-

Statement of Comprehensive Revenue and Expense for the years ended 30 June 2022 – 2031

Statement of Comprehensive Revenue and Expense for the Years Ended 30 June 2022 - 2031 (shown in $000's) Annual Plan Budget 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Revenue from continuing operations Rates revenue 163,136 179,124 191,664 205,077 217,372 230,421 244,239 257,666 271,826 283,234 294,293 Development and financial contributions 832 3,467 3,544 3,622 3,702 3,785 3,868 3,718 3,801 3,885 3,973 Subsidies and grants 40,700 33,292 27,261 29,143 29,342 26,131 29,553 28,621 26,856 25,560 27,633 Financial revenue 11,566 9,645 9,454 9,362 9,285 9,312 9,427 9,578 9,735 9,856 9,981 Other revenue 62,408 68,408 71,555 72,985 75,351 76,559 77,807 79,815 81,767 83,392 84,958 Total operating revenue 278,642 293,936 303,477 320,189 335,052 346,210 364,893 379,396 393,985 405,926 420,837 Expenses Other expenses 128,850 129,599 135,135 145,141 149,982 154,825 161,001 165,962 175,196 179,876 185,439 Personnel expenses 67,972 69,965 71,111 73,046 74,556 76,210 77,820 79,701 81,543 83,677 85,611 Audit fees 314 243 206 340 262 221 367 283 239 397 306 Financial expenses 12,051 9,943 10,836 12,792 14,615 16,454 18,137 19,571 20,825 21,881 22,949 Depreciation and amortisation 73,289 76,519 78,498 82,123 85,787 90,048 94,104 97,689 101,721 106,257 111,169 Total operating expenses 282,476 286,269 295,786 313,442 325,202 337,758 351,429 363,206 379,524 392,088 405,474 Operating surplus/(deficit) from continuing operations (3,834) 7,667 7,691 6,747 9,850 8,452 13,464 16,190 14,461 13,838 15,363 Share of associate surplus/(deficit) 0 0 0 0 0 0 0 0 0 0 0 Surplus/(deficit) before taxation (3,834) 7,667 7,691 6,747 9,850 ; 8,452 13,464 16,190 14,461 13,838 15,363 Less taxation (864) (450) (450) (450) (450) (450) (450) (450) (450) (450) (450) Surplus/(deficit) after taxation (2,970) 8,117 8,141 7,197 10,300 8,902 13,914 16,640 14,911 14,288 15,813 Attributable to: Dunedin City Council and Group (2,970) 8,117 8,141 7,197 10,300 8,902 13,914 16,640 14,911 14,288 15,813 Non-controlling interest 0 0 0 0 0 0 0 0 0 0 0 -

Statement of Other Comprehensive Revenue and Expense for the years ended 30 June 2022 – 2031

Statement of Other Comprehensive Revenue and Expense for the Years Ended 30 June 2022 - 2031 (shown in $000's) Annual Plan Budget 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Other comprehensive revenue and expense Gain/(loss) on property plant and equipment revaluations 37,500 63,000 63,000 76,000 63,000 63,000 76,000 63,000 63,000 76,000 63,000 Gain/(loss) on property plant and equipment disposals 0 0 0 0 0 0 0 0 0 0 0 Gain/(loss) of cash flow hedges at fair value through other comprehensive revenue and expense 1,196 480 0 0 0 0 0 0 0 0 0 Total other comprehensive revenue and expense 38,696 63,480 63,000 76,000 63,000 63,000 76,000 63,000 63,000 76,000 63,000 Net surplus/(deficit) for the year (2,970) 8,117 8,141 7,197 10,300 8,902 13,914 16,640 14,911 14,288 15,813 Total comprehensive revenue and expense for the year 35,726 71,597 71,141 83,197 73,300 71,902 89,914 79,640 77,911 90,288 78,813 Attributable to: Dunedin City Council and Group 35,726 71,597 71,141 83,197 73,300 71,902 89,914 79,640 77,911 90,288 78,813 Non-controlling interest 0 0 0 0 0 0 0 0 0 0 0 -

Statement of Changes in Equity for the years ended 30 June 2022 – 2031

Statement of Changes in Equity for the Years Ended 30 June 2022 - 2031 (shown in $000's) Annual Plan Budget 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Movements in equity Opening equity 3,161,587 3,211,117 3,282,714 3,353,855 3,437,052 3,510,352 3,582,254 3,672,168 3,751,808 3,829,719 3,920,007 Total comprehensive revenue and expense 35,726 71,597 71,141 83,197 73,300 71,902 89,914 79,640 77,911 90,288 78,813 Closing equity 3,197,313 3,282,714 3,353,855 3,437,052 3,510,352 3,582,254 3,672,168 3,751,808 3,829,719 3,920,007 3,998,820 -

Statement of Financial Position for the years ended 30 June 2022 – 2031

Statement of Financial Position for the Years Ended 30 June 2022 - 2031 (shown in $000's) Annual Plan Budget 2021 Forecast 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Current assets Cash and cash equivalents 9,558 7,481 6,071 6,426 6,782 6,954 7,617 8,550 9,433 10,372 11,210 11,980 Other current financial assets 9,733 6,428 5,928 5,964 6,022 6,074 6,126 6,183 6,246 6,318 6,394 6,473 Trade and other receivables 18,015 17,808 12,289 11,755 12,401 12,788 12,519 13,479 13,674 13,714 13,758 14,453 Taxation refund receivable 864 864 450 450 450 450 450 450 450 450 450 450 Inventories 288 392 392 392 392 392 392 392 392 392 392 392 Non current assets held for sale 0 3,000 0 0 0 0 0 0 0 0 0 0 Prepayments 500 500 500 500 500 500 500 500 500 500 500 500 Total current assets 38,958 36,473 25,630 25,487 26,547 27,158 27,604 29,554 30,695 31,746 32,704 34,248 Non-current assets Other non-current financial assets 192,180 203,977 205,503 206,066 206,982 207,799 208,611 209,500 210,502 211,618 212,821 214,056 Shares in subsidiary companies 128,689 128,689 131,239 133,789 136,339 138,889 141,439 143,989 146,539 149,089 151,639 154,189 Intangible assets 3,395 4,923 4,923 4,923 4,923 4,923 4,923 4,923 4,923 4,923 4,923 4,923 Investment property 93,480 95,740 95,740 96,771 99,942 101,026 102,140 103,283 104,457 105,665 106,907 108,183 Property, plant and equipment 3,098,618 3,077,163 3,212,052 3,357,292 3,495,928 3,631,981 3,762,590 3,902,941 4,022,855 4,139,902 4,256,542 4,373,949 Total non-current assets 3,516,362 3,510,492 3,649,457 3,798,841 3,944,114 4,084,618 4,219,703 4,364,636 4,489,276 4,611,197 4,732,832 4,855,300 Total assets 3,555,320 3,546,965 3,675,087 3,824,328 3,970,661 4,111,776 4,247,307 4,394,190 4,519,971 4,642,943 4,765,536 4,889,548 Current liabilities Trade and other payables 25,544 34,009 28,753 29,849 31,410 32,423 33,396 34,521 35,452 37,205 38,191 39,245 Revenue received in advance 3,600 7,980 5,394 6,444 6,517 6,585 6,656 6,732 6,806 6,883 6,946 7,006 Employee entitlements 8,263 8,623 9,495 9,638 9,884 10,073 10,281 10,483 10,721 10,955 11,226 11,472 Current derivative financial instruments 0 0 0 0 0 0 0 0 0 0 0 0 Current portion of term loans 0 0 0 0 0 0 0 0 0 0 0 0 Total current liabilities 37,407 50,612 43,642 45,931 47,811 49,081 50,333 51,736 52,979 55,043 56,363 57,723 Non-current liabilities Term loans 308,873 271,973 335,948 411,769 473,028 539,579 601,960 657,530 702,430 745,429 776,413 820,252 Provisions 11,131 12,483 12,483 12,473 12,470 12,464 12,460 12,456 12,454 12,452 12,453 12,453 Non-current derivative financial instruments 367 480 0 0 0 0 0 0 0 0 0 0 Other non-current liabilities 229 300 300 300 300 300 300 300 300 300 300 300 Total non-current liabilities 320,600 285,236 348,731 424,542 485,798 552,343 614,720 670,286 715,184 758,181 789,166 833,005 Equity Accumulated funds 1,688,539 1,695,305 1,703,242 1,711,545 1,718,490 1,728,528 1,737,158 1,750,792 1,767,142 1,781,751 1,795,724 1,811,212 Revaluation reserves 1,498,197 1,505,815 1,568,815 1,631,815 1,707,815 1,770,815 1,833,815 1,909,815 1,972,815 2,035,815 2,111,815 2,174,815 Restricted reserves 10,944 10,477 10,657 10,495 10,747 11,009 11,281 11,561 11,851 12,153 12,468 12,793 Cash flow hedge reserves -367 -480 0 0 0 0 0 0 0 0 0 0 Total equity 3,197,313 3,211,117 3,282,714 3,353,855 3,437,052 3,510,352 3,582,254 3,672,168 3,751,808 3,829,719 3,920,007 3,998,820 Total liabilities and equity 3,555,320 3,546,965 3,675,087 3,824,328 3,970,661 4,111,776 4,247,307 4,394,190 4,519,971 4,642,943 4,765,536 4,889,548 The accompanying notes and accounting policies form an integral part of these financial statements. -

