Rating method

The rating method refers to the ways that the Council uses the rating system to allocate rates among groups of ratepayers, and how the liability for rates will be distributed within each group.

When considering the rating method, the Council takes into consideration the funding principles provided at the end of this section. It should be read in conjunction with the Revenue and Financing Policy and the Funding Principles.

Figures in this policy are GST inclusive.

The following rates will be set by the Council for the financial year commencing 1 July 2023 and ending 30 June 2024.

-

General rate

A general rate based on the capital value of each rating unit in the district.

The general rate will be set on a differential basis based on land use (the categories are “residential”, “lifestyle”, “commercial”, “farmland”, “residential heritage bed and breakfasts” and “stadium: 10,000+ seat capacity”).

The rates (in cents per dollar of capital value) for the 2023/24 year are:

Table 1: General Rates

Categories Rates, Cents in $ per Capital Value Factor Revenue Sought $ General Rate Share Residential 0.2566 1 81,192,000 59.81% Lifestyle 0.2438 0.95 7,467,000 5.50% Commercial 0.6338 2.47 42,313,000 31.17% Farmland 0.2053 0.8 4,628,000 3.41% Residential Heritage Bed and Breakfasts 0.449 1.75 19,000 0.01% Stadium: 10,000+ Seat Capacity 0.0508 0.2 127,000 0.09% The objective of the differential rate is to provide a mechanism to charge general rates to the six differential categories in a way that best achieves the 11 funding principles provided at the end of this section.

The Council uses the ‘factor method’ of setting the general rate differential. Under this method, a general rate factor is established which is simply the degree to which the rate (the cents in the dollar) on each category of property is higher or lower than residential property. In other words, the Council determines the degree to which the rate on a category of property is higher or lower than residential property.

The practical effect of the differential is that commercial properties pay more rates than would be expected under a “pure, undifferentiated” capital value (CV) system, and lifestyle, farmland and residential property owners pay less.

In December 2020, the Council reviewed the six general rate differential categories, specifically how the general rate is allocated across ratepayers. Due to the integrated nature of two targeted rates, Community Services and Tourism/Economic Development, these were also considered. The review also considered the rating of short term visitor accommodation. No changes to the general rate differentials were made because the status quo was felt to be appropriate.

-

Uniform Annual General Charge

The Council will not be using a Uniform Annual General Charge.

-

Targeted Rates

Community Services

A targeted rate for community services of $111.50. This rate will be set on a differential basis based on land use (the categories are “residential, residential heritage bed and breakfasts, lifestyle and farmland” and “commercial and stadium: 10,000+ seat capacity”). The rate will be charged on the following basis:

Table 2: Targeted Rate – Community Services

Categories Rate/Liability Calculated Revenue Sought $ Residential, Residential Heritage Bed and Breakfasts, Lifestyle and Farmland $111.50 per separately used or inhabited part of a rating unit 6,150,000 Commercial and Stadium: 10,000+ Seat Capacity $111.50 per rating unit 311,000 The community services targeted rate will be used to fund part of the Parks and Reserves activity and the Botanic Garden.

Kerbside Recycling Collection

A targeted rate for a kerbside recycling collection service. This rate will be set on a differential basis based on land use (the categories are “residential, residential heritage bed and breakfasts, lifestyle and farmland” and “commercial”). This rate applies to all separately used or inhabited parts of a rating unit or rating units that receive a kerbside recycling collection service. The rate for the 2023/24 year is:

Table 3: Targeted Rate – Kerbside Recycling Collection

Categories Rate/Liability Calculated Revenue Sought $ Residential, Residential Heritage Bed and Breakfasts, Lifestyle and Farmland $106.10 per separately used or inhabited part of a rating unit 5,451,000 Commercial $106.10 per rating unit 32,000 Drainage

A targeted rate for drainage. Drainage is a combined targeted rate for sewage disposal and stormwater. Sewage disposal makes up 78% of the drainage rate, and stormwater makes up 22%. This rate will be set on a differential basis based on the provision of service (with the categories being “connected” and “serviceable”) and on land use (with the categories being “residential, residential heritage bed and breakfasts, lifestyle and farmland”, “commercial, residential institutions, schools and stadium: 10,000+ seat capacity” and “churches”). The rate will be charged on the following basis:

Table 4: Targeted Rate – Drainage Categories

Categories Liability Calculated Revenue Sought $ Residential, Residential Heritage Bed and Breakfasts, Lifestyle and Farmland Per separately used or inhabited part of a rating unit 33,422,000 Commercial, Residential Institutions, Schools and Stadium: 10,000+ Seat Capacity Per rating unit 1,939,000 Churches Per rating unit 12,000 The rates for the 2023/24 year are:

Table 5: Targeted Rate – Drainage Rates

Residential, Residential Heritage Bed and Breakfasts, Lifestyle and Farmland Rates $ Connected 683 Serviceable 341.5 Commercial, Residential Institutions, Schools and Stadium: 10,000+ Seat Capacity Rates $ Connected 683 Serviceable 341.5 Churches Rate $ Connected 102.25 Non–rateable land will not be liable for the stormwater component of the drainage targeted rate. Rates demands for the drainage targeted rate for non–rateable land will therefore be charged at 78%.

