-

Funding Impact Statement

Funding Impact Statement for the Years Ended 30 June 2022 - 2031 (whole of council) (shown in $000's) Annual Plan 2021 Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Sources of operating funding General rates, uniform annual general charges, rates penalties 93,883 103,014 109,864 116,958 125,849 135,088 145,458 155,363 164,303 171,220 177,618 Targeted rates 69,585 76,960 82,673 89,014 92,441 96,276 99,744 103,291 108,540 113,057 117,745 Subsidies and grants for operating purposes 11,329 11,001 11,187 11,417 11,745 12,082 12,429 12,787 13,156 13,548 13,938 Fees and charges 56,845 62,402 65,314 66,712 69,039 70,220 71,434 73,406 75,323 76,908 78,438 Interest and dividends from investments 9,816 8,619 8,391 8,260 8,144 8,129 8,201 8,307 8,417 8,490 8,566 Local authorities fuel tax, fines, infringement fees, and other receipts 3,163 3,003 3,239 3,276 3,317 3,353 3,389 3,427 3,466 3,507 3,548 Total operating funding (A) 244,621 264,999 280,668 295,637 310,535 325,148 340,655 356,581 373,205 386,730 399,853 Application of operating funding Payments to staff and suppliers 197,137 199,810 206,451 218,528 224,802 231,260 239,188 245,945 256,978 263,950 271,355 Finance costs 12,051 9,943 10,836 12,792 14,615 16,454 18,137 19,571 20,825 21,881 22,949 Other operating funding applications 0 0 0 0 0 0 0 0 0 0 0 Total application of operating funding (B) 209,188 209,753 217,287 231,320 239,417 247,714 257,325 265,516 277,803 285,831 294,304 Surplus/(deficit) of operating funding (A-B) 35,433 55,246 63,381 64,317 71,118 77,434 83,330 91,065 95,402 100,899 105,549 Sources of capital funding Subsidies and grants for capital expenditure 28,439 21,445 15,202 16,828 16,673 13,097 16,145 14,826 12,661 10,944 12,595 Development and financial contributions 832 3,468 3,545 3,623 3,703 3,785 3,868 3,718 3,801 3,886 3,973 Increase/(decrease) in debt 7,222 63,975 75,821 61,259 66,551 62,382 55,570 44,900 42,999 30,985 43,839 Gross proceeds from sale of assets 120 3,165 120 120 120 120 120 120 120 120 120 Lump sum contributions 0 0 0 0 0 0 0 0 0 0 0 Other dedicated capital funding 0 0 0 0 0 0 0 0 0 0 0 Total sources of capital funding (C) 36,613 92,053 94,688 81,830 87,047 79,384 75,703 63,564 59,581 45,935 60,527 Application of capital funding Capital expenditure - to meet additional demand 1,651 6,712 8,535 9,121 9,155 9,290 9,448 9,471 9,468 9,066 9,946 - to improve the level of service 28,122 61,791 65,534 50,991 57,417 68,127 56,400 48,697 45,062 31,355 40,898 - to replace existing assets 35,908 77,024 84,820 84,938 90,472 78,475 90,869 94,729 99,565 104,838 113,128 Increase/(decrease) in reserves 0 0 0 0 0 0 0 0 0 0 0 Increase/(decrease) of investments 6,365 1,771 -820 1,097 1,121 927 2,315 1,732 887 1,575 2,104 Total application of capital funding (D) 72,046 147,299 158,069 146,147 158,165 156,818 159,033 154,629 154,983 146,834 166,076 Surplus/(deficit) of capital funding (C-D) -35,433 -55,246 -63,381 -64,317 -71,118 -77,434 -83,330 -91,065 -95,402 -100,899 -105,549 Funding balance ((A-B)+(C-D)) 0 0 0 0 0 0 0 0 0 0 0

Rating method

The rating method refers to the ways that the Council uses the rating system to allocate rates among groups of ratepayers, and how the liability for rates will be distributed within each group.

When considering the rating method, the Council takes into consideration the funding principles provided at the end of this section. It should be read in conjunction with the Revenue and Financing Policy and the Funding Principles. Figures in this policy are GST inclusive.

The following rates will be set by the Council for the financial year commencing 1 July 2021 and ending 30 June 2022.

-

General Rate

A general rate based on the capital value of each rating unit in the district.

The general rate will be set on a differential basis based on land use (the categories are “residential”, “lifestyle”, “commercial”, “farmland”, “residential heritage bed and breakfasts” and “stadium: 10,000+ seat capacity”).