Statement of Cash Flows for the years ended 30 June 2022 – 2031

Statement of Cash Flows for the Years Ended 30 June 2022 - 2031 (shown in $000's) Annual Plan Budget 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Cashflow from Operating Activities Cash was provided from operating activities: Rates received 162,974 178,929 192,503 204,925 217,232 230,273 244,082 257,513 271,665 283,104 294,167 Other revenue 100,611 105,295 100,453 102,330 105,214 103,965 107,501 109,184 109,621 109,984 113,054 Interest received 8,105 7,389 7,251 7,109 7,110 7,114 7,118 7,120 7,123 7,121 7,179 Divided received 1,531 1,229 1,254 1,280 1,306 1,334 1,362 1,392 1,423 1,454 1,487 Taxation refund received 850 864 450 450 450 450 450 450 450 450 450 Cash was applied to: Supplies and employees -198,532 -204,190 -205,222 -216,724 -223,602 -230,080 -237,865 -244,779 -254,991 -262,691 -270,056 Interest paid -11,571 -9,943 -10,836 -12,793 -14,615 -16,454 -18,137 -19,570 -20,825 -21,880 -22,948 Net cash inflow (outflow) from operations 63,968 79,573 85,853 86,577 93,095 96,602 104,511 111,310 114,466 117,542 123,333 Cashflow from Investing Activities Cash was provided from investing activities: Sale of assets 120 3,120 120 120 120 120 120 120 120 120 120 Reduction in loans and advances 0 0 0 0 0 0 0 0 0 0 0 Decrease in investments 0 0 0 0 0 0 0 0 0 0 0 Cash was applied to: Increase in investments -2,550 -2,550 -2,550 -2,550 -2,550 -2,550 -2,550 -2,550 -2,550 -2,550 -2,550 Capital expenditure -124,841 -145,528 -158,889 -145,050 -157,044 -155,891 -156,718 -152,897 -154,096 -145,259 -163,972 Net cash inflow (outflow) from investing activity -127,271 -144,958 -161,319 -147,480 -159,474 -158,321 -159,148 -155,327 -156,526 -147,689 -166,402 Cashflow from Financing Activities Cash was provided from financing activities: Loans raised 64,900 63,975 75,821 61,259 66,551 62,382 55,570 44,900 42,999 30,985 43,839 Cash was applied to: Loans repaid 0 0 0 0 0 0 0 0 0 0 0 Net cash inflow (outflow) from financing activity 64,900 63,975 75,821 61,259 66,551 62,382 55,570 44,900 42,999 30,985 43,839 Net increase/(decrease) in cash held 1,597 -1,410 355 356 172 663 933 883 939 838 770 Opening cash balance 7,961 7,481 6,071 6,426 6,782 6,954 7,617 8,550 9,433 10,372 11,210 Closing cash balance 9,558 6,071 6,426 6,782 6,954 7,617 8,550 9,433 10,372 11,210 11,980 -

Income Statement for the years ended 30 June 2022 – 2031

Income Statement for the Years Ended 30 June 2022 - 2031 (shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Revenue Rates revenue 163,136 179,124 191,664 205,077 217,372 230,421 244,239 257,666 271,826 283,234 294,293 External revenue 71,838 75,503 78,458 79,797 82,086 83,323 84,683 86,841 88,952 90,697 92,388 Grants and subsidies revenue 40,700 33,292 27,261 29,143 29,342 26,131 29,553 28,621 26,856 25,560 27,633 Development contributions revenue 832 3,467 3,544 3,622 3,702 3,785 3,868 3,718 3,801 3,885 3,973 Vested assets 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 Internal revenue 35,181 35,297 36,285 37,273 38,229 39,187 40,166 41,209 42,324 43,466 44,596 Total revenue 314,687 329,683 340,212 357,912 373,731 385,847 405,509 421,055 436,759 449,842 465,883 Expenditure Personnel costs 67,972 69,965 71,110 73,047 74,555 76,210 77,818 79,701 81,544 83,677 85,610 Operations and maintenance 68,292 67,667 70,470 77,795 79,870 82,346 86,332 89,110 93,632 96,100 99,144 Occupancy costs 26,235 27,875 29,315 30,687 31,653 32,965 34,357 35,771 39,064 40,456 41,807 Consumables and general 23,847 24,057 25,113 26,512 28,108 28,880 29,578 30,032 31,169 31,894 32,725 Grants and subsidies 10,790 10,243 10,444 10,485 10,614 10,855 11,103 11,333 11,569 11,824 12,071 Internal charges 35,181 35,297 36,285 37,273 38,229 39,187 40,166 41,209 42,324 43,466 44,596 Depreciation and amortisation 73,289 76,519 78,498 82,123 85,787 90,048 94,104 97,689 101,721 106,257 111,169 Interest 12,051 9,943 10,836 12,793 14,615 16,454 18,137 19,570 20,825 21,880 22,948 Total expenditure 317,657 321,566 332,071 350,715 363,431 376,945 391,595 404,415 421,848 435,554 450,070 Net surplus/(deficit) -2,970 8,117 8,141 7,197 10,300 8,902 13,914 16,640 14,911 14,288 15,813 Expenditure by Activity Roading and Footpaths 50,969 53,234 53,053 54,591 56,062 57,442 58,944 60,318 62,120 64,572 66,927 Sewerage and Sewage 33,629 33,087 33,363 33,882 34,992 36,400 37,421 39,041 40,929 42,237 43,815 Stormwater 9,089 9,215 10,862 11,510 12,566 13,458 14,365 15,085 15,840 16,437 17,061 Water Supply 29,873 30,830 31,588 32,094 32,991 34,237 35,407 36,271 38,567 40,835 42,927 Waste Management 13,599 16,424 18,342 25,845 27,445 27,384 31,026 32,400 33,831 35,229 36,328 Reserves and Recreational Facilities 36,633 37,410 40,074 43,285 44,600 46,064 47,238 48,426 49,646 50,635 51,882 Property 34,603 33,965 35,180 38,221 40,405 43,109 45,667 47,949 51,660 53,023 54,741 Galleries, Libraries and Museums 27,120 26,177 26,750 27,252 28,145 28,781 29,524 30,342 31,369 32,241 33,126 Regulatory Services 17,290 17,104 17,295 17,645 18,080 18,537 19,013 19,458 19,999 20,515 21,116 Community and Planning 14,073 15,034 14,595 14,845 15,059 15,516 15,786 16,259 16,538 17,054 17,341 Economic Development 5,928 5,824 5,971 6,090 6,215 6,354 6,501 6,654 6,816 6,988 7,157 Governance and Support Services 44,851 43,262 44,998 45,455 46,871 49,663 50,703 52,212 54,533 55,788 57,649 Total expenditure 317,657 321,566 332,071 350,715 363,431 376,945 391,595 404,415 421,848 435,554 450,070 -

Notes to the Financial Statements for the years ended 30 June 2022 – 2031

1 Statement of accounting policies

REPORTING ENTITY

Dunedin City Council (the Council) is a territorial local authority established under the Local Government Act 2002 (LGA) and is domiciled and operates in New Zealand. The relevant legislation governing the Council's operations includes the LGA and the Local Government (Rating) Act 2002.

The financial statements presented are for the reporting entity Dunedin City Council (the Council).

The registered address of the Council is 50 The Octagon, Dunedin.

The Council provides local infrastructure, local public services, and performs regulatory functions to the community. The Council does not operate to make a financial return.

The Council has designated itself as public benefit entities (PBEs) for the purposes of complying with generally accepted accounting practice.

The forecast financial statements of the Council are for the years ended 30 June 2021 to 2031. The financial statements were authorised for issue by the Council on 30 June 2021.

BASIS OF PREPARATION

The financial statements have been prepared on the historical cost basis, except for the revaluation of certain property, plant and equipment, investment properties, biological assets, derivative financial instruments, financial instruments classified as available for sale and financial instruments held for trading.

The financial statements have been prepared on the going concern basis, and the accounting policies have been applied consistently throughout the year.

Statement of compliance

The financial statements of the Council have been prepared in accordance with the requirements of the LGA and the Local Government (Financial Reporting and Prudence) Regulations 2014 (LG(FRP)R), which include the requirement to comply with generally accepted accounting practice in New Zealand (NZ GAAP).

The financial statements have been prepared in accordance with and comply with PBE Standards.

Presentation currency and rounding

The financial statements are presented in New Zealand dollars because that is the currency of the primary economic environment in which the Council operates. All values are rounded to the nearest thousand dollars ($000), other than the remuneration and severance payment disclosures. The remuneration and severance payments are rounded to the nearest dollar.

Other changes in accounting policies

There have been no changes in accounting policy in the current year.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Significant accounting policies are included in the notes to which they relate. Significant accounting policies that do not relate to a specific note are outlined below.

Prospective financial statements

The financial statements are forecast using the best information available at the time they were prepared.

Foreign currency transactions

The individual financial statements of Council are presented in the currency of the primary economic environment in which the entity operates (its functional currency). For the purpose of the financial statements the results and financial position are expressed in New Zealand dollars, which is the functional currency of the Council.

