At a glance

Gross Debt Limit: 250% of revenue Rate increases limited as follows:

Year 1: limited to no more than 10%

Years 2-10: limited to 6.5% on average annually over the period

Average Dunedin rates for Dunedin residents will be less than the national average for city councils around the country.

Forecast total operating surplus is greater than zero for each year of the plan

Council aims to ensure everyday costs of running the city can be funded from the everyday revenue (excluding any non-recurring/non-cash items) consistently by the end of the 10 years

The following liquid assets held by Council will be retained as a partial hedge against the gross debt:

- Waipori Fund

- Investment Property Portfolio

- Interest-bearing shareholder advance to Dunedin City Holdings Limited (DCHL).

Income from Group companies is limited to $5.9 million annually, being the current interest earned from the interest-bearing shareholder advance to Dunedin City Holdings Limited ($112.0 million)

-

The financial landscape

In 2018, Council’s Financial Strategy focused on investing in our great small city, with plans to invest in infrastructure, both above and below ground, to build resilience and enhance and improve our city. It recognised the competing tensions of affordability, maintaining assets and investing for the future.

The focus has not changed, but Dunedin’s environment has. For example, Dunedin city is now predicted to have higher population growth over the next 10 years – compared to estimates in 2018 that predicted low to medium growth.

We are now living through a pandemic – the impacts of COVID-19 have been and continue to be felt throughout New Zealand. The serious challenges of climate change and its impacts are forefront in everyone’s minds, and our response to reduce emissions and adapt to climate change needs to speed up.

This Financial Strategy does not change the direction of the 2018 strategy but builds on it. The Council has an important role to play in the economic and social recovery of the city from COVID-19, by investing in both services and capital projects for our city. At the same time, the Council needs to help foster social wellbeing and stimulate economic activity at a local level.

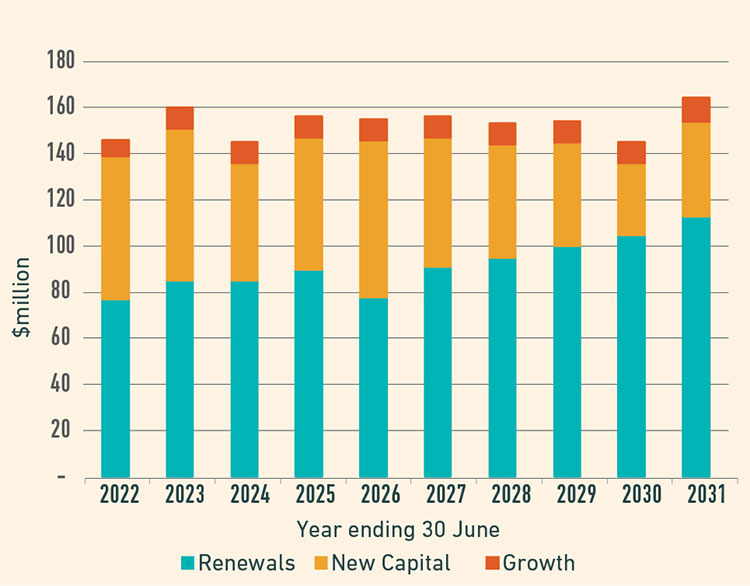

A lot of planning has been undertaken over the last three years, and now it is time to deliver. The Council is planning to invest $1.5 billion on capital projects over the next 10 years, compared with $878 million in the last 10 year plan. Of this, $919 million is dedicated to renewals, primarily replacing key 3 Waters and transport infrastructure, building the resilience of these essential assets. $526 million will be invested in new capital projects that will improve the city, and $90 million will be used to build new 3 Waters and other infrastructure needed for the growth that is being experienced.

To fund this level of capital investment, the debt limit has been reviewed. The last 10 year plan had a fixed debt limit of $350 million. This Financial Strategy has changed the debt limit, setting it at 250% of revenue. This revised debt level will be responsive to change and will move in line with the level of activities.