The rates (in cents per dollar of capital value) for the 2021/22 year are:

Table 1: General Rates

Categories Rates, Cents in $ per Capital Value Factor Revenue Sought $ General Rate Share Residential 0.3091 1 69,245,000 58.93% Lifestyle 0.2937 0.95 5,792,000 4.93% Commercial 0.7604 2.46 37,930,000 32.29% Farmland 0.2473 0.8 4,379,000 3.73% Residential Heritage Bed and Breakfasts 0.541 1.75 24,000 0.02% Stadium: 10,000+ Seat Capacity 0.0621 0.2 116,000 0.10% The objective of the differential rate is to provide a mechanism to charge general rates to the six differential categories in a way that best achieves the 11 funding principles provided at the end of this section.

The Council uses the ‘factor method’ of setting the general rate differential. Under this method, a general rate factor is established which is simply the degree to which the rate (the cents in the dollar) on each category of property is higher or lower than residential property. In other words, the Council determines the degree to which the rate on a category of property is higher or lower than residential property.

The practical effect of the differential is that commercial properties pay more rates than would be expected under a “pure, undifferentiated” capital value (CV) system, and lifestyle, farmland and residential property owners pay less.

In December 2020, the Council reviewed the six general rate differential categories, specifically how the general rate is allocated across ratepayers. Due to the integrated nature of two targeted rates, Community Services and Tourism/ Economic Development, these were also considered.

The review also considered the rating of short term visitor accommodation. No changes to the general rate differentials were made because the status quo was felt to be appropriate.

-

Uniform Annual General Charge

The Council will not be using a Uniform Annual General Charge.

-

Targeted Rates

Community Services

A targeted rate for community services of $102.00. This rate will be set on a differential basis based on land use (the categories are “residential, residential heritage bed and breakfasts, lifestyle and farmland” and “commercial and stadium: 10,000+ seat capacity”). The rate will be charged on the following basis:

Table 2: Targeted Rate – Community Services

Categories Rate/Liability Calculated Revenue Sought $ Residential, Residential Heritage Bed and Breakfasts, Lifestyle and Farmland $102.00 per separately used or inhabited part of a rating unit 5,546,000 Commercial and Stadium: 10,000+ Seat Capacity $102.00 per rating unit 284,000 The community services targeted rate will be used to fund part of the Parks and Reserves activity and the Botanic Garden.

Kerbside Recycling Collection

A targeted rate for a kerbside recycling collection service. This rate will be set on a differential basis based on land use (the categories are “residential, residential heritage bed and breakfasts, lifestyle and farmland” and “commercial”).

This rate applies to all separately used or inhabited parts of a rating unit or rating units that receive a kerbside recycling collection service. The rate for the 2021/22 year is:

Table 3: Targeted Rate – Kerbside Recycling Collection

Liability Calculated Rate/Liability Calculated Revenue Sought $ Residential, Residential Heritage Bed and Breakfasts, Lifestyle and Farmland $106.10 per separately used or inhabited part of a rating unit 5,319,000 Commercial $106.10 per rating unit 29,000 Drainage

A targeted rate for drainage. Drainage is a combined targeted rate for sewage disposal and stormwater. Sewage disposal makes up 78% of the drainage rate, and stormwater makes up 22%. This rate will be set on a differential basis based on the provision of service (with the categories being “connected” and “serviceable”) and on land use (with the categories being “residential, residential heritage bed and breakfasts, lifestyle and farmland”, “commercial, residential institutions, schools and stadium: 10,000+ seat capacity” and “churches”). The rate will be charged on the following basis:

Table 4: Targeted Rate – Drainage Categories

Categories Liability Calculated Revenue Sought $ Residential, Residential Heritage Bed and Breakfasts, Lifestyle and Farmland Per separately used or inhabited part of a rating unit 29,867,000 Commercial, Residential Institutions, Schools and Stadium: 10,000+ Seat Capacity Per rating unit 1,758,000 Churches Per rating unit 12,000 The rates for the 2021/22 year are:

Table 5: Targeted Rate – Drainage Rates

Residential, Residential Heritage Bed and Breakfasts, Lifestyle and Farmland Rates $ Connected 618.5 Serviceable 309.25 Commercial, Residential Institutions, Schools and Stadium: 10,000+ Seat Capacity Rates $ Connected 618.5 Serviceable 309.25 Churches Rate $ Connected 102.25 Non–rateable land will not be liable for the stormwater component of the drainage targeted rate. Rates demands for the drainage targeted rate for non–rateable land will therefore be charged at 78%.

Rating units which are not connected to the scheme, and which are not serviceable, will not be liable for this rate.

Commercial Drainage – Capital Value

In addition, a capital value–based targeted rate for drainage on a differential basis based on land use (the categories are “commercial and residential institutions”, “schools” and “stadium: 10,000+ seat capacity”) and the provision of services (the categories being “connected” and “serviceable”). This rate shall not apply to properties in Karitane, Middlemarch, Seacliff, Waikouaiti and Warrington. This rate shall not apply to churches.