Transactions in currencies other than New Zealand dollars are recorded at the rates of exchange prevailing on the dates of the transactions. At each balance sheet date, monetary assets and liabilities that are denominated in foreign currencies are retranslated at the rates prevailing on the balance sheet date. The Council does not hold non-monetary assets and liabilities denominated in foreign currencies.

In order to hedge its exposure to certain foreign exchange risks, the Council may enter into forward contracts and options (see below for details of the Council's accounting policies in respect of such derivative financial instruments).

Goods and services tax

Items in the financial statements are stated exclusive of GST, except for receivables and payables which are presented on a GST-inclusive basis. Where GST is not recoverable as input tax, it is recognised as part of the related asset or expense.

The net amount of GST recoverable from, or payable to, the IRD is included as part of receivables or payables in the statement of financial position.

The net GST paid to, or received from, the IRD, including the GST relating to investing and financing activities, is classified as an operating cash flow in the statement of cash flows.

Commitments and contingencies are disclosed exclusive of GST.

Critical accounting estimates and assumptions

The Council makes estimates and assumptions concerning the future. The resulting accounting estimates will, by definition, seldom equal the related actual results. The estimates and assumptions that have a significant risk of causing a material adjustment to carrying amounts of assets and liabilities within the next financial year include:

- landfill provision;

- valuation of property, plant and equipment;

- valuation of derivative financial instruments;

2 Rates revenue

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Rates revenue by type General rates 93,550 102,163 108,989 116,062 124,929 134,145 144,494 154,374 163,285 170,176 176,548 Community services rate 4,936 5,070 5,212 5,342 5,476 5,612 5,753 5,902 6,062 6,225 6,387 Kerbside recycling rate 2,899 4,650 7,774 12,492 12,980 13,424 13,886 14,366 14,865 15,385 15,925 Citywide water rate 22,086 24,915 25,466 25,813 26,534 27,593 28,577 29,229 31,286 33,306 35,165 Citywide drainage rate 38,471 41,262 43,152 44,290 46,428 48,695 50,591 52,895 55,496 57,359 59,520 Allanton drainage rate 19 19 19 19 19 19 19 19 19 19 19 Blanket Bay drainage rate 1 1 1 1 1 1 1 1 1 1 1 Curles Point drainage rate 1 1 1 1 1 1 1 1 1 1 1 Private street lighting rate 30 30 32 34 36 38 40 42 45 47 48 Tourism/economic development rate 500 500 500 500 500 500 500 500 500 500 500 Warm Dunedin rate 643 513 518 523 468 393 377 337 266 215 179 163,136 179,124 191,664 205,077 217,372 230,421 244,239 257,666 271,826 283,234 294,293 Rates revenue by activity Roading and Footpaths 17,409 17,905 21,421 23,170 27,537 30,733 33,835 38,643 40,292 42,567 43,497 Sewerage and Sewage 32,291 32,190 32,436 32,931 34,015 35,394 36,387 37,975 39,826 41,097 42,640 Stormwater 6,201 9,092 10,736 11,380 12,433 13,321 14,224 14,940 15,690 16,282 16,901 Water Supply 22,086 24,915 25,466 25,813 26,534 27,593 28,577 29,229 31,286 33,306 35,165 Waste Management 3,475 4,650 7,785 12,503 12,984 13,423 16,894 17,895 19,119 20,459 21,517 Reserves and Recreational Facilities 30,694 31,831 33,832 36,306 37,446 38,731 39,723 40,715 41,727 42,502 43,538 Property 8,091 9,155 9,661 11,906 13,325 15,270 17,049 18,501 21,328 21,781 22,594 Galleries, Libraries and Museums 24,877 24,672 24,454 24,907 25,741 26,335 27,036 27,808 28,787 29,609 30,446 Regulatory Services 0 0 0 0 0 0 0 0 0 0 0 Community and Planning 12,199 12,669 12,660 12,754 13,027 13,320 13,651 13,950 14,287 14,618 14,969 Economic Development 5,417 5,402 5,537 5,645 5,759 5,887 6,022 6,163 6,311 6,469 6,625 Governance and Support Services 396 6,643 7,676 7,762 8,571 10,414 10,841 11,847 13,173 14,544 16,401 163,136 179,124 191,664 205,077 217,372 230,421 244,239 257,666 271,826 283,234 294,293 Rating base information The number of rating units 59,065 59,582 60,099 60,615 61,003 61,390 61,776 62,163 62,551 62,900 63,248 Relevant significant accounting policies

Rates are set annually by resolution from Council and relate to a financial year. All ratepayers are invoiced within the financial year to which the rates have been set. Rates revenue is recognised when payable.

Revenue from water rates by meter is recognised on an accrual basis based on usage. Unbilled usage, as a result of unread meters at year-end, is accrued on an average usage basis.

Revenue from rates penalties is recognised when the penalty is imposed.

Rates remissions are recognised as a reduction of rates revenue when the Council has received an application that satisfies its rates remission policy.

3 Development and financial contributions

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Development and financial contributions 832 3,467 3,544 3,622 3,702 3,785 3,868 3,718 3,801 3,885 3,973 832 3,467 3,544 3,622 3,702 3,785 3,868 3,718 3,801 3,885 3,973 Relevant significant accounting policies

Development and financial contributions are recognised as revenue when the Council provides, or is able to provide, the services for which the contribution was charged. Otherwise, development and financial contributions are recognised as liabilities until such time as the Council provides, or is able to provide, the service.

4 Subsidies and grants

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 New Zealand Transport Agency new capital roading subsidies 20,710 9,846 8,293 10,655 9,635 6,296 9,588 7,344 5,434 3,978 4,641 New Zealand Transport Agency renewal roading subsidies 7,698 7,010 6,878 6,141 7,006 6,767 6,523 7,447 7,191 6,929 7,916 New Zealand Transport Agency operational roading subsidies 10,482 10,033 10,254 10,459 10,762 11,074 11,396 11,726 12,066 12,428 12,789 Government and government agency grants 1,378 1,399 1,380 1,420 1,459 1,500 1,542 1,586 1,631 1,679 1,726 Other grants 432 5,004 456 468 480 494 504 518 534 546 561 40,700 33,292 27,261 29,143 29,342 26,131 29,553 28,621 26,856 25,560 27,633 Relevant significant accounting policies

The Council receives funding assistance from the New Zealand Transport Agency, which subsidises part of the costs of maintenance and capital expenditure on the local roading infrastructure. The subsidies are recognised as revenue upon entitlement, as conditions pertaining to eligible expenditure have been fulfilled.

Other grants received are recognised as revenue when they become receivable unless there is an obligation in substance to return funds if conditions of the grant are not met. If there is such an obligation, the grants are initially recorded as grants received in advance and recognised as revenue when conditions of the grant are satisfied.

5 Financial revenue

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Gain on fair value of investments 1,750 1,026 1,063 1,102 1,142 1,183 1,226 1,271 1,317 1,365 1,415 Dividends received - Dunedin City Holdings Limited 0 0 0 0 0 0 0 0 0 0 0 Dividends received - Waipori Fund 1,531 1,229 1,254 1,280 1,306 1,334 1,362 1,392 1,423 1,454 1,487 Interest received - Dunedin City Holdings Limited 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 Interest received - Waipori Fund 2,053 1,252 997 839 693 648 689 764 841 881 920 Other interest received 330 236 238 239 242 245 248 249 252 254 257 11,566 9,645 9,454 9,362 9,285 9,312 9,427 9,578 9,735 9,856 9,981 Relevant significant accounting policies

Interest income is accrued on a time basis, by reference to the principal outstanding and at the effective interest rate applicable, which is the rate that exactly discounts estimated future cash receipts through the expected life of the financial asset to that asset’s net carrying amount.

Dividend income from investments is recognised when the shareholders’ rights to receive payment have been established.

6 Other revenue

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Profit on sale of property, plant and equipment 30 45 0 0 0 0 0 0 0 0 0 Rental from investment properties 7,651 8,223 8,453 8,664 8,881 9,103 9,330 9,573 9,831 10,097 10,359 Gain on fair value of investment property 0 0 0 0 0 0 0 0 0 0 0 Regulatory services rendered 4,649 4,649 4,779 4,898 5,021 5,146 5,275 5,412 5,558 5,708 5,857 Vested assets 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 Other fees and charges 47,078 52,491 55,323 56,423 58,449 59,310 60,202 61,830 63,378 64,587 65,742 62,408 68,408 71,555 72,985 75,351 76,559 77,807 79,815 81,767 83,392 84,958 Relevant significant accounting policies

Revenue is measured at fair value. The specific policies for significant revenue items included in other revenue are explained below:

Rental from investment properties

Lease rentals (net of any incentives given) are recognised on a straight line basis over the term of the lease.

Regulatory services rendered

Fees and charges for building and resource consent services are recognised on a percentage completion basis with reference to the recoverable costs incurred at balance date.

Vested assets

For assets received for no or nominal consideration, the asset is recognised at its fair value when the Council obtains control of the asset. The fair value of the asset is recognised as revenue, unless there is a use or return condition attached to the asset.

Gain on fair value of investment property

Investment properties are held primarily to earn lease revenue and/or for capital growth. All investment properties are measured at fair value, determined annually by an independent registered valuer. Any gain or loss arising is recognised in the surplus or deficit for the period in which the gain or loss arises. Investment properties are not depreciated.