-

What might impact us over the next 10 years

There are a number of factors that may have an impact on what and how much Council does, and how services are delivered over the next 10 years. These are discussed below.

COVID-19

Since February 2020, the New Zealand economy has undergone a significant period of upheaval due to the COVID-19 pandemic. This has created uncertainty around

Dunedin’s growth and economic performance into the future.

Growth projections that were developed prior to COVID-19, have been reviewed to assess what impact COVID-19 may have had on those projections. These are discussed below in “Changing population, land use and rating base”.

The review also concluded that the Dunedin economy is expected to hold up and recover reasonably well. Dunedin has the new Hospital rebuild and other major infrastructure projects that will stimulate job opportunities. Tourism is expected to recover and return to pre COVID-19 levels by 2031.

These outcomes are of course based on many assumptions. While New Zealand is currently experiencing no community transmission of COVID-19, and is living at Alert level 1, there is no certainty of the path that COVID-19 may take, and any possible further impacts on Dunedin and the rest of New Zealand.

Climate change and zero carbon

During 2019, Council declared a climate emergency and established a dedicated work programme to meet climate change mitigation and adaptation planning needs. It also set 2030 as the target for achieving zero carbon. Council’s focus is mirrored at a national level, with the government making changes including increased carbon prices, and growing expectations of local government to work with communities on solutions.

The climate change work programme has two work streams, Climate Change Adaptation and Zero Carbon 2030 (the later focused on climate change mitigation).

In terms of adapting to climate change, we face significant risks, especially relating to sea level rise and adverse weather events causing flooding.

Of particular concern is the South Dunedin area, which sits on reclaimed land, has high groundwater levels, and is extremely vulnerable to sea level rise from climate

change. It has around 4,500 homes, housing 10,000 people. As part of the Climate Change Adaptation work, the “South Dunedin Future” programme is being developed with the Otago Regional Council, to respond to these issues. This is also being done in consultation with the community, central government and other stakeholders.

The Zero Carbon 2030 work programme has targets in two parts as follows:

- net zero emissions of all greenhouse gases other than biogenic methane by 2030, and

- 24% to 47% reduction below 2017 biogenic methane emissions by 2050, including 10% reduction below 2017 biogenic methane emissions by 2030.

While the target is for the whole city, it also includes reducing emissions from Council’s own activities, which have been measured since 2013/14.

To achieve this target, the way services are delivered needs to change. The focus to date has been on developing policies and processes to ensure that emissions are considered in all decision making on major projects, and in the Council’s procurement practices. For this 10 year plan, transport and waste have been identified as priority

areas for investment to reduce emissions. While the cost of capital is likely to be higher for solutions that will reduce emissions, it is anticipated that there will be savings in the ongoing associated operating costs.

Council’s Zero Carbon 2030 target will only be achieved by the whole community working together. A key focus during 2021/22 will be the development of a Zero Carbon Plan for

Dunedin, where the community and key stakeholders will help Council decide how to invest and partner to achieve its target. Until the Zero Carbon Plan has been developed, an assumption has been made that the target will be able to be met without the need to purchase carbon offsets. Potential implications of not achieving this are discussed in the Significant Forecasting Assumptions section of the 10 year plan.

3 Waters reform

In July 2020, the Government launched the 3 Waters Reform Programme, a three-year programme to change the way three waters service (drinking water, wastewater and stormwater) are delivered.

Rather than having 67 individual councils providing three water services, the Government plans to have a small number of larger regional entities that would provide these services, to realise economic, public health, environmental, and other benefits.

In July 2020, the Government announced a $761 million stimulus funding package to maintain and improve three waters infrastructure, support the three-year reform programme, and support the establishment of Taumata Arowai, the new Water Services Regulator.

Funding has been given to those councils that have agreed to participate in the first stage of the reform programme. This included Council signing a Memorandum of Understanding with the Government, agreeing to work together to help identify an approach to the delivery of water services.

