Have Your Say on the proposal to sell Aurora Energy Limited, pay off Aurora Energy’s debt and invest the proceeds into an investment Fund.

Decision

The Dunedin City Council has voted to retain ownership of Aurora Energy Limited.

The decision reflects the views of many of the people who took time to make submissions during public consultation.

The overwhelming majority of submissions received – about 80% – favoured keeping the company in DCC ownership as a strategic asset.

Councillors voted 13-2 in favour of retaining ownership.

Read more about the decision at DCC votes to retain Aurora Energy

Submissions open

28 March 2024

Submissions Close

12 noon 2 May 2024

Hearings

14, 15 and 16 May

Decision

Late 2024

Background

Aurora Energy Limited (Aurora Energy) is an electricity distribution business that owns and operates regulated electricity distribution networks in Dunedin, Central Otago (including Wanaka) and Queenstown Lakes.

Aurora Energy is 100% owned by Dunedin City Holdings Limited (DCHL), and DCHL is 100% owned by Dunedin City Council (Council). The “Council Group” is Council, DCHL and its subsidiary companies.

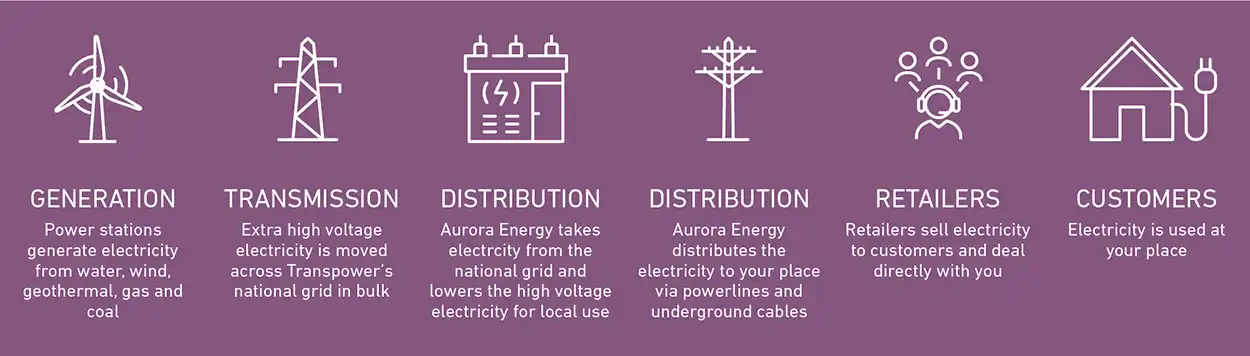

- Generation: Power stations generate electricity from water, wind, geothermal, gas and coal

- Transmission: Extra high voltage electricity is moved across Transpower’s national grid in bulk

- Distribution: Aurora Energy takes electricity from the national grid and lowers the high voltage electricity for local use

- Distribution: Aurora Energy distributes the electricity to your place via powerlines and underground cables

- Retailers: Retailers sell electricity to customers and deal directly with you

- Customers: Electricity is used at your place

Timeline

The Proposal

Council is considering the possibility of approving the sale of Aurora Energy and using the proceeds:

- To repay Aurora Energy’s debt (forecast to be $576 million by mid-2025); and

- To establish a diversified investment fund to generate income for Council.

The diversified investment fund would be worth many hundreds of millions of dollars and be professionally managed. The capital in the fund would be protected and inflation adjusted to protect its value over time, making it an intergenerational asset. Council would receive income from the fund. Council would decide how to use the income through the usual annual plan and long-term plan processes. The income could, for example, be used to offset rates or repay Council debt.

Key reasons for the proposal are:

- To increase income to Council by having a more consistent and sustainable income stream. Aurora Energy has not paid a dividend since 2017.

- To reduce Council Group debt by repaying Aurora Energy’s debt.

- To avoid the Council Group debt increasing to fund Aurora Energy’s future capital requirements.

- To reduce risk by having a diversified investment fund.

Aurora Energy is a regulated company. Consumers would continue to be protected by the Commerce Commission and Electricity Authority if Aurora Energy was sold to a new owner.

Aurora Energy’s most recent Annual Report records that Aurora Energy has total assets of $805 million. Given recent sales evidence for infrastructure companies, interest in purchasing Aurora Energy is expected to be high and is likely to generate a price premium. If Council decided to approve a sale of Aurora Energy, it would set a confidential minimum price that reflects what Council considers (after taking advice) to be the current market value.

Council’s preferred option for consultation is to sell Aurora Energy and to use the proceeds of any sale to repay Aurora Energy’s debt and use the remainder to generate income through a diversified investment fund.

The alternative is to keep Aurora Energy, which is likely to increase in capital value over time. However:

- Aurora Energy is unlikely to provide a dividend to Council in the short term. If it does provide a dividend, it is likely to be debt funded (i.e., Aurora Energy would probably need to borrow funds to provide a dividend to Council).

- Aurora Energy is likely to take on more debt over the next decade which, together with borrowing by Council, is likely to increase the Council Group debt.

A sale of Aurora Energy would not make a difference to this year’s proposed rates increase of 17.5%, but a sale would affect Council’s budgets in the future.

This is because Council expects that, at least in the short to medium term, a diversified investment fund would provide a higher income to Council than dividends (income) from Aurora Energy. As set out above, the income could, for example, be used to offset rates or repay Council debt.

Who are we consulting?

We want to consult widely, so we are asking Dunedin ratepayers, residents and members of the public what they think. We are also asking Central Otago residents and Queenstown Lakes residents what they think as Aurora Energy operates in those areas as well as Dunedin.

The question for you and what we were consulting on is:

Option 1 - Council’s preferred option - Sale of Aurora Energy

Council to approve a sale of Aurora Energy, on the basis that the proceeds are used:

- To repay Aurora Energy’s debt (forecast to be $576 million by mid-2025); and

- To establish a diversified investment fund worth many hundreds of millions of dollars to generate income for Council.

OR

Option 2 - the alternative option - Keep Aurora Energy

Council to keep Aurora Energy. If Council keeps Aurora Energy, then it will likely increase in value over time, but a regular income to Council is uncertain. If Aurora Energy was to pay dividends (income) to Council, this would probably be funded by debt.

What you told us

Information and reports

What happens next?

Submissions open from 28 March 2024 and close at 12 noon on 2 May 2024.

Council will have Hearings in mid-May for anyone that wants to speak to their submission. Council will consider submissions and then make a decision in late May/early June 2024 on whether to sell Aurora Energy.

If it decides to sell, it would set a confidential minimum price that reflects what Council considers (after taking advice) to be the current market value. Aurora Energy would then be marketed for sale in the second half of 2024.

A potential sale of Aurora Energy was not included in the current 2021-31 long term plan. This is because work on possible divestments commenced after the long-term plan was adopted. In 2023, DCHL signalled that they were likely to recommend the divestment of Aurora Energy in early 2024.

If a sale proceeds, then this would be incorporated into the Council’s next long-term plan which will be developed in the second half of this year and the first half of next year. The Council’s next long-term plan is called the 9 Year Plan, which will relate to the period from 2025 to 2034.

As part of the 9 Year Plan process, Council will develop an investment plan for all its investments. The investment plan would include the new diversified investment fund (if Aurora Energy is sold).