The rates for the 2021/22 year are:

Table 6: Targeted Rate – Commercial Drainage Rates

Categories Rates, Cents in $ per Capital Value Revenue Sought $ Connected Serviceable Connected Serviceable Commercial and Residential Institutions 0.2878 0.1439 14,800,000 274,000 Schools 0.2159 0.1079 692,000 5,000 Stadium: 10,000+ Seat Capacity 0.0233 N/A 44,000 N/A Non–rateable land will not be liable for the stormwater component of the drainage targeted rate. Rates demands for the drainage targeted rate for non–rateable land will therefore be charged at 78%.

Water

A targeted rate for water supply per separately used or inhabited part of a rating unit on all property either connected, or for which connection is available, to receive an ordinary supply of water within the meaning of the Dunedin City bylaws, excepting properties in Karitane, Merton, Rocklands/Pukerangi, Seacliff, Waitati, Warrington, East Taieri, West Taieri and North Taieri. This rate will be set on a differential basis based on the availability of service (the categories are “connected” and “serviceable”).

Rating units which are not connected to the scheme, and which are not serviceable, will not be liable for this rate.

The rates for the 2021/22 year are:

Table 7: Targeted Rate – Water (Ordinary)

Categories Rate/Liability Calculated Revenue Sought $ Connected $469.00 per separately used or inhabited part of a rating unit 21,905,000 Serviceable $234.50 per separately used or inhabited part of a rating unit 255,000 A targeted rate for water supply that is based on the volume of water made available to all separately used or inhabited parts of a rating unit in Karitane, Merton, Seacliff, Waitati, Warrington, East Taieri, West Taieri and North Taieri.

This rate will be set on a differential basis based on the availability of service (the categories are “connected” and “serviceable”).

The rates for the 2021/22 year are:

Table 8: Targeted Rate – Water (Volume of Water)

Categories Rate/Liability Calculated Revenue Sought $ Connected $469.00 per unit of water being one cubic metre (viz 1,000 litres) per day made available at a constant rate of flow during a full 24–hour period 1,428,000 Serviceable $234.50 per separately used or inhabited part of a rating unit (note this rate shall not apply to the availability of water in Merton, Karitane or Seacliff) 27,000 Fire Protection

A targeted rate for rating units that receive a water supply for the provision of a fire protection service. The rate will be set on a differential basis based on land use on certain categories of property (“commercial”, “residential institutions” and “stadium: 10,000+ seat capacity”).

This rate will be based on capital value. This rate shall not apply to churches.

The rates for the 2021/22 year are:

Table 9: Targeted Rate – Fire Protection Capital Value

Categories Rates, Cents in $ per Capital Value Revenue Sought $ Commercial 0.0826 4,676,000 Residential Institutions 0.062 321,000 Stadium: 10,000+ Seat Capacity 0.0094 18,000 A targeted rate for water supply for the provision of a fire protection service for each separately used or inhabited part of a rating unit within the “residential, residential heritage bed and breakfasts, lifestyle and farmland” categories that are not receiving an ordinary supply of water within the meaning of the Dunedin City bylaws.

The rate for the 2021/22 year is:

Table 10: Targeted Rate – Fire Protection

Categories Rate/Liability Calculated Revenue Sought $ Residential, Residential Heritage Bed and Breakfasts, Lifestyle and Farmland $140.70 per separately used or inhabited part of a rating unit 23,000 Water – Quantity of Water

A targeted rate for the quantity of water provided, reconnection fee and special reading fee, to any rating unit fitted with a water meter, being an extraordinary supply

of water within the meaning of the Dunedin City bylaws, according to the following scale of charges:

Table: 11: Targeted Rate – Quantity of Water

Annual Meter Rental Charge $ 20mm nominal diameter 157.01 25mm nominal diameter 201.57 30mm nominal diameter 223.85 40mm nominal diameter 253.56 50mm nominal diameter 513.48 80mm nominal diameter 634.42 100mm nominal diameter 669.43 150mm nominal diameter 962.24 300mm nominal diameter 1,248.68 Hydrant Standpipe 621.69 Reconnection Fee 437.6 Special Reading Fee 59.47 Backflow Prevention Charge $ Backflow Preventer Test Fee 108.44 Rescheduled Backflow Preventer Test Fee 61.61 Backflow Programme – incomplete application fee (hourly rate) 43.54 Water Charge $ Merton, Hindon and individual farm supplied Bulk Water 0.11 per cubic metre All other treated water per cubic metre 1.76 per cubic metre Disconnection of Water Supply (AWSCI to excavate) 243.69 Disconnection of Water Supply (DCC contractor to excavate) 954.81 Where the supply of a quantity of water is subject to this Quantity of Water Targeted Rate, the rating unit will not be liable for any other targeted rate for the supply of the same water.