Other fees and charges

Entrance fees are charged to users of the Council's local facilities, such as pools, museum exhibitions and Dunedin Chinese Garden. Revenue from entrance fees is recognised upon entry to such facilities.

Fees for disposing of waste at the Council's landfill are recognised as waste is disposed by users.

Infringement fees and fines which mostly relate to traffic and parking infringements, and library overdue book fines, are recognised when the infringement notice is issued or when the fines/penalties are otherwise imposed.

Rental income from operating leases, such as social housing, is recognised on a straight line basis over the term of the relevant lease.

Revenue from the sale of goods is recognised when significant risks and rewards of owning the goods are transferred to the buyer, when the revenue can be measured reliably and when management effectively ceases involvement or control.

Revenue from other services rendered is recognised when it is probable that the economic benefits associated with the transaction will flow to the entity. The stage of completion at balance date is assessed based on the value of services performed to date as a percentage of the total services to be performed.

7 Other expenses

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Operations and maintenance 68,291 67,667 70,470 77,795 79,870 82,346 86,332 89,110 93,632 96,100 99,144 Occupancy costs 26,235 27,875 29,315 30,687 31,653 32,965 34,357 35,771 39,064 40,456 41,807 Consumables and general 23,534 23,814 24,906 26,174 27,845 28,659 29,209 29,748 30,931 31,496 32,417 Grants and subsidies 10,790 10,243 10,444 10,485 10,614 10,855 11,103 11,333 11,569 11,824 12,071 128,850 129,599 135,135 145,141 149,982 154,825 161,001 165,962 175,196 179,876 185,439 Relevant significant accounting policies

General grants

Non-discretionary grants are grants that awarded if the grant application meets the specified criteria and are recognised as expenditure when an application that meets the specified criteria for the grant has been received.

Discretionary grants are grants where the Council has no obligation to award on receipt of the grant application and are recognised as expenditure when approved by the Council and the approval has been communicated to the applicant.

Operating lease expenses

An operating lease is a lease that does not transfer substantially all the risks and rewards incidental to ownership of an asset. Lease payments under an operating lease are recognised as an expense on a straight-line basis over the lease term. Lease incentives received are recognised in the surplus or deficit as a reduction of rental expense over the lease term.

Finance leases

Leases are classified as finance leases whenever the terms of the lease transfer substantially all the risks and rewards of ownership to the lessee whether or not title is eventually transferred.

Assets held under finance leases are recognised as assets of the Group at their fair value or, if lower, at the present value of the minimum lease payments, each determined at the inception of the lease. The corresponding liability to the lessor is included in the balance sheet as a finance lease obligation. Lease payments are apportioned between finance charges and reduction of the lease obligation so as to achieve a constant rate of interest on the remaining balance of the liability.

Research and development

Expenditure on research activities is recognised as an expense in the period in which it is incurred.

8 Audit fees

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Fees paid to Audit New Zealand for; Financial statements 191 200 206 210 216 221 227 233 239 246 252 Long-term plan audit 123 43 0 130 46 0 140 50 0 151 54 314 243 206 340 262 221 367 283 239 397 306 9 Financial expenses

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Interest paid to subsidiaries 12,051 9,943 10,836 12,792 14,615 16,454 18,137 19,571 20,825 21,881 22,949 12,051 9,943 10,836 12,792 14,615 16,454 18,137 19,571 20,825 21,881 22,949 Relevant significant accounting policies

Borrowing costs directly attributable to the acquisition, construction or production of qualifying assets, which are assets that necessarily take a substantial period of time to get ready for their intended use or sale, are added to the cost of those assets, until such time as the assets are substantially ready for their intended use or sale.

All other borrowing costs are recognised as an expense in the financial year in which they are incurred.

10 Depreciation and amortisation

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Depreciation and amortisation expense by group of activity Roading and Footpaths 23,428 24,957 24,145 24,437 24,601 24,628 24,845 25,009 25,699 27,043 28,296 Sewerage and Sewage 12,188 13,058 13,766 13,824 14,218 14,744 15,214 15,912 16,611 17,294 17,948 Stormwater 4,380 4,693 5,525 5,634 6,197 6,598 7,030 7,353 7,736 8,016 8,315 Water Supply 14,023 15,024 14,888 14,905 15,218 15,815 16,307 16,382 17,650 18,854 19,892 Waste Management 491 582 978 1,496 1,761 2,063 2,627 2,869 3,121 3,403 3,401 Reserves and Recreational Facilities 4,686 4,956 5,784 7,216 7,658 8,397 8,654 8,888 9,094 9,051 9,283 Property 10,435 10,372 10,744 12,008 13,122 14,095 15,263 16,445 16,180 16,303 17,019 Galleries, Libraries and Museums 1,365 1,095 1,045 1,027 1,063 1,109 1,239 1,389 1,710 1,868 2,049 Regulatory Services 409 280 98 107 139 206 232 249 282 319 398 Community and Planning 15 8 8 8 7 7 8 8 9 5 5 Economic Development 47 24 41 34 34 34 37 36 34 34 35 Governance and Support Services 1,822 1,470 1,476 1,427 1,769 2,352 2,648 3,149 3,595 4,067 4,528 73,289 76,519 78,498 82,123 85,787 90,048 94,104 97,689 101,721 106,257 111,169 11 Total group expenditure

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Roading and Footpaths 50,969 53,234 53,053 54,591 56,062 57,442 58,944 60,318 62,120 64,572 66,927 Sewerage and Sewage 33,629 33,087 33,363 33,882 34,992 36,400 37,421 39,041 40,929 42,237 43,815 Stormwater 9,089 9,215 10,862 11,510 12,566 13,458 14,365 15,085 15,840 16,437 17,061 Water Supply 29,873 30,830 31,588 32,094 32,991 34,237 35,407 36,271 38,567 40,835 42,927 Waste Management 13,599 16,424 18,342 25,845 27,445 27,384 31,026 32,400 33,831 35,229 36,328 Reserves and Recreational Facilities 36,633 37,410 40,074 43,285 44,600 46,064 47,238 48,426 49,646 50,635 51,882 Property 34,603 33,965 35,180 38,221 40,405 43,109 45,667 47,949 51,660 53,023 54,741 Galleries, Libraries and Museums 27,120 26,177 26,750 27,252 28,145 28,781 29,524 30,342 31,369 32,241 33,126 Regulatory Services 17,290 17,104 17,295 17,645 18,080 18,537 19,013 19,458 19,999 20,515 21,116 Community and Planning 14,073 15,034 14,595 14,845 15,059 15,516 15,786 16,259 16,538 17,054 17,341 Economic Development 5,928 5,824 5,971 6,090 6,215 6,354 6,501 6,654 6,816 6,988 7,157 Governance and Support Services 44,851 43,262 44,998 45,455 46,871 49,663 50,703 52,212 54,533 55,788 57,649 Total expenditure per activity 317,657 321,566 332,071 350,715 363,431 376,945 391,595 404,415 421,848 435,554 450,070 Less: Internal expenditure -35,181 -35,297 -36,285 -37,273 -38,229 -39,187 -40,166 -41,209 -42,324 -43,466 -44,596 Total expenditure per financial statements 282,476 286,269 295,786 313,442 325,202 337,758 351,429 363,206 379,524 392,088 405,474 12 Taxation

Relevant significant accounting policies

The tax expense represents the sum of the tax currently payable and deferred tax.

The tax currently payable is based on taxable profit for the year. Taxable profit differs from net surplus as reported in the Statement of Comprehensive Revenue and Expense because it excludes items of income or expense that are taxable or deductible in other years and it further excludes items that are never taxable or deductible. The Council’s liability for current tax is calculated using tax rates that have been enacted by the balance sheet date.

Deferred tax is the tax expected to be payable or recoverable on differences between the carrying amounts of assets and liabilities in the financial statements and the corresponding tax bases used in the computation of taxable profit, and is accounted for using the balance sheet liability method.

Deferred tax liabilities are generally recognised for all taxable temporary differences and deferred tax assets are recognised to the extent that it is probable that taxable profits will be available against which deductible temporary differences can be utilised. Such assets and liabilities are not recognised if the temporary difference arises from goodwill or from the initial recognition (other than in a business combination) of other assets and liabilities in a transaction that affects neither the tax profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary differences arising on investments in subsidiaries and associates, and interests in joint ventures, except where the Council is able to control the reversal of the temporary difference and it is probable that the temporary difference will not reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at each balance sheet date and reduced to the extent that it is no longer probable that sufficient taxable profits will be available to allow all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to apply in the period when the liability is settled or the asset is realised. Deferred tax is charged or credited in the surplus or deficit, except when it relates to items charged or credited directly to equity, in which case the deferred tax is also dealt with in equity.