The Council’s share of the stimulus funding is being used to improve Dunedin’s three waters pipeline infrastructure networks.

At this time there is not enough information to meaningfully engage on what the reform means for Dunedin, and so this 10 year plan provides for the Council to continue to provide three waters services throughout the 10 year period. This approach is being taken by all Councils as recommended by the local government sector.

Changing population, land use and rating base We have undertaken a review of growth projections that we had developed prior to COVID-19. That review suggests

that net migration (international and domestic) is expected to be near zero during 2020 – 2024 because of COVID-19 border restrictions. Domestic migration is expected to be relatively resilient with strong inflows of students moving to Dunedin to go to study. Dunedin’s population is predicted to grow at a higher rate from 2024 until 2038, when it could reach 142,318. From 2038 onwards, the population rate is predicted to return to a medium growth rate.

Dunedin’s population is ageing, with 21% of the population projected to be 65 years or over by 2068, compared to 16% in 2018. Most of the growth in this population group is forecast to occur between 2018 and 2038.

Housing is projected to grow from 52,747 in 2018 to 60,511 in 2038, as a result of population growth, an ageing population and the changing make up of families and households.

Land use changes are expected to allow for housing growth. Investment of $77 million for essential services to enable growth has been provided for in the 10 year plan, for water assets. The work on transport growth has yet to be factored in.

Any impacts of these projections being different are discussed in the Significant Forecasting Assumptions section of the 10 year plan.

Ability to deliver on the planned capital programme

The Council’s planned capital expenditure programme represents a significant uplift from the last 10 year plan, with renewals a key area of focus. The challenge for Council will be its ability to deliver this programme, acknowledging that the annual targets are higher than previous achievements, and the lead time for delivery is always longer than anticipated. These risks will be managed through improved forward planning, early contractor engagement, innovative procurement strategies, and strong disciplines around project management and monitoring to ensure progress is on track.

-

Strategic financial limits

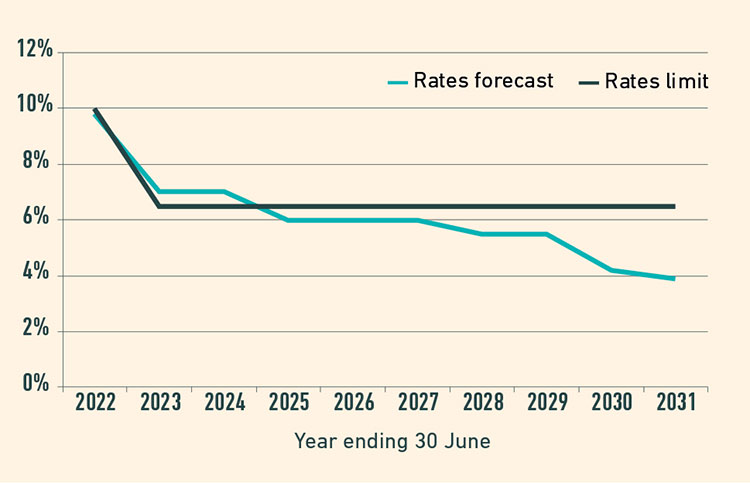

Rates

The Council recognises that rates need to be at an affordable level overall, and that it needs to balance affordability with increasing costs of delivering core services. This strategy assumes that affordability will be maintained, and that the Dunedin average residential rates are below the national average for city councils around the country.

The Council will limit the rate increase to 10% for the first year of the 10 year plan and an average of 6.5% per annum across years 2 to 10. These increases are due to the operating impacts of the capital expenditure programme, inflationary pressures on Council costs and ensuring the Council has a sustainable operating result after removal of non-recurring/non-cash revenue items.

Rates Increase Year ending 30 June 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Rates forecast 9.8% 7.0% 7.0% 6.0% 6.0% 6.0% 5.5% 5.5% 4.2% 3.9% Rates limit 10.0% 6.5% 6.5% 6.5% 6.5% 6.5% 6.5% 6.5% 6.5% 6.5% As part of this 10 year plan, we consulted on an enhanced kerbside waste collection service. This will come at an additional cost and recovery from rates revenue is included in the limits discussed above.

