of electricity distribution network assets and other infrastructural assets | To support the future growth and wellbeing of communities in the Otago region by supplying electricity when and where it is needed – safely, reliably and efficiently. | To deliver electricity supplies to consumers on the Aurora network of a reliability standard that meets the service level targets in the company’s 2020-2030 Asset Management Plan. Contribute to Council’s Strategic Framework and Climate Change and Carbon Neutrality initiatives. Engage with the Shareholder annually on opportunities for the Company to contribute, or assist where possible, with Council’s community outcomes (as listed in the Annual Plan). |

| City Forests Limited | ||

| The Company’s forests are principally located in the Coastal Otago Region while the products produced from its activities are sold on local and international markets. The Company’s scope of activities includes expansion of opportunities in forest ownership and activities across the value chain. | Maintain and enhance the values of the Forest Estate investment, including economic, social and environmental values, through a strategy of sustainable forest management, sustainable harvest levels, fit for purpose asset maintenance, maintaining a safe and capable workforce of both staff and contract employees, and caring for and enhancing environmental values, particularly carbon sequestration, water quality and rare threatened and endangered species. | The Company will achieve a 6% return (or greater) on Shareholders’ funds measured on a post-tax 3 year rolling average basis. The Company will participate in the NZ ETS and may realise returns from the sales of carbon stored in the Company forests in compliance with its Carbon Policy. The company will meet its annual supply commitment to domestic customers taking into account any mutually agreed variations. Opportunities for expanding the Company’s scale will continue to be investigated including joint ventures. The company will report annually on the hectares of land acquired / divested including joint ventures. |

| Delta Utility Services Limited | ||

| The principal activity of the Company is the provision of contracting services, which include the construction, operation and maintenance of essential energy and environmental infrastructure. | To deliver innovative, high quality infrastructure services, by providing smart, sustainable thinking to its customers and always working safe, therefore ensuring the vision of being a leading infrastructure specialist. | Contribute to Council’s Strategic Framework, Climate Change and Carbon Neutrality initiatives. Bring to the attention of the Shareholder any strategic or operational matters where there may be conflict between the Council’s community outcomes and those of the Company and seek the Shareholder’s view on these. |

| Dunedin City Treasury Limited (DCTL) | ||

The company is responsible for managing the funding the Council and its CCOs, and includes cash and liquidity management, group banking and investment management. | Ensure adequate funds are available to meet ongoing obligations, minimising funding costs and maximising return on surplus funds, within acceptable levels of risk. | Manage the liquidity risk of the DCC Group and use a variety of funding sources to achieve appropriate levels of funds as required by the DCC group. Securely invest surplus cash available from within the DCC Group, ensuring funds deposited outside the DCC Group are compliant with the DCC Treasury Risk Management Policy. Manage the ‘Waipori Fund’ fully in accordance with policy and objectives set by Council to achieve the investment objectives. |

| Dunedin International Airport Limited | ||

| The primary activity of the company is to operate a safe and efficient airport utilising sound business principles, for the benefit of both commercial and non- commercial aviation users, and in accordance with the terms of its aerodrome certificate issued by the Civil Aviation Authority of NZ. The company is also responsible for managing assets not currently used for airport activities, but which may be used in the future, e.g., land held for airport expansion, environmental control purposes, or commercial operations inside the airport zone. | To make safety and security first priority. To be environmentally responsible. To optimise commercial return to our shareholders. Increase passenger numbers on regular scheduled services. To develop and strengthen our partnerships. To provide the best customer service experience. | Work with staff and stakeholders to maximise safety on site for all staff, passengers and visitors. In a cost-effective manner, establish systems to measure and publicly report our environmental footprint from our waste, energy, fuel, water and noise by the end of 2021-22 financial year. Achieve increased non-aeronautical activities revenues from activities compared to the previous year. Produce quarterly reports from continuous customer satisfaction surveys. No delays to regular scheduled passenger operations are incurred as a result of airside infrastructure. |

| Dunedin Stadium Property Limited | ||

The primary purpose is ownership of Forsyth Barf Stadium. | Ensure this asset remains a fit for purpose venue for public and private events. | Asset maintenance is compliant with the Asset Management Plan schedules and principles, including condition based assessments. Ensure an appropriate debt repayment programme is in place. |

| Dunedin Railways Limited | ||

| The company previously operated tourist train services. The company is now in hibernation, maintaining assets pending evaluation and consideration of options for the Company and its assets. | Manage the Hibernation Plan to protect and maintain Dunedin Railways Limited’s assets. | Hibernation Plan is prepared and reported on to the Board on a quarterly basis. |

| Dunedin Venues Management Limited (DVML) | ||

| The principal activities of DVML are: source and secure appropriate events for all venues under its management; plan, host and deliver exceptional events; manage the assets and facilities for which it is responsible; facilitate community access to the venues for which it is responsible. | DVML will contribute to the growth and vitality of Dunedin City by driving strong and sustainable business performance, building a reputation for innovation and excellence in venue management and demonstrating our commitment to the delivery of outstanding event experiences. | Achieve a 15:1 return on investment of the Event Attraction Fund. Achieve a minimum of $5m visitor spend per each major event (>10,000 pax) for Dunedin City. Achieve minimum 80% satisfaction rating through surveys of all major events (>10,000 pax). 60% of attendees of all major events (>10,000 pax) to come from outside of Dunedin City. |

* the key performance measures are from the 2020/21 Statement of Intent for each company and are reviewed annually.

Council controlled organisations (not for profit)

Not-for-profit organisations are also considered Council Controlled Organisations if the Council and other local authorities have the power to appoint 50% of the trustees to the Board.

Small organisations

Dunedin (New Zealand) Masters Games Trust On 10 August 2011, the Council granted an exemption under section 7 of the Local Government Act 2002 after consideration of the size of the organisation and the nature and scope of the Trust activities. This exemption was reconfirmed on 24 November 2020.

Minority shareholdings

Golden Block Investments Limited

Golden Block Investments Limited owns and manages a retail property in central Dunedin with the Council being a 49% shareholder. Major tenants include Starbucks, Fisher and Paykel, Millers and Barkers.