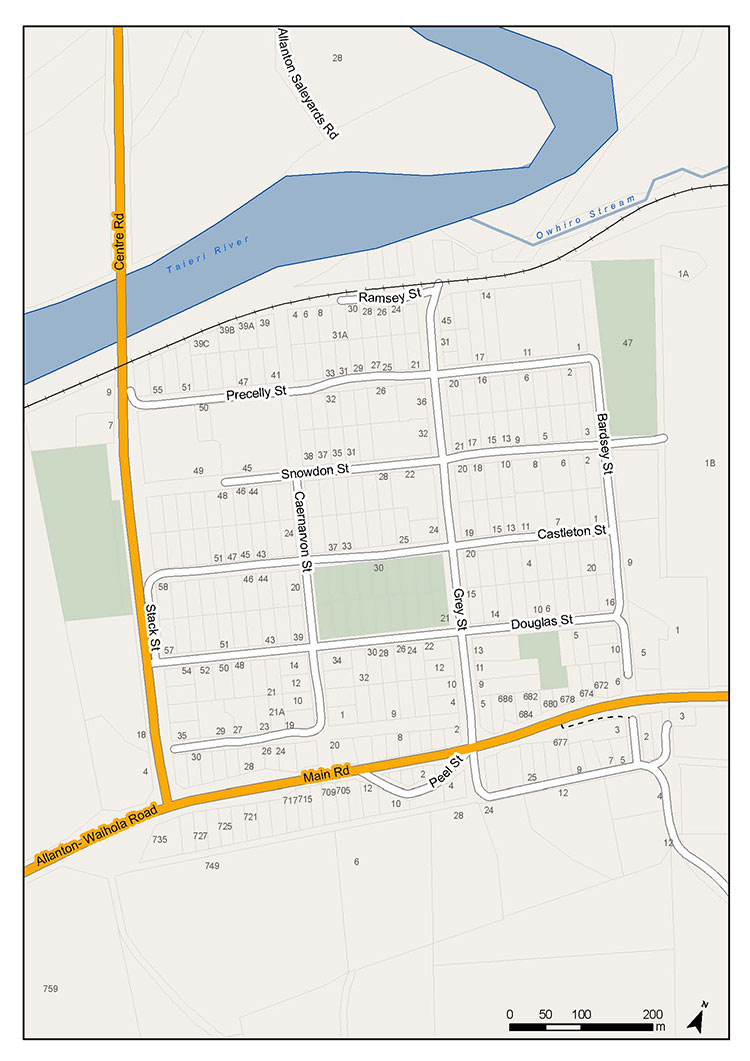

Allanton Drainage

A targeted rate for rating units within the Allanton area that are paying the capital contribution towards the Allanton Wastewater Collection System, as a targeted rate over 20 years. Liability for the rate is on the basis of the provision of service to each rating unit.

The rate for the 2021/22 year is:

Liability Calculated Rate Revenue Sought $ Per rating unit $411.00 22,000 The Allanton area is shown in the map below:

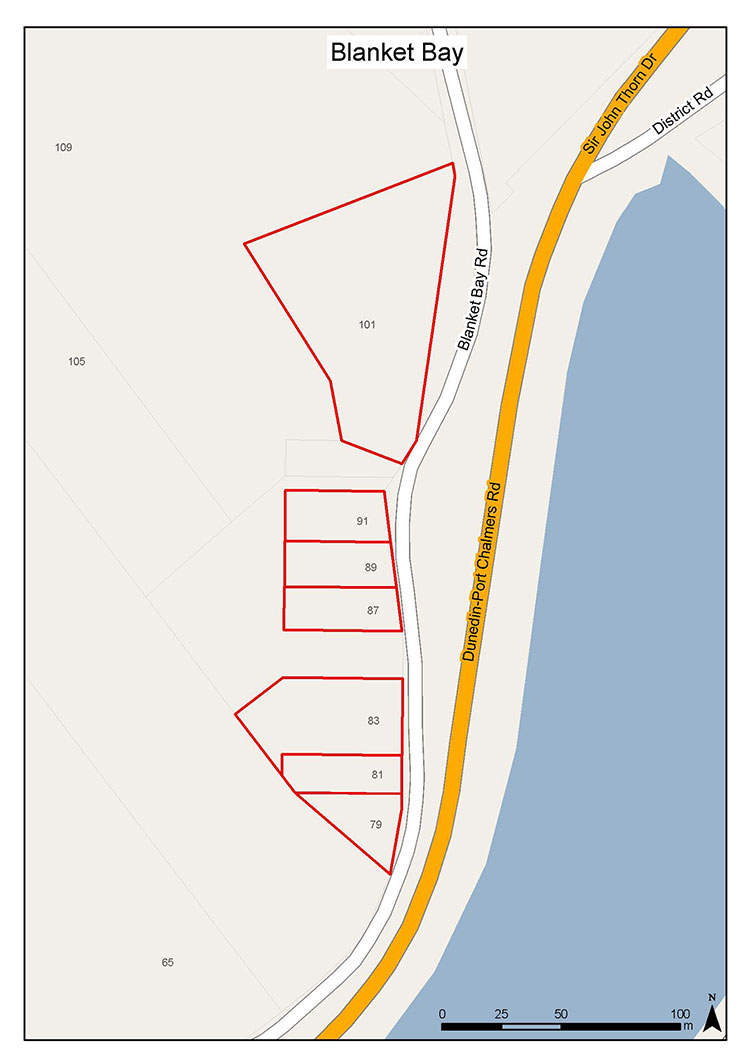

Blanket Bay Drainage

A targeted rate for rating units within the Blanket Bay area that are paying the capital contribution towards the Blanket Bay Drainage system, as a targeted rate over 20 years.