Residents on low incomes will continue to be encouraged to access the rates rebate scheme offered by central government as a means of offsetting the cost of rates. We will also continue to maintain our rates remission and rates postponement policies.

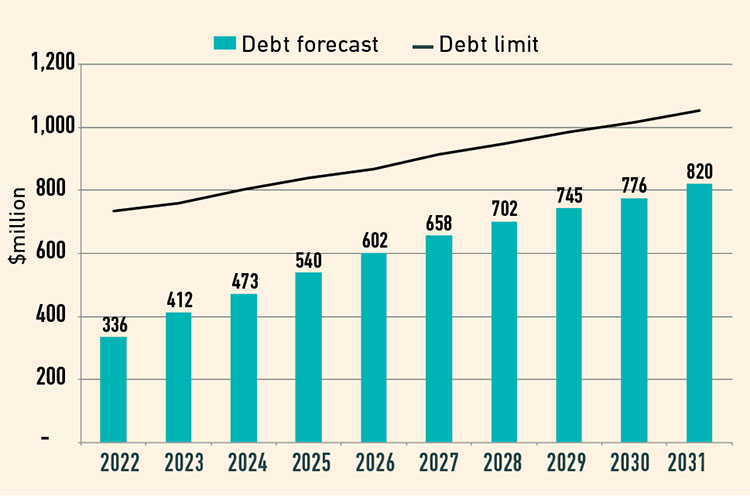

Debt

The use of debt allows the financial burden of new capital expenditure to be spread across a number of financial years, recognising that the expenditure is on

intergenerational assets, i.e., the assets have a long life and generate benefits both now and to future generations.

Debt is also used to fund the portion of capital renewals that is not covered by funded depreciation.

In the last 10 year plan, the debt limit was fixed at $350 million. This limit is not sufficient to fund planned investment in capital projects and does not recognise the impact of changing costs and/or activity.

In response to this, Council approved changing the debt limit from a fixed amount to a variable amount calculated as a percentage of revenue. The gross debt limit for this 10 year plan is set as 250% of revenue. This means that our debt level will be responsive to change and will move in line with the level of our activities. This revised debt limit will allow flexibility to deliver the planned capital expenditure programme, while also having capacity to fund potential unplanned events.

The following chart shows the forecast 10 year borrowing from 2021 to 2031.

Forecast 10 year borrowing from 2021 to 2031 (shown in $millions) 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Debt limit 230 736 760 802 839 867 913 950 986 1,016 1,053 Debt forecast 275 336 412 473 540 602 658 702 745 776 820 Over the 10 year period, the debt required to fund the planned capital investment does not reach the 250% of revenue limit.

This debt limit is considered financially prudent, as it sits within the lending limits set by the Local Government Funding Authority (LGFA). The LGFA equivalent metric is based on net debt, where net debt is defined as gross debt less liquid financial assets and investments.

The Council has significant liquid assets and investments to provide a partial offset to gross debt. As at 30 June 2020, these included the Waipori Fund of $94.2 million, an investment property portfolio of $95.7 million, and a Dunedin City Holdings Ltd interest-bearing shareholder advance of $112.0 million.

Operating surplus

The Local Government Act 2002 requires councils to have a balanced budget unless it is prudent to do otherwise. This Financial Strategy will ensure that each year of the 10 year plan has a positive operating surplus.

Further to this requirement, the Council needs to ensure that the everyday costs of running the city can be funded from the everyday revenue. For the purposes of achieving this, everyday revenue excludes some capital expenditure funding items (e.g., Development Contributions, Non- Recurring Waka Kotahi NZ Transport Agency capital subsidies) and any non-cash income (e.g., Vested Assets, fair values gains related to the Waipori Fund investments) as these items are not ‘everyday revenue’ and/or cash generating. The 10 year plan will aim to achieve this requirement within the period of the plan and ensure it is sustainable into the future.