13 Equity

(shown in $000's) Forecast 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Accumulated Funds Opening balance 1,692,509 1,695,305 1,703,242 1,711,545 1,718,490 1,728,528 1,737,158 1,750,792 1,767,142 1,781,751 1,795,724 Surplus/(deficit) 2,966 8,117 8,141 7,197 10,300 8,902 13,914 16,640 14,911 14,288 15,813 Net transfers from/(to) restricted reserves -170 -180 162 -252 -262 -272 -280 -290 -302 -315 -325 Closing balance 1,695,305 1,703,242 1,711,545 1,718,490 1,728,528 1,737,158 1,750,792 1,767,142 1,781,751 1,795,724 1,811,212 Revaluation reserves Opening balance 1,420,815 1,505,815 1,568,815 1,631,815 1,707,815 1,770,815 1,833,815 1,909,815 1,972,815 2,035,815 2,111,815 Property plant and equipment revaluations 85,000 63,000 63,000 76,000 63,000 63,000 76,000 63,000 63,000 76,000 63,000 Closing balance 1,505,815 1,568,815 1,631,815 1,707,815 1,770,815 1,833,815 1,909,815 1,972,815 2,035,815 2,111,815 2,174,815 Restricted reserves Opening balance 10,307 10,477 10,657 10,495 10,747 11,009 11,281 11,561 11,851 12,153 12,468 Net transfers from/(to) accumulated funds 170 180 -162 252 262 272 280 290 302 315 325 Closing balance 10,477 10,657 10,495 10,747 11,009 11,281 11,561 11,851 12,153 12,468 12,793 Cash flow hedge reserves Opening balance -2,052 -480 0 0 0 0 0 0 0 0 0 Gains/(losses) on interest rate swaps 1,572 480 0 0 0 0 0 0 0 0 0 Closing balance -480 0 0 0 0 0 0 0 0 0 0 3,211,117 3,282,714 3,353,855 3,437,052 3,510,352 3,582,254 3,672,168 3,751,808 3,829,719 3,920,007 3,998,820 Activity and output group Purpose Opening Balance 2021 Transfers Inwards 2021-2031 Transfers Outwards 2021-2031 Closing Balance 2031 Roading and Footpaths Transport Roading property reserve for property purchases 156 6,026 -6,009 173 Sewerage and Sewage Wastewater Water development and operational reserves 46 25,834 -25,831 49 Waste Management Landfills Waste minimisation projects 578 8,796 -7,516 1,858 Reserves and Recreational Facilities Cemeteries and Crematorium To maintain cemeteries and specific burial plots and mausoleums 2,207 231 0 2,438 Dunedin Botanic Garden Aviary Bird Fund operations reserve 27 3 0 30 Clive R. B. Lister Capital to maintain the Clive Lister Garden 246 26 0 272 Mediterranean Garden development reserve 16 2 0 18 Parks and Recreation Reserve of development contributions for playgrounds, specific Parks and Subdivision reserves -129 5,536 -5,549 -142 To maintain specific reserve areas 1,619 169 0 1,788 Property Housing Operational housing reserve 2,119 222 0 2,341 Investment Property Endowment property investment reserve 1,104 116 0 1,220 Miscellaneous Property Air Development to develop the Taieri aerodrome 381 40 0 421 Libraries and Museums Dunedin Public Art Gallery Art Gallery funded operations reserves 998 105 0 1,103 Dunedin Public Libraries To extend the Reed and other library collections 745 77 0 822 Regulatory Services Animal Services Dog Control operations reserve 13 1 0 14 Governance and Support Services Finance Insurance reserve 317 33 0 350 Other Hillary Commission General Subsidies Reserve 34 4 0 38 10,477 47,220 -44,905 12,793 Equity is the community's interest in the Council and is measured as the difference between total assets and total liabilities. Equity is disaggregated and classified into components. The components are accumulated funds, revaluation reserves, restricted reserves, cash flow hedge reserves.

Relevant significant accounting policies

Restricted reserves are a component of equity generally representing a particular use to which various parts of equity have been assigned. Reserves may be legally restricted or created by the Council.

Restricted reserves include those subject to specific conditions accepted as binding by the Council and which may not be revised by the Council without reference to the Courts or a third party. Transfers from these reserves may be made only for certain specified purposes or when certain specified conditions are met.

Also included in restricted reserves are reserves restricted by Council decision. The Council may alter them without reference to any third party or the Courts. Transfers to and from these reserves are at the discretion of the Council.

The hedging reserve comprises the effective portion of the cumulative net change in the fair value of the cash flow hedging instruments relating to interest payments and foreign exchange transactions that have not yet occurred.

14 Cash and cash equivalents

Relevant significant accounting policies

Cash and cash equivalents include cash on hand, deposits held at call with banks, other short-term highly liquid investments with original maturities of three months or less, and bank overdrafts. Bank overdrafts are shown within borrowings in current liabilities in the statement of financial position.

15 Trade and other receivables and term receivables

Relevant significant accounting policies

Short-term receivables are recorded at the amount due, less an allowance for expected credit losses (ECL). The Council applies the simplified ECL model of recognising lifetime ECL for receivables.

In measuring ECLs, trade receivables are grouped based on similar credit risk and aging. A provision matrix is then established based on historical credit loss experience, adjusted for forward looking factors specific to the debtors and the economic environment.

The Dunedin City Council does not provide for any impairment on rates receivable as it has various powers under the Local Government (Rating) Act 2002 to recover any outstanding debts. These powers allow the Council to commence legal proceedings to recover any rates that remain unpaid four months after the due date for payment. If payment has not been made within three months of the Court's judgement, then the Council can apply to the Registrar of the High Court to have the judgement enforced by sale or lease of the rating unit.

"Rates are "written-off":

* when remitted in accordance with the Council's rates and remission policy; and

* in accordance with the write-off criteria of sections 90A (where rates cannot be reasonably recovered) and 90B (in relation to Māori freehold land) of the Local Government (Rating) Act 2002."

Other receivables are written-off when there is no reasonable expectation of recovery.

16 Inventories

Relevant significant accounting policies

Inventories are stated at the lower of cost and net realisable value. Cost comprises direct materials and, where applicable, direct labour costs and those overheads that have been incurred in bringing the inventories to their present location and condition. Cost is calculated using the weighted average method. Net realisable value represents the estimated selling price less all estimated costs of completion and costs to be incurred in marketing, selling and distribution.

17 Non-current assets held for sale

Relevant significant accounting policies

Non-current assets are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather than through continuing use. They are measured at the lower of their carrying amount and fair value less costs to sell.

Any impairment losses for write-downs are recognised in the surplus or deficit.

Any increases in fair value (less costs to sell) are recognised up to the level of any impairment losses that have been previously recognised.

Non-current assets are not depreciated or amortised while they are classified as held for sale (including those that are part of a disposal group).

18 Other financial assets

(shown in $000's) Forecast 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Other current financial assets Waipori Fund interest bearing securities 6,428 5,928 5,964 6,022 6,074 6,126 6,183 6,246 6,318 6,394 6,473 6,428 5,928 5,964 6,022 6,074 6,126 6,183 6,246 6,318 6,394 6,473 Other non-current financial assets Waipori Fund interest bearing securities 38,979 38,979 39,215 39,599 39,941 40,282 40,655 41,074 41,542 42,046 42,564 Waipori Fund equity investments 52,516 54,043 54,370 54,902 55,377 55,848 56,364 56,947 57,595 58,294 59,011 Other shares 481 481 481 481 481 481 481 481 481 481 481 Advances to subsidiaries 112,000 112,000 112,000 112,000 112,000 112,000 112,000 112,000 112,000 112,000 112,000 203,977 205,503 206,066 206,982 207,799 208,611 209,500 210,502 211,618 212,821 214,056 210,405 211,431 212,030 213,004 213,873 214,737 215,683 216,748 217,936 219,215 220,529 Relevant significant accounting policies

Investments are recognised and derecognised on a trade date where a purchase or sale of an investment is under a contract whose terms require delivery of the investment within the timeframe established by the market concerned, and are initially measured at cost, including transaction costs.

Investments in debt and equity securities are financial instruments classified as held for trading and are measured at fair value in the surplus or deficit at balance date. Any resultant gains or losses are recognised in the surplus or deficit for the period.

Loans and advances are financial instruments that are measured at amortised cost using the effective interest method. This type of financial instrument includes deposits, term deposits, inter company loans, community loans and mortgages.

19 Accounts payable, accrued expenditure and employee entitlements

Relevant significant accounting policies

Trade and other payables are stated at cost.

Short-term employee entitlements

Employee benefits that are expected to be settled wholly before twelve months after the reporting period in which the employees render the related service are measured based on accrued entitlements at current rates of pay. These include salaries and wages accrued up to balance date and annual leave earned to but not yet taken at balance date.

The Council recognises a liability for sick leave to the extent that absences in the coming year are expected to be greater than the sick leave entitlements earned in the coming year.

The current portion of the retirement gratuities provision has been calculated on an actuarial basis and is based on the reasonable likelihood that it will be earned by employees and paid by the Council.

20 Term loans

Relevant significant accounting policies

Borrowings are initially recorded net of directly attributable transaction costs. Finance charges, premiums payable on settlement or redemption and direct costs are accounted for on an accrual basis to the surplus or deficit using the effective interest method.

21 Provisions

Relevant significant accounting policies

Entitlements to the non-current portion of accrued long service leave and retirement gratuities are calculated on an actuarial basis and are based on the reasonable likelihood that they will be earned by employees and paid by the Council.

A provision is recognised in the balance sheet when the Council has a present legal or constructive obligation as a result of a past event, and it is probable that an outflow of economic benefits will be required to settle the obligation.