Liability for the rate is on the basis of the provision of the service to each rating unit.

The rate for the 2021/22 year is:

Liability Calculated Rate Revenue Sought $ Per rating unit $636.00 1,000 The Blanket Bay area is shown in the map below:

Curles Point Drainage

A targeted rate for rating units within the Curles Point area that are paying the capital contribution towards the Curles Point Drainage System, as a targeted rate over 20 years. Liability for the rate is on the basis of the provision of the service to each rating unit.

The rate for the 2021/22 year is:

Liability Calculated Rate Revenue Sought $ Per rating unit $749.00 1,000 The Curles Point area is shown in the map below:

Tourism/Economic Development

A capital value–based targeted rate for all commercial properties. The rate will be set on a differential basis based on land use (the categories are “commercial” and “stadium: 10,000+ seat capacity”).

The rate for the 2021/22 year will be charged on the following basis:

Table 12: Targeted Rate –Tourism/Economic Development

Categories Rates, cents in $ per Capital Value Revenue Sought $ Commercial 0.0116 573,000 Stadium: 10,000+ Seat Capacity 0.0013 2,000 The Tourism/Economic Development targeted rate will be used to fund part of the Economic Development budget.

Warm Dunedin Targeted Rate Scheme

A targeted rate for each rating unit in the Warm Dunedin Targeted Rate Scheme. The revenue sought from this targeted rate is $590,000. The targeted rate scheme provides a way for homeowners to install insulation and/or clean heating. The targeted rate covers the cost and an annual interest rate. The interest rates have been and will be:

- Rates commencing 1 July 2013 and 1 July 2014 8%;

- Rates commencing 1 July 2015 and 1 July 2016 8.3%;

- Rates commencing 1 July 2017 7.8%;

- Rates commencing 1 July 2018 7.2%;

- Rates commencing 1 July 2019 6.8%.

- Rates commencing 1 July 2020 5.7%.

- Rates commencing 1 July 2021 4.4%.

Table 13: Targeted Rate – Warm Dunedin Targeted Rate Scheme

Liability Calculated Revenue Sought $ Per rating unit 590,000 Private Street Lighting

A targeted rate for street lighting in the private streets to which the Council supplies a private street lighting service. The targeted rate will be set on a differential basis based on land use (the categories are “residential”, “lifestyle” and “commercial”).

The rate for the 2021/22 year will be charged on the following basis:

Table 14: Targeted Rate – Private Street Lighting

Categories Liability Calculated Rate $ Revenue Sought $ Residential and Lifestyle For each separately used or inhabited part of a rating unit in a private street the sum calculated on the formula of $149.40 per street light in a private street divided by the number of separately used or inhabited parts of a rating unit in the private street. 149.40 for each street light 31,000 Commercial For each rating unit in a private street the sum calculated on the formula of $149.40 per street light in a private street divided by the number of rating units in the private street. 149.40 for each street light 4,000 Private Street Lighting Addresses ( opens in new window)

-

Differential matters and categories

Where councils assess rates on a differential basis, the definition of differential categories is limited to the list of matters specified in Schedule 2 of the Local Government (Rating) Act 2002. The Council is required to state which matters will be used for definition of the categories, and the category or categories of any differentials.

The differential categories are determined in accordance with the Council’s land use codes and the provision or availability of services. The land use code for each property is available from the Council’s Customer Services Agency and on the website (on a property by property basis) at www.dunedin.govt.nz/services/rates-information.