Surplus funds

In general, any surplus funds will be used to repay debt, invest in Dunedin, and help pay for priority projects.

In deciding to dispose of an asset, the Council may consider the option of using the proceeds to invest in an income generating asset (e.g., Waipori Fund) rather than pay down debt. The Council would elect to do this at the time of the approval to dispose.

Security for debt

Council’s policy is to give rates as security for our debt. Most of our borrowing will be done through our group company Dunedin City Treasury Limited.

-

Strategic asset investment

Council will prioritise funding maintenance and renewals as per its Asset Management Plans. These are regularly updated to reflect changing needs and emerging risks that will ensure resilience of Council assets and services. Asset management planning focuses on asset condition, risk assessment, planning and delivery opportunities, and long term asset solutions that provide value for residents, businesses and the environment.

This Financial Strategy is closely linked to the Infrastructure Strategy so significant issues such as these can be properly considered. Updated information has been used to make decisions about assets that need renewing over the 10 year plan. The Infrastructure Strategy expands this timeframe out to 50 years and gives greater confidence around how this work can be paid for in the longer term.

The Council is planning to invest in projects that will provide resilience for our city and enhance amenity levels. Some of the significant projects to upgrade or continue to improve services include:

- improving the resilience of Dunedin’s transport system, water supply and stormwater infrastructure

- responding to infrastructure needs for our growing population

- minimising transport disruption during and after the construction of the new Dunedin Hospital

- upgrading the central city area

- investing in flood alleviation in South Dunedin

- investing in reducing our carbon emissions through waste minimisation initiatives

- investing in a new modern landfill to replace the current facility at Green Island

The graph below shows planned capital investment over the next 10 years.

Capital spending on assets (shown in $millions) 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Growth 7 9 9 9 9 9 9 9 9 10 New Capital 62 66 51 57 68 56 49 45 31 41 Renewals 77 85 85 90 78 91 95 100 105 113 The Council’s activities and services provided, and investment in infrastructure will be paid for using the following sources of funds over the 10 year period.

-

Maintaining services

The Council will continue to fund and deliver the full range of services currently being offered, maintaining current levels of service over the 10 year period. In some areas, there will be some increased levels of service with planned investment in new projects, building resilience and preparing for future growth.

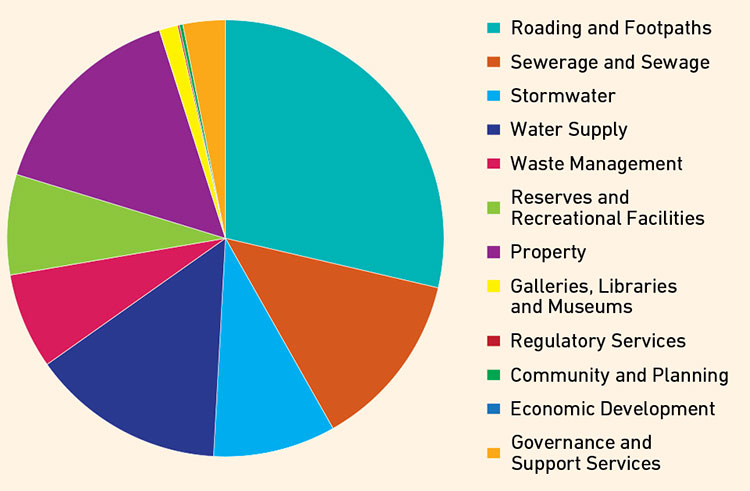

Operating expenditure - 10 year total

Operating expenditure - 10 year total Roading and Footpaths 16.41% Sewerage and Sewage 9.92% Stormwater 3.80% Water Supply 9.83% Waste Management 7.92% Reserves and Recreational Facilities 12.32% Property 12.09% Galleries, Libraries and Museums 6.35% Regulatory Services 3.62% Community and Planning 3.97% Economic Development 1.51% Governance and Support Services 12.26% Capital expenditure - 10 year total