Provisions for restructuring costs are recognised when the Council has a detailed formal plan for the restructuring that has been communicated to affected parties.

22 Property, plant and equipment

Relevant significant accounting policies

Property, plant and equipment are those assets held by the Council for the purpose of carrying on its business activities on an ongoing basis.

Operational assets

These include land, buildings, improvements, library books, plant and equipment, and motor vehicles.

Land and buildings

Land and buildings are stated at revalued amounts being fair value at date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. The revaluations are performed by an independent valuer on a three-yearly cycle.

Fixed plant and equipment

Fixed plant and equipment is stated at cost, less any subsequent accumulated depreciation and any accumulated impairment losses.

Vehicles, mobile plant

Motor vehicles and other mobile plant and equipment are stated at cost less any subsequent accumulated depreciation and any accumulated impairment losses.

Office equipment

Office equipment and fittings are stated at cost less any subsequent accumulated depreciation less any accumulated impairment losses.

Library collection

Library collections are stated at cost less any subsequent accumulated depreciation and any impairment losses.

Infrastructural assets

Infrastructure assets are the fixed utility systems owned by the Council. Each asset type includes all items that are required for the network to function; for example, sewer reticulation includes reticulation piping and sewer pump stations.

Land is stated at revalued amounts being fair value at date of valuation less any subsequent accumulated impairment losses. The revaluations are performed by an independent valuer on a three yearly cycle.

Landfill assets being earthworks, plant and machinery and the estimate of site restoration, are stated at cost less any accumulated depreciation and any accumulated impairment losses. The useful life of the Green Island Landfill is considered to be the period of time to the expiring of the associated consents in 2023.

Roadways and bridges have been stated at their revalued amounts being fair value based on depreciated replacement cost as at the date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Roadways and bridges are valued annually by an independent valuer.

Plant and facilities have been stated at their revalued amounts being fair value based on depreciated replacement cost as at the date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Plant and facilities are valued annually in-house and peer reviewed by an independent valuer. Additions are recorded at cost and depreciated.

Reticulation assets, being the reticulation system and networks of water and drainage, have been stated at their revalued amounts being fair value based on depreciated replacement cost as at the date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Reticulation assets are valued annually in-house and peer reviewed by an independent valuer.

Restricted assets

Restricted assets are parks and reserves owned by the Council which cannot be disposed of because of legal or other restrictions, and provide a benefit or service to the community.

Land, buildings and structures are stated at revalued amounts being fair value at date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. The revaluations are performed by an independent valuer on a three yearly cycle.

Hard surfaces and reticulation systems are stated at revalued amounts being fair value at date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. The revaluations are performed by an independent valuer on a three yearly cycle.

Road reserve land is stated at revalued amounts being fair value at date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Revaluations are performed by an independent valuer on a three yearly cycle.

Playground and soft-fall areas are stated at revalued amounts being fair value at date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Revaluations are performed by an independent valuer on a four yearly cycle.

Fixed plant and equipment has been stated at their deemed cost being fair value at the date of valuation based on depreciated replacement cost less any subsequent accumulated depreciation and subsequent accumulated impairment losses

Additions are recorded at cost and depreciated.

Heritage assets

These include, but are not limited to, assets held by the Council subject to deeds of agreement, terms and conditions of bequests, donations, trusts or other restrictive legal covenants. The Council’s control of these assets is restricted to a management/custodial role.

Heritage assets included are the Art Gallery Collection at the Dunedin Public Art Gallery, the Theomin Collection at Olveston, the Toitū Otago Settlers Museum and the monuments, statues and outdoor art as well as land and buildings of the railway station and Olveston.

Except land and buildings, all other heritage assets are stated at cost less any subsequent accumulated depreciation and accumulated impairment losses.

Vested assets

Vested assets are fixed assets given to the Council by a third party and could typically include water, drainage and roading assets created in the event of a subdivision. Vested assets also occur in the event of the donation of heritage or art assets by third parties. The value of assets vested are recorded at fair value which could include as sale or acquisition the cost price to the third party to create or purchase that asset and equates to its fair value at the date of acquisition. Vested assets, other than those pertaining to collections, are subsequently depreciated.

Revaluations

Revaluations are performed with sufficient regularity such that the carrying amount does not differ materially from that which would be determined using fair values at the balance sheet date.

Revaluation increases and decreases relating to individual assets within a class of assets are offset. Revaluation increases and decreases in respect of assets in different classes are not offset.

Where the carrying amount of a class of assets is increased as a result of a revaluation, the net revaluation increase is credited to the revaluation reserve. The net revaluation increase shall be recognised in the surplus or deficit to the extent that it reverses a net revaluation decrease of the same class of assets previously recognised in the surplus or deficit. A net revaluation decrease for a class of assets is recognised in the surplus or deficit, except to the extent it reverses a revaluation increase previously recognised in the revaluation reserve to the extent of any credit balance existing in the revaluation reserve in respect of the same class of asset.

Derecognition

Items of property, plant and equipment are derecognised upon disposal or when no future economic benefits are expected to arise from the continued use of the asset.

Any gain or loss arising on derecognition of the asset (calculated as the difference between the net disposal proceeds and the carrying amount of the item) is included in the surplus or deficit in the year the item is derecognised.

Depreciation

Depreciation has been charged so as to write off the cost or valuation of assets, other than land, properties under construction and capital work in progress, on the straight line basis (SL). Rates used have been calculated to allocate the asset’s cost or valuation less estimated residual value over their estimated remaining useful lives.

Where parts of an item of property, plant and equipment have different useful lives, they are accounted for as separate items of property, plant and equipment.

Depreciation commences when the assets are ready for their intended use.

Depreciation on revalued assets, excluding land, is charged to the Statement of Comprehensive Revenue and Expense. On the subsequent sale or retirement of a revalued asset, the attributable revaluation surplus remaining in the appropriate property revaluation reserve is transferred directly to retained earnings.

Assets held under finance leases are depreciated over their expected useful lives on the same basis as owned assets, or where shorter, over the term of the relevant lease.

23 Investment property

(shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Rental from investment properties 7,651 8,223 8,453 8,664 8,881 9,103 9,330 9,573 9,831 10,097 10,359 Investment property operating expenses -3,096 -3,522 -3,645 -3,756 -3,886 -4,021 -4,162 -4,306 -4,458 -4,599 -4,737 4,555 4,701 4,808 4,908 4,995 5,082 5,168 5,267 5,373 5,498 5,622 Plus internal rental for car-park buildings 1,007 1,007 1,036 1,061 1,088 1,115 1,143 1,173 1,204 1,237 1,269 Less internal management fees and salaries -531 -531 -546 -559 -573 -588 -602 -618 -635 -652 -669 476 476 490 502 515 527 541 555 569 585 600 Net income 5,031 5,177 5,298 5,410 5,510 5,609 5,709 5,822 5,942 6,083 6,222 Relevant significant accounting policies

Investment property is property held to earn rentals and/or for capital appreciation. All investment properties are stated at fair value, as determined annually by independent valuers at the balance sheet date.

Gains or losses arising from changes in the fair value of investment properties are recognised in the surplus or deficit for the period in which the gain or loss arises.

24 Derivative financial instruments

The Council’s activities expose it primarily to the financial risks of changes in interest rates. The Council uses interest rate swap contracts to hedge these exposures.

The Council does not use derivative financial instruments for speculative purposes. However, derivatives that do not qualify for hedge accounting, under the specific IFRS rules, are accounted for as trading instruments with fair value gains/losses being taken directly to the surplus or deficit.

The use of financial derivatives is governed by Council’s policies which provide written principles on the use of financial derivatives.

Derivative financial instruments are recognised initially at fair value. Subsequent to initial recognition derivative financial instruments are re-measured at fair value.

Changes in the fair value of derivative financial instruments that are designated and effective as hedges of future cash flows are recognised directly in equity and the ineffective portion is recognised immediately in the surplus or deficit. If the cash flow hedge of a firm commitment or forecasted transaction results in the recognition of an asset or a liability, then, at the time the asset or liability is recognised, the associated gains or losses on the derivative that had previously been recognised in equity are included in the initial measurement of the asset or liability. For hedges that do not result in the recognition of an asset or a liability, amounts deferred in equity are recognised in the surplus or deficit in the same period in which the hedged item affects net surplus or deficit.

For an effective hedge of an exposure to changes in the fair value, the hedged item is adjusted for changes in fair value attributable to the risk being hedged with the corresponding entry in the surplus or deficit. Gains or losses from re-measuring the derivative, or for non-derivatives the foreign currency component of its carrying amount, are recognised in the surplus or deficit.

Changes in the fair value of derivative financial instruments that do not qualify for hedge accounting are recognised in the surplus or deficit as they arise. Derivatives not designated into an effective hedge relationship are classified as current assets or liabilities.

Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated, or exercised, or no longer qualifies for hedge accounting. At that time, any cumulative gain or loss on the hedging instrument recognised in equity is retained in equity until the forecasted transaction occurs. If a hedged transaction is no longer expected to occur, the net cumulative gain or loss recognised in equity is transferred to the surplus or deficit for the period.

Derivatives embedded in other financial instruments or other host contracts are treated as separate derivatives when their risks and characteristics are not closely related to those of host contracts and the host contracts are not carried at fair value with unrealised gains or losses reported in the surplus or deficit.