The Council’s land use codes are based on the land use codes set under the Rating Valuation Rules 2008, which are set out below:

Land Code Land Use Category Differential Category Land Code Land Use Category Differential Category 0 Multi–use: Vacant/Indeterminate Commercial 51 Recreational: Entertainment Commercial 1 Multi–use: Rural Industry Farmland 52 Recreational: Active Indoor Commercial 2 Multi–use: Lifestyle Lifestyle 53 Recreational: Active Outdoor Commercial 3 Multi–use: Transport Commercial 54 Recreational: Passive Indoor Commercial 4 Multi–use: Community Services Commercial 55 Recreational: Passive Outdoor Commercial 5 Multi–use: Recreational Commercial 59 Recreational: Vacant Commercial 6 Multi–use: Utility Services Commercial 60 Utility Services: Multi–use within Utility Services Commercial 7 Multi–use: Industrial Commercial 61 Utility Services: Communications Commercial 8 Multi–use: Commercial Commercial 62 Utility Services: Electricity Commercial 9 Multi–use: Residential Residential 63 Utility Services: Gas Commercial 10 Rural: Multi–use within Rural Industry Farmland 64 Utility Services: Water Supply Commercial 11 Rural: Dairy Farmland 65 Utility Services: Sanitary Commercial 12 Rural: Stock Finishing Farmland 66 Utility Services: Other Commercial 13 Rural: Arable Farming Farmland 67 Utility Services: Post Boxes Commercial 14 Rural: Store Livestock Farmland 69 Utility Services: Vacant Commercial 15 Rural: Market Gardens and Orchards Farmland 70 Industrial: Multi–use within Industrial Commercial 16 Rural: Specialist Livestock Farmland 71 Industrial: Food, Drink and Tobacco Commercial 17 Rural: Forestry Farmland 72 Industrial: Textiles, Leather and Fur Commercial 18 Rural: Mineral Extraction Commercial 73 Industrial: Timber Products and Furniture Commercial 19 Rural: Vacant Farmland 74 Industrial: Building Materials Other than Timber Commercial 20 Lifestyle: Multi–use within Lifestyle Lifestyle 75 Industrial: Engineering, Metalworking, Appliances and Machinery Commercial 21 Lifestyle: Single Unit Lifestyle 76 Industrial: Chemicals, Plastics, Rubber and Paper Commercial 22 Lifestyle: Multi–unit Lifestyle 77 Industrial: Other Industries – including Storage Commercial 29 Lifestyle: Vacant Lifestyle 78 Industrial: Depots, Yards Commercial 30 Transport: Multi–use within Transport Commercial 79 Industrial: Vacant Commercial 31 Transport: Road Transport Commercial 80 Commercial: Multi–use within Commercial Commercial 32 Transport: Parking Commercial 81 Commercial: Retail Commercial 33 Transport: Rail Transport Commercial 82 Commercial: Services Commercial 34 Transport: Water Transport Commercial 83 Commercial: Wholesale Commercial 35 Transport: Air Transport Commercial 84 Commercial: Offices Commercial 39 Transport: Vacant Commercial 85 Commercial: Carparking Commercial 40 Community Services: Multi–use within Community Services Commercial 89 Commercial: Vacant Commercial 41 Community Services: Educational Commercial 90 Residential: Multi–use within Residential Residential 42 Community Services: Medical and Allied Commercial 91 Residential: Single Unit excluding Bach/Crib Residential 43 Community Services: Personal and Property Protection Commercial 92 Residential: Multi–unit Residential 44 Community Services: Religious Commercial 93 Residential: Public Communal – Unlicensed Commercial 45 Community Services: Defence Commercial 94 Residential: Public Communal – Licensed Commercial 46 Community Services: Halls Commercial 95 Residential: Special Accommodation Residential 47 Community Services: Cemeteries and Crematoria Commercial 96 Residential: Communal Residence Dependent on Other Use Residential 49 Community Services: Vacant Commercial 97 Residential: Bach/Crib Residential 50 Recreational: Multi–use within Recreational Commercial 98 Residential: Carparking Residential 99 Residential: Vacant Residential In addition to the categories set out above, the Council has established categories for residential institutions, residential heritage bed and breakfasts, the stadium: 10,000+ seat capacity, churches, and schools.

1 Differentials based on land use

The Council uses this matter to:

- differentiate the General Rate

- differentiate the Community Services Rate

- differentiate the Kerbside Recycling Collection Rate

- differentiate the Private Street Lighting Rate

- differentiate the Tourism/Economic Development Rate

- differentiate the Fire Protection Rate.

The differential categories based on land use are:

Residential – includes all rating units used for residential purposes including single residential, multi–unit residential, multi–use residential, residential special accommodation, residential communal residence dependent on other use, residential bach/cribs, residential carparking and residential vacant land.

Lifestyle – includes all rating units with Council land use codes 2, 20, 21, 22 and 29.

Commercial – includes all rating units with land uses not otherwise categorised as Residential, Lifestyle, Farmland, Stadium: 10,000+ Seat Capacity or Residential Heritage Bed and Breakfasts.

Farmland – includes all rating units used solely or principally for agricultural or horticultural or pastoral purposes.

Residential Heritage Bed and Breakfasts – includes all rating units meeting the following description:

- Bed and breakfast establishments; and

- Classified as commercial for rating purposes due to the number of bedrooms (greater than 4); and

- Either:

- the majority of the establishment is at least 80 years old; or

- the establishment has Heritage New Zealand Pouhere Taonga Registration; or

- the establishment is a Dunedin City Council Protected Heritage Building, as identified in the District Plan; and

- The bed and breakfast owner lives at the facility.