Rating units which are not connected to the scheme, and which are not serviceable, will not be liable for this rate.

Commercial Drainage – Capital Value

In addition, a capital value–based targeted rate for drainage on a differential basis based on land use (the categories are “commercial and residential institutions”, “schools” and “stadium: 10,000+ seat capacity”) and the provision of services (the categories being “connected” and “serviceable”). This rate shall not apply to properties in Karitane, Middlemarch, Seacliff, Waikouaiti and Warrington.

This rate shall not apply to churches.

The rates for the 2023/24 year are:

Table 6: Targeted Rate – Commercial Drainage Rates

Categories Rates, Cents in $ per Capital Value Revenue Sought $ Connected Serviceable Connected Serviceable Commercial and Residential Institutions 0.2354 0.1177 16,428,000 410,000 Schools 0.1766 0.0883 797,000 7,000 Stadium: 10,000+ Seat Capacity 0.019 N/A 48,000 N/A Non–rateable land will not be liable for the stormwater component of the drainage targeted rate. Rates demands for the drainage targeted rate for non–rateable land will therefore be charged at 78%.

Water

A targeted rate for water supply per separately used or inhabited part of a rating unit on all property either connected, or for which connection is available, to receive an ordinary supply of water within the meaning of the Dunedin City bylaws, excepting properties in Karitane, Merton, Rocklands/Pukerangi, Seacliff, Waitati, Warrington, East Taieri, West Taieri and North Taieri. This rate will be set on a differential basis based on the availability of service (the categories are “connected” and “serviceable”).

Rating units which are not connected to the scheme, and which are not serviceable, will not be liable for this rate.

The rates for the 2023/24 year are:

Table 7: Targeted Rate – Water (Ordinary)

Categories Rate/Liability Calculated Revenue Sought $ Connected $517.00 per separately used or inhabited part of a rating unit 25,116,000 Serviceable $258.50 per separately used or inhabited part of a rating unit 260,000 A targeted rate for water supply that is based on the volume of water made available to all separately used or inhabited parts of a rating unit in Karitane, Merton, Seacliff, Waitati, Warrington, East Taieri, West Taieri and North Taieri. This rate will be set on a differential basis based on the availability of service (the categories are “connected” and “serviceable”).

The rates for the 2023/24 year are:

Table 8: Targeted Rate – Water (Volume of Water)

Categories Rate/Liability Calculated Revenue Sought $ Connected $517.00 per unit of water being one cubic metre (viz 1,000 litres) per day made available at a constant rate of flow during a full 24–hour period 1,010,000 Serviceable $258.50 per separately used or inhabited part of a rating unit (note this rate shall not apply to the availability of water in Merton, Karitane or Seacliff) 24,000 Fire Protection

A targeted rate for rating units that receive a water supply for the provision of a fire protection service. The rate will be set on a differential basis based on land use on certain categories of property (“commercial”, “residential institutions” and “stadium: 10,000+ seat capacity”).

This rate will be based on capital value. This rate shall not apply to churches.

The rates for the 2023/24 year are:

Table 9: Targeted Rate – Fire Protection Capital Value

Categories Rates, Cents in $ per Capital Value Revenue Sought $ Commercial 0.067 5,255,000 Residential Institutions 0.0503 330,000 Stadium: 10,000+ Seat Capacity 0.0077 19,000 A targeted rate for water supply for the provision of a fire protection service for each separately used or inhabited part of a rating unit within the “residential, residential heritage bed and breakfasts, lifestyle and farmland” categories that are not receiving an ordinary supply of water within the meaning of the Dunedin City bylaws.

The rate for the 2023/24 year is:

Table 10: Targeted Rate – Fire Protection

Categories Rate/Liability Calculated Revenue Sought $ Residential, Residential Heritage Bed and Breakfasts, Lifestyle and Farmland $155.10 per separately used or inhabited part of a rating unit 27,000 Water – Quantity of Water

A targeted rate for the quantity of water provided, reconnection fee and special reading fee, to any rating unit fitted with a water meter, being an extraordinary supply of water within the meaning of the Dunedin City bylaws, according to the following scale of charges:

Table: 11: Targeted Rate – Quantity of Water

Annual Meter Rental Charge $ 20mm nominal diameter 166.57 25mm nominal diameter 213.85 30mm nominal diameter 237.49 40mm nominal diameter 268.99 50mm nominal diameter 544.75 80mm nominal diameter 673.05 100mm nominal diameter 710.2 150mm nominal diameter 1,020.83 300mm nominal diameter 1,324.72 Hydrant Standpipe 70mm 659.55 Reconnection Fee – includes the removal of water restrictors installed due to non-compliance of the water bylaw. 464.25 Special Reading Fee 63.09 Backflow Prevention Charge $ Backflow Preventer Test Fee 115.04 Rescheduled Backflow Preventer Test Fee 65.36 Backflow Programme – incomplete application fee (hourly rate) 46.2 Water Charge $ Merton, Hindon and individual farm supplied Bulk Water 0.11 per cubic metre All other treated water per cubic metre 1.93 per cubic metre Network Contributions $ Disconnection of Water Supply (AWSCI to excavate) 258.53 Disconnection of Water Supply (DCC contractor to excavate) 1,012.95 Where the supply of a quantity of water is subject to this Quantity of Water Targeted Rate, the rating unit will not be liable for any other targeted rate for the supply of the same water.

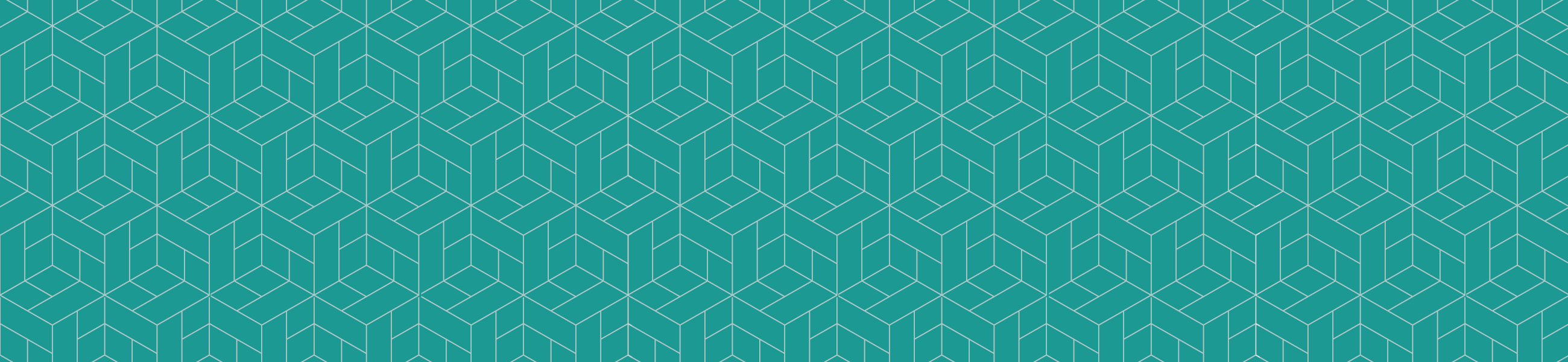

Allanton Drainage

A targeted rate for rating units within the Allanton area that are paying the capital contribution towards the Allanton Wastewater Collection System, as a targeted rate over 20 years. Liability for the rate is on the basis of the provision of service to each rating unit.

The rate for the 2023/24 year is:

Liability Calculated Rate Revenue Sought $ Per rating unit $411.00 22,000 The Allanton area is shown in the map below:

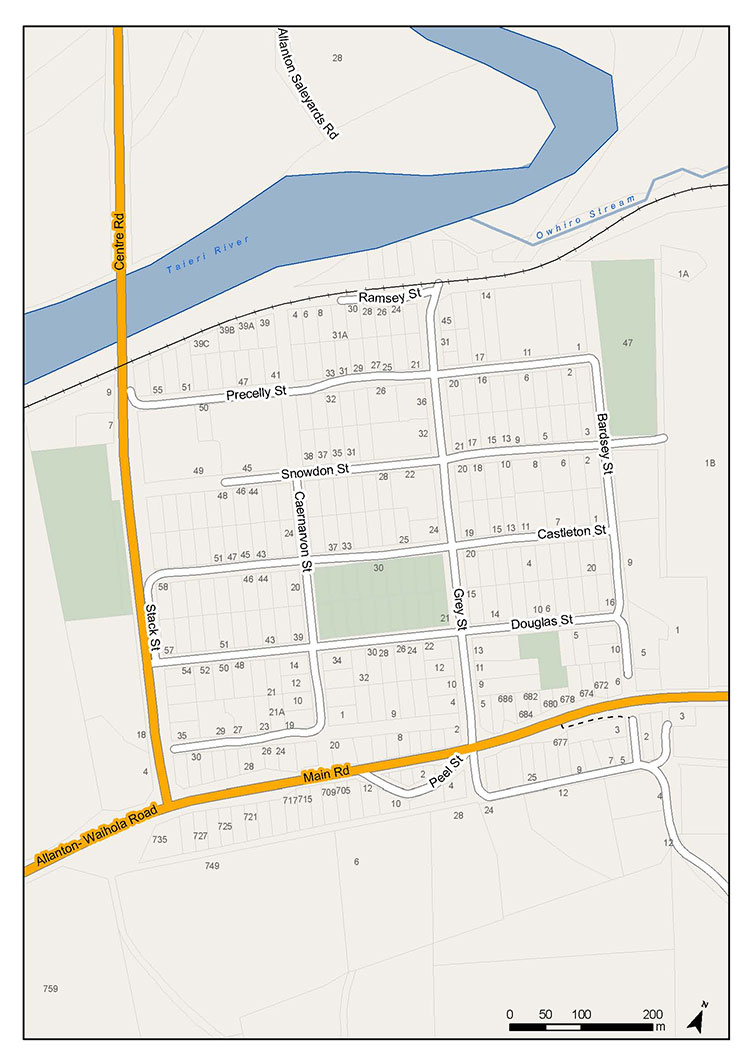

Blanket Bay Drainage

A targeted rate for rating units within the Blanket Bay area that are paying the capital contribution towards the Blanket Bay Drainage system, as a targeted rate over 20 years. Liability for the rate is on the basis of the provision of the service to each rating unit.

The rate for the 2023/24 year is:

Liability Calculated Rate Revenue Sought $ Per rating unit $636.00 1,000 The Blanket Bay area is shown in the map below:

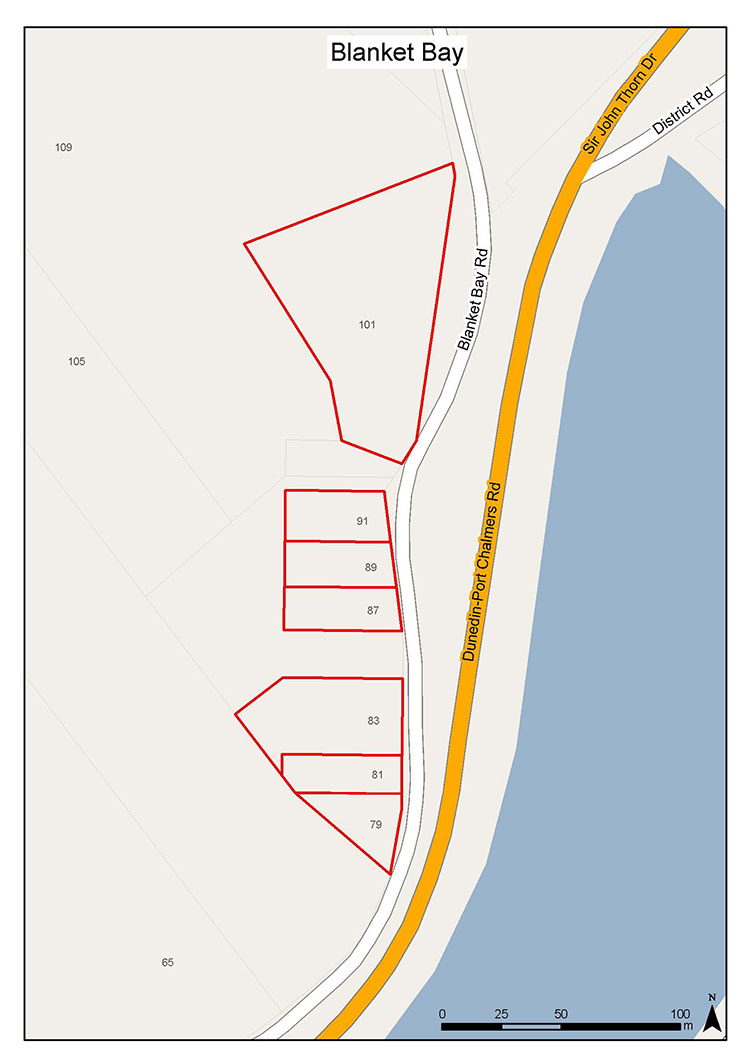

Curles Point Drainage

A targeted rate for rating units within the Curles Point area that are paying the capital contribution towards the Curles Point Drainage System, as a targeted rate over 20 years. Liability for the rate is on the basis of the provision of the service to each rating unit.

The rate for the 2023/24 year is:

Liability Calculated Rate Revenue Sought $ Per rating unit $749.00 1,000 The Curles Point area is shown in the map below:

Tourism/Economic Development

A capital value–based targeted rate for all commercial properties. The rate will be set on a differential basis based on land use (the categories are “commercial” and “stadium: 10,000+ seat capacity”).

The rate for the 2023/24 year will be charged on the following basis:

Table 12: Targeted Rate –Tourism/Economic Development

Categories