-

Prospective Information for the years ended 30 June 2022 – 2031

The Council has not presented group prospective financial statements. The prospective financial statements are for core Council only.

The main purpose of prospective financial statements in the 10 year plan is to provide users with information about the core services that the Council intends to provide ratepayers, the expected cost of those services and, as a consequence, how much the Council requires by way of rates to fund the intended levels of service. The level of rates funding required is not affected by subsidiaries except to the extent that the Council obtains distributions from, or further invests in, those subsidiaries. Such effects are included in the prospective financial statements of the Council.

The forecast financial statements have been prepared in accordance with the Local Government Act 2002.

The Local Government Act 2002 requires a council to, at all times, have a long-term plan under s 93, which covers a period of not less than 10 consecutive financial years; and includes the information required by Part 1 of Schedule 10.

Under Section 93 of the Local Government Act 2002, the purpose of a long term plan is to:

- describe the activities of the local authority; and

- describe the community outcomes of the local authority’s district or region; and

- provide integrated decision-making and co-ordination of the resources of the local authority; and

- provide a long-term focus for the decisions and activities of the local authority; and

- provide a basis for accountability of the local authority to the community.

The Council adopted the 10 year plan on 30 June 2021.

The Council is responsible for the forecast financial statements including the appropriateness of the underlying assumptions and other disclosures.

Nature of prospective information

The forecast financial statements are prepared in accordance with Tier 1 Public Benefit Entity Financial Reporting Standard 42. They are prepared on the basis of best-estimate assumptions as to future events, which the Council expects to take place in June 2021.

Cautionary note

The forecast financial statements are prospective financial information. Actual results are likely to vary from the information presented, and the variations may be material.

The following assumptions, which have a level of uncertainty of high, could lead to a material difference to the prospective financial statements. The uncertainties could lead to additional rates revenue and/or debt to the extent that budgets cannot be reprioritised.

- COVID-19 – Impacts of COVID-19 on DCC population, dwelling and rating projections – impacts of higher or lower growth than projected are an increase or decrease in demand for services and infrastructure creating potential for under or overspend of the 10 year plan budget.

- COVID-19 – Impacts of COVID-19 on projected visitor numbers on a peak day – the potential impact of lower or higher than anticipated visitor growth are impacts on the timing/demand for infrastructure and on the composition of the Dunedin economy.

- COVID-19 – Impacts of COVID-19 on the Dunedin economy – potential impacts of slower than anticipated economic growth could lead to financial pressure on DCC.

- CLIMATE CHANGE – Carbon Zero 2030 target

- RESILIENCE AND CIVIL DEFENCE – Resilience to emergencies – if a significant disaster occurs that exceeds the DCC’s ability to respond.

The following assumption, which has a level of uncertainty of high, could lead to a material difference to the prospective financial statements. The uncertainty could lead to assets being transferred to a new entity. This would impact on operating revenues, operating costs, assets, debt, the Financial Strategy and the Infrastructure Strategy.

- FUTURE LEGISLATIVE CHANGES – Proposed 3 Waters reform

Extent to which prospective information incorporates actual results

The period covered by the 10 year plan contains no actual operating results, but the forecast balance sheet is extrapolated from the audited Statement of Financial

Position included in the Dunedin City Council Annual Report as at 30 June 2020.

Basis of underlying assumptions

The 10 year plan brings together summary information from several vastly detailed and comprehensive strategic planning processes. There are a number of Council strategies, plans and policies that guide the Council’s decision-making and influence the content of this plan.

All Council groups of activities have prepared Group Management Plans. These plans have been prepared using standard templates and business assumptions. The most significant business assumption is the provision of the same level of service, which implies there will be no termination of service for any activity.

-

10 Year Plan Disclosure Statement for the years ended 30 June 2022 – 2031

What is the purpose of this Statement?

The purpose of this statement is to disclose the Council’s planned financial performance in relation to various benchmarks to enable the assessment of whether the Council is prudently managing its revenues, expenses, assets, liabilities, and general financial dealings.

The Council is required to include this statement in its long-term plan in accordance with the Local Government (Financial Reporting and Prudence) Regulations 2014 (the regulations). Refer to the regulations for more information, including definitions of some of the terms used in this statement.

Rates Affordability Benchmark

The Council meets the rates affordability benchmark if –

- Its planned rates income equals or is less than each quantified limit on rates; and

- Its planned rates increases equal or are less than each quantified limit on rates increases.

Rates (Income) Affordability

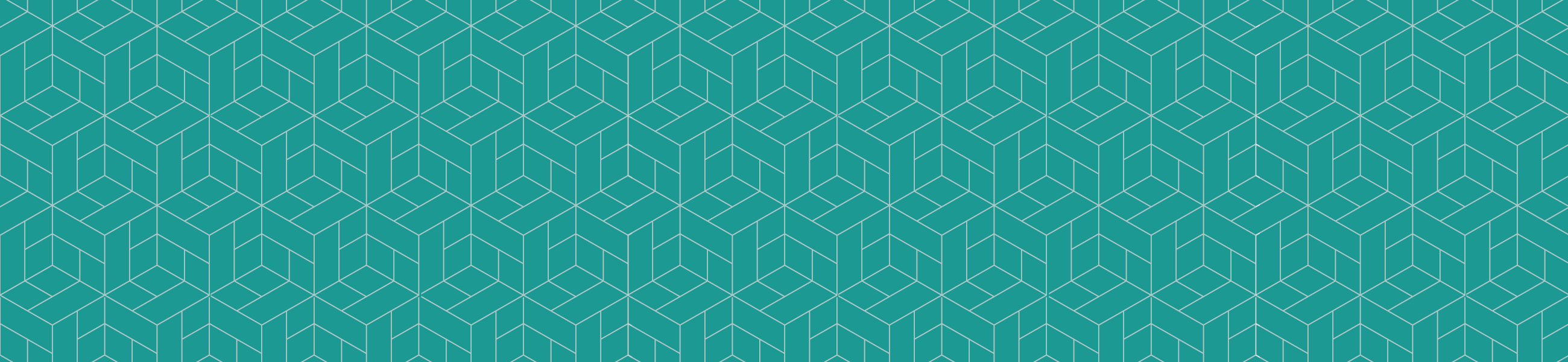

The following graph compares the Council’s planned rates with a quantified limit on rates contained in the financial strategy included in the Council’s long-term plan. The quantified limit is $179 million for the 2021/22 year.

Year Quantified limit on rates income Proposed rates income (at or within limit) Proposed rates income (exceeds limit) 2022 179 179 2023 191 192 2024 204 205 2025 217 217 2026 231 230 2027 246 244 2028 262 258 2029 279 272 2030 297 283 2031 316 294 Rates (Increases) Affordability

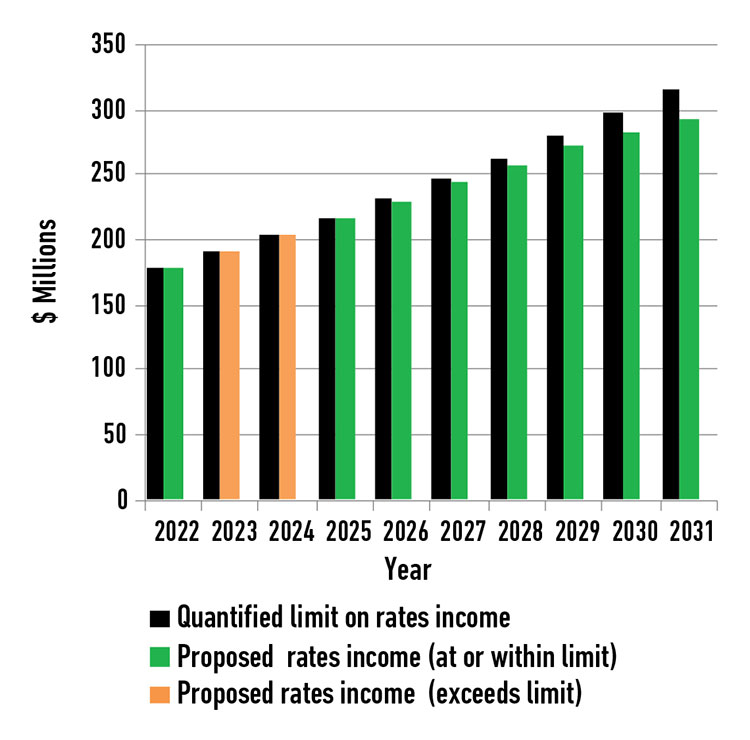

The following graph compares the Council’s planned rates increases with a quantified limit on rates increases contained in the financial strategy included in the Council’s long term plan. The quantified limit is 10.0% for the 2021/22 year. Please refer to the financial strategy for the quantified limits for the remaining nine years.