Stadium: 10,000+ Seat Capacity – this includes land at 130 Anzac Avenue, Dunedin, Assessment 4026695, Valuation reference 27190–01403.

2 Differentials based on land use and provision or availability of service

The Council uses these matters to differentiate the drainage rate and commercial drainage rate.

The differential categories based on land use are:

Residential – includes all rating units used for residential purposes including single residential, multi–unit residential, multi–use residential, residential special accommodation, residential communal residence dependent on other use, residential bach/cribs, residential carparking and residential vacant land.

Lifestyle – includes all rating units with Council land use codes 2, 20, 21, 22 and 29.

Farmland – includes all rating units used solely or principally for agricultural or horticultural or pastoral purposes.

Commercial – includes all rating units with land uses not otherwise categorised as Residential, Lifestyle, Farmland, Stadium: 10,000+ Seat Capacity, Residential Heritage, Bed and Breakfasts, Residential Institutions, Churches or Schools.

Stadium: 10,000+ Seat Capacity – this includes land at 130 Anzac Avenue, Dunedin, Assessment 4026695, Valuation reference 27190–01403.

Residential Heritage Bed and Breakfasts – includes all rating units meeting the following description:

- Bed and breakfast establishments; and

- Classified as commercial for rating purposes due to the number of bedrooms (greater than 4); and

- Either:

- the majority of the establishment is at least 80 years old; or

- the establishment has Heritage New Zealand Pouhere Taonga Registration; or

- the establishment is a Dunedin City Council Protected Heritage Building, as identified in the District Plan; and

- The bed and breakfast owner lives at the facility.

Residential Institutions – includes only rating units with Council land use codes 95 and 96.

Churches – includes all rating units used solely or principally as places of religious worship.

Schools – includes only rating units used for schools that do not operate for profit.

The differential categories based on provision or availability of service are:

Connected – any rating unit that is connected to a public sewerage drain.

Serviceable – any rating unit that is not connected to a public sewerage drain but is capable of being connected to the sewerage system (being a property situated within 30 metres of a public drain).

3 Differentials based on provision or availability of service

The Council uses these matters to differentiate the water rates.

The differential categories based on provision or availability of service are:

Connected – any rating unit that is supplied by the water supply system

Serviceable – any rating unit that is not supplied but is capable of being supplied by the water supply system (being a rating unit situated within 100 metres of the nearest water supply).

-

Minimum rates and Low value rating units

Minimum rates

Where the total amount of rates payable in respect of any rating unit is less than $5.00, the rates payable in respect of the rating unit shall be such amount as the Council determines, but not exceeding $5.00

Low value rating units

Rating units with a capital value of $6,000 or less will only be charged the general rate.

-

Separately used or inhabited part of a rating unit

A separately used or inhabited part of a rating unit includes any portion inhabited or used by the owner/a person other than the owner, and who has the right to use or inhabit that portion by virtue of a tenancy, lease, licence, or other agreement.

This definition includes separately used parts, whether or not actually occupied at any particular time, which are provided by the owner for rental (or other form of occupation) on an occasional or long term basis by someone other than the owner.

For the purpose of this definition, vacant land and vacant premises offered or intended for use or habitation by a person other than the owner and usually used as such are defined as ‘used’.

For the avoidance of doubt, a rating unit that has a single use or occupation is treated as having one separately used or inhabited part.

-

Lump sum contributions

No lump sum contributions will be sought for any targeted rate.

-

Rating by instalments

All rates to be collected by the Council will be payable by four instalments according to the following schedule.

The City is divided into four areas based on Valuation Roll Numbers, as set out below:

Table 15: Rating Areas

Area 1 Area 2 Area 3 Area 3 continued Valuation Roll Numbers: 26700 26990 26500 27550 26710 27000 26520 27560 26760 27050 26530 27600 26770 27060 26541 27610 26850 27070 26550 27760 26860 27080 26580 27770 26950 27150 26590 27780 26960 27350 26620 27790 26970 27360 26640 27811 26980 27370 26651 27821 27160 27380 26750 27822 27170 27500 26780 27823 27180 27510 27250 27831 27190 27520 27260 27841 27200 27851 27270 27871 27861 27280 27911 27880 27450 27921 27890 27460 27931 27901 27470 27941 28000 28010 28020 Area 4 comprises ratepayers with multiple assessments who pay on a schedule.

-

Due dates for payments of rates

All rates, with the exception of water rates which are charged based on water meter consumption, will be payable in four instalments, due on the dates shown below:

Table 16: Due Dates

Due Dates Area 1 Areas 2 and 4 Area 3 Instalment 1 27/08/2021 03/09/2021 17/09/2021 Instalment 2 19/11/2021 26/11/2021 10/12/2021 Instalment 3 11/02/2022 25/02/2022 11/03/2022 Instalment 4 06/05/2022 20/05/2022 03/06/2022 Water meter invoices are sent separately from other rates at intervals depending on the quantity of water consumed.