Capital expenditure - 10 year total Roading and Footpaths 28.66% Sewerage and Sewage 13.16% Stormwater 9.06% Water Supply 14.33% Waste Management 7.10% Reserves and Recreational Facilities 7.43% Property 15.37% Galleries, Libraries and Museums 1.37% Regulatory Services 0.13% Community and Planning 0.26% Economic Development 0.00% Governance and Support Services 3.13% The Council’s activities and services provided, and investment in infrastructure will be paid for using the following sources of funds over the 10 year period.

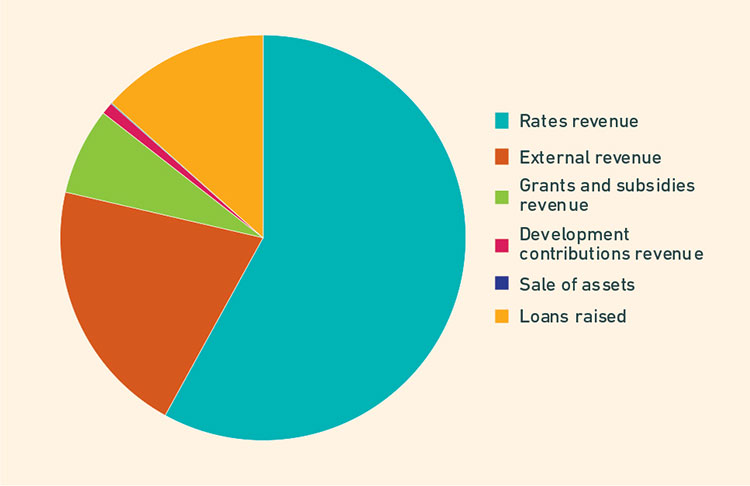

Forecast sources of funds 2021-2031

Sources of funds Rates revenue 58.0% External revenue 20.6% Grants and subsidies revenue 6.9% Development contributions revenue 1.0% Sale of assets 0.1% Loans raised 13.4% -

Financial resilience

The Council needs to have the ability to respond to unplanned events, such as natural disasters, civil defence emergencies and pandemics. These events can result in significant unplanned operating and capital costs.

If a significant event occurs, the Council has a range of options for funding unbudgeted expenditure within the financial strategy limits, including rates, debt, insurance, Government funding for infrastructure assets, financial assets and reprioritisation of existing budgets.

-

Managing investments and Council- owned companies

The Council holds a range of investments, including Council- owned companies, investment property and the Waipori Fund. These investments are designed to provide ongoing non-rates income over the medium to long term as well as a partial offset to gross debt as discussed above.

Investments

Waipori Fund

Established in 1999, using proceeds from the sale of the Waipori electricity generation assets, the Waipori Fund is a diversified investment portfolio comprising both fixed interest deposits and equity investments.

The Fund is managed by Dunedin City Treasury Limited on behalf of Council, using the Statement of Investment Policy and Objectives (SIPO) approved by Council. The SIPO defines the primary objectives of the fund to be:

- Maximise its income, subject always to a proper consideration of investment risk and;

- Grow the Fund’s base value, while maintaining an agreed cash distribution to Council.

The fund value at 30 June 2020 was $94.2 million.

Investment property portfolio

Council owns an investment property portfolio comprising a mixture of property types, including a number located outside of Dunedin

The minimum target return from Council’s investment properties is to be greater than the weighted average cost of funds.

The portfolio value at 30 June 2020 was $95.7 million, broken down as follows:

Investment property $ million Dunedin retail 28.500 Dunedin parking 25.000 Dunedin other 10.690 Christchurch 7.900 Wellington 15.400 Auckland 8.250 Total 95.740 Shareholder Advance

Council has provided an interest-bearing shareholder advance to Dunedin City Holdings Limited of $112 million, which has an associated annual income stream of $5.9 million.