Year Quantified limit on rates increase Proposed rates increase (at or within limit) Proposed rates increase (exceeds limit) 2022 10.00 9.8 2023 6.50 7.0 2024 6.50 7.0 2025 6.50 6.0 2026 6.50 6.0 2027 6.50 6.0 2028 6.50 5.5 2029 6.50 5.5 2030 6.50 4.2 2031 6.50 3.9 Debt Affordability Benchmark

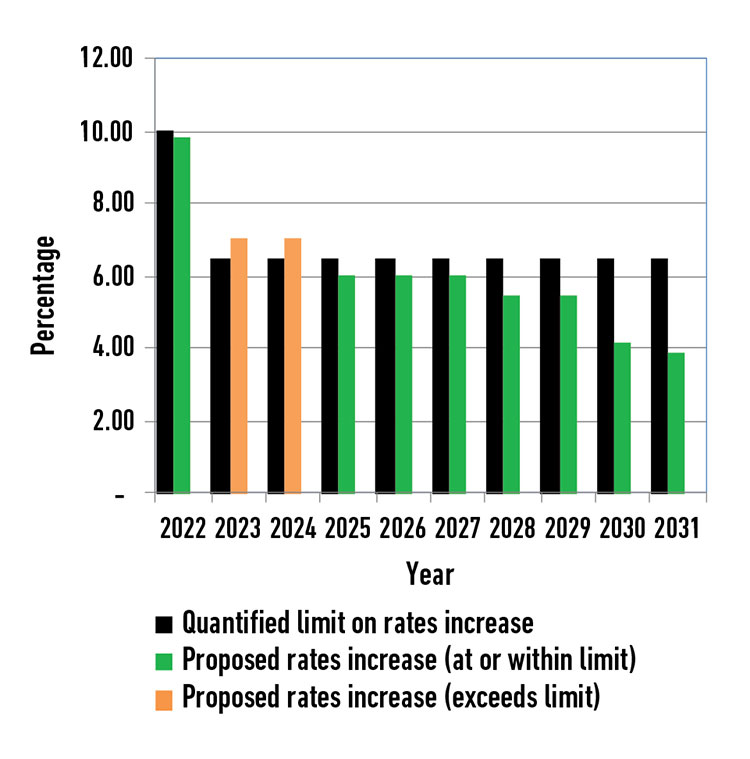

The Council meets the debt affordability benchmark if its planned borrowing is within each quantified limit on borrowing.

The following graph compares the Council’s planned debt with a quantified limit on borrowing contained in the financial strategy included in the Council’s long term plan. The quantified limit is $736 million for the 2021/22 year. Please refer to the financial strategy for the quantified limits for the remaining nine years.

Year Quantified limit on debt Proposed debt (at or within limit) 2022 736 336.0 2023 760 412.0 2024 802 473.0 2025 839 540.0 2026 867 602.0 2027 913 658.0 2028 950 702.0 2029 986 745.0 2030 1016 776.0 2031 1053 820.0 Balanced Budget Benchmark

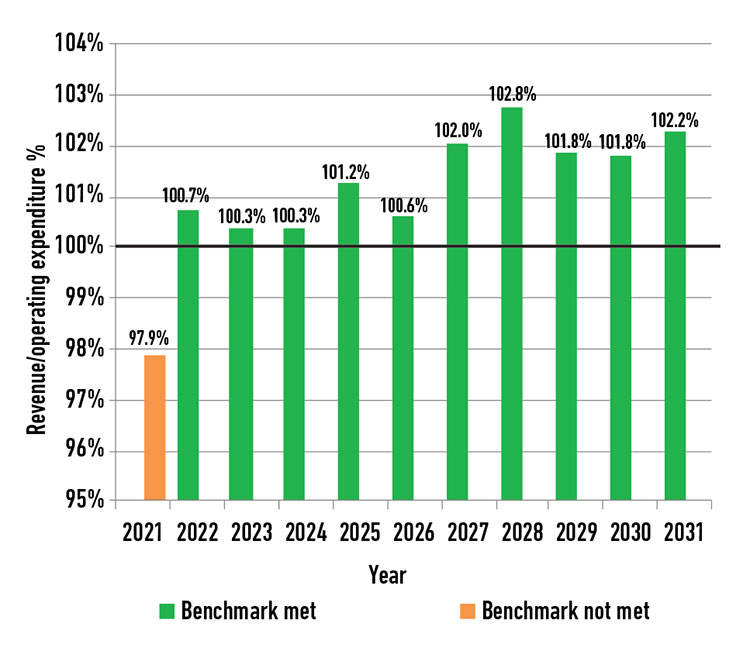

The following graph displays the Council’s planned revenue (excluding development contributions, financial contributions, vested assets, gains on derivative financial instruments and revaluations of property, plant or equipment) as a proportion of planned operating expenses (excluding losses on derivative financial instruments and revaluations of property, plant or equipment).

The Council meets the balanced budget benchmark if its planned revenue equals or is greater than its planned operating expenses.

Year Benchmark met Benchmark not met 2021 97.9% 2022 100.7% 2023 100.3% 2024 100.3% 2025 101.2% 2026 100.6% 2027 102.0% 2028 102.8% 2029 101.8% 2030 101.8% 2031 102.2% Essential Services Benchmark

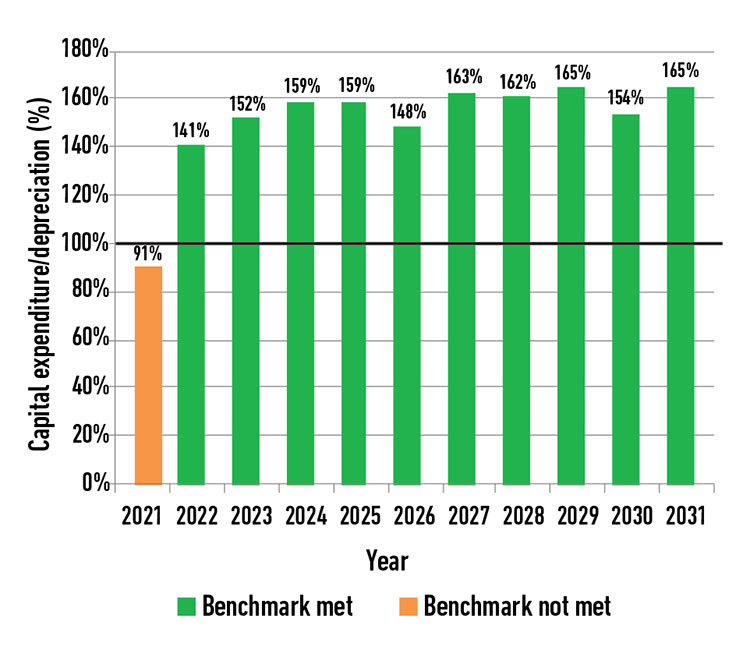

The following graph displays the Council’s planned capital expenditure on network services as a proportion of expected depreciation on network services.

The Council meets the essential services benchmark if its planned capital expenditure on network services equals or is greater than expected depreciation on network services.

Year Benchmark met Benchmark not met 2021 91% 2022 141% 2023 152% 2024 159% 2025 159% 2026 148% 2027 163% 2028 162% 2029 165% 2030 154% 2031 165% Debt Servicing Benchmark

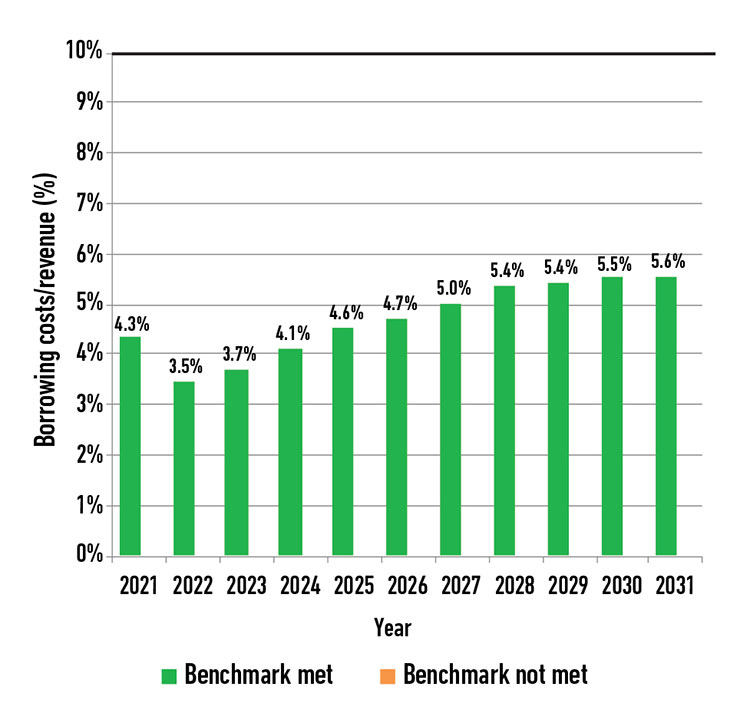

The following graph displays the Council’s planned borrowing costs as a proportion of planned revenue (excluding development contributions, financial contributions, vested assets, gains on derivative financial instruments, and revaluations of property, plant or equipment).

Because Statistics New Zealand projects the Council’s population will grow more slowly than the national population is expected to grow, it meets the debt servicing benchmark if its planned borrowing costs equal or are less than 10% of its revenue

Year Benchmark met Benchmark not met 2021 4.3% 2022 3.5% 2023 3.7% 2024 4.1% 2025 4.6% 2026 4.7% 2027 5.0% 2028 5.4% 2029 5.4% 2030 5.5% 2031 5.6%

Current Alerts and Notices (View all)

Financial statements and disclosures | He pūroko tahua, tūhurataka

Last updated: 24 Nov 2023 6:30am