Where water meter invoices are sent on a quarterly or monthly basis, the due date for payment shall be the 20th of the month following the date of invoice as set out in the table below:

Date of Invoice Date for Payment July 2021 20 August 2021 August 2021 20 September 2021 September 2021 20 October 2021 October 2021 20 November 2021 November 2921 20 December 2021 December 2021 20 January 2022 January 2022 20 February 2022 February 2022 20 March 2022 March 2022 20 April 2022 April 2022 20 May 2022 May 2022 20 June 2022 June 2022 20 July 2022 -

Example rate accounts

Capital value 2020/21 Rates 2021/22 Rates Increase Increase % Residential Example 345,000 2,153 2,362 209 9.70% Mode Value 385,000 2,268 2,486 218 9.60% Median Value 420,000 2,368 2,594 226 9.60% Average Value 464,400 2,494 2,731 237 9.50% Example 530,000 2,682 2,934 252 9.40% Example 600,000 2,882 3,150 268 9.30% Example 750,000 3,311 3,614 303 9.10% Commercial Example 245,000 3,261 3,519 259 7.90% Median Value 495,000 5,892 6,375 483 8.20% Example 1,150,000 12,789 13,858 1,069 8.40% Average Value 1,605,000 17,579 19,056 1,477 8.40% Example 2,345,000 25,371 27,510 2,139 8.40% Example 5,500,000 58,589 63,553 4,964 8.50% Example 10,800,000 114,392 124,102 9,710 8.50% Farmland (General and Community Services Rates only) Median Value 550,000 1,358 1,462 104 7.60% Average Value 1,265,000 2,994 3,230 236 7.90% Example 1,430,000 3,372 3,638 267 7.90% Example 2,060,000 4,813 5,196 383 8.00% Example 4,230,000 9,778 10,563 785 8.00% Example 7,250,000 16,688 18,031 1,343 8.00% Example 10,300,000 23,666 25,574 1,908 8.10% Lifestyle (General and Community Service Rates only) Example 510,000 1,486 1,600 114 7.70% Median Value 725,000 2,070 2,231 161 7.80% Average Value 746,000 2,127 2,293 166 7.80% Example 930,000 2,626 2,833 207 7.90% Definitions

Mode – this is the most frequently occurring capital value.

Median – this capital value is the one in the middle of the list of individual capital values. Half of the values are above

this amount, and half below.Average – this is the capital value calculated if the whole value in each category was divided by the number of properties in each category.

Example – these properties provide additional example rate accounts.

-

Mix of funding mechanisms by group activity

The following funding mechanisms are applied to the Council’s group activities. All mechanisms that have been used are in accordance with the Revenue and Financing Policy.

Reserves and Recreational Facilities Community and Planning Libraries and Museums Water Supply Waste Management Sewerage and Sewage Stormwater Property Regulatory Services Economic Development Roading and Footpaths Governance and Support Services General Rate * * * * * * * * Community Services Rate * Kerbside Recycling Rate * City–wide Water Rates * City–wide Drainage Rates * * Allanton Drainage Rate * Blanket Bay Drainage Rate * Curles Point Drainage Rate * Private Street Lighting Rate * Tourism/

Economic Development Rate* Warm Dunedin Rate * Revenue * * * * * * * * * * * * * Loans Raised * * * * * * * * * * * * Sale of Assets * * Reduction in Loans and Advances * Dunedin City Holdings Limited Interest and Dividend * NZTA Income * * Cash * * * * * * * * * * * * Development Contributions * * * * * * Revenue includes fees and charges, subsidies, capital revenue, interest and dividends (other than Dunedin City Holdings Limited dividends). Revenue also includes water rates based on quantity of water and any lump sum payments for the Blanket Bay and Curles Point drainage system.

-

Funding principles

The Dunedin City Council, in adopting the rating method, takes into consideration the following funding principles:

- That, in so far as possible, the rating method should be simple, efficient and understandable.

- People who benefit (including secondary beneficiaries) should contribute to costs.

- Capital value is the primary method of determining the rating method. Capital value is based on market value and reflects the property valuation.

- Property rates are a mechanism, which contains principles of public benefit taxation. Rates are not a user–pays mechanism.

- The application of funding mechanisms should not distort markets.

- The funding of activities and services should have regard to the interests of residents and ratepayers, including future ratepayers.

- The funding of services and activities should not make these unaffordable.

- People who pollute or damage the environment should bear the cost of redress.

- To promote fairness and equity in rating, fixed charges may be used.

- Where changes are contemplated to the rating method, transition arrangements may be used.

- Specific rating areas may be considered on a case–by– case basis.