Council-owned companies

Council-owned companies (CCOs) are an important component in this Financial Strategy.

While they are valuable assets in terms of their capital value, the income they generate can be used to keep down the levels of funding required from ratepayers. In more recent years, the revenue Council has expected to receive

from the companies has been unrealistic. This, coupled with stadium-related debt pressure and the need for group companies to re-invest, has created a degree of financial uncertainty for the Council when trying to adopt budgets and set rates.

Group companies are in a rebuilding phase and investing in their own infrastructure – particularly important in the case of lines company Aurora Energy which has infrastructure that needs to be replaced.

In addition, Dunedin City Holdings Limited (DCHL), which owns the companies on behalf of the Council, continues the process of building financial headroom so that the Council can receive a steady income stream in the future. Any volatility in group annual earnings will be absorbed by DCHL so that the Council can be certain about the money it will receive.

The 10 year plan assumes income from CCOs of $5.9 million per annum being the current interest on the shareholder advance to DCHL ($112.0 million). In the event the interest rate is renegotiated down, it is anticipated any difference to the $5.9 million would be made up by a compensating dividend stream.

The 10 year plan does not include any additional revenue in the form of dividends from group companies. The Council will continue to work with Dunedin City Holdings Limited to explore the option of a dividend stream in the future, on the basis that any dividend delivered can be sustained.

-

Financial Strategy Information

Budget 2022 Budget 2023 Budget 2024 Budget 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Overall 2022-31 Debt Debt forecast 335,948 411,769 473,028 539,579 601,960 657,530 702,430 745,429 776,413 820,252 Debt limit (at 250% of revenue) 735,965 759,818 801,598 838,755 866,650 913,358 949,615 986,088 1,015,940 1,053,218 Total revenue 294,386 303,927 320,639 335,502 346,660 365,343 379,846 394,435 406,376 421,287 Gross debt limit (less than 250% of revenue) 114.1% 135.5% 147.5% 160.8% 173.7% 180.0% 184.9% 189.0% 191.1% 194.7% Target Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Rates Increase Rates revenue 179,124 191,664 205,077 217,372 230,421 244,239 257,666 271,826 283,234 294,293 2,195,792 Increase 9.8% 7.0% 7.0% 6.0% 6.0% 6.0% 5.5% 5.5% 4.2% 3.9% 5.7% Limit (less than 10% in 2022 then 6.5% on average for 2023-2031) 10.0% 6.5% 6.5% 6.5% 6.5% 6.5% 6.5% 6.5% 6.5% 6.5% 6.5% Target Achieved Achieved Achieved Operating Surplus Operating surplus greater than zero 8,117 8,141 7,197 10,300 8,902 13,914 16,640 14,911 14,288 15,813 Target Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Balanced Budget Operating surplus 8,117 8,141 7,197 10,300 8,902 13,914 16,640 14,911 14,288 15,813 Less: Development Contributions -3,467 -3,544 -3,622 -3,702 -3,785 -3,868 -3,718 -3,801 -3,885 -3,973 Vested Assets -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 External Subsidies for new capital projects -14,405 -8,293 -10,655 -9,635 -6,296 -9,588 -7,344 -5,434 -3,978 -4,641 Gain on fair value of investments -1,026 -1,063 -1,102 -1,142 -1,183 -1,226 -1,271 -1,317 -1,365 -1,415 Balanced budget surplus/(deficit) -13,781 -7,759 -11,182 -7,179 -5,362 -3,768 1,307 1,359 2,060 2,784 Target Achieved Not achieved Not achieved Not achieved Not achieved Not achieved Not achieved Achieved Achieved Achieved Achieved Group Financial Income Dividend received - Dunedin City Holdings Limited 0 0 0 0 0 0 0 0 0 0 Shareholder Advance Interest received - Dunedin City Holdings Limited 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 Total income from group companies 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 Target Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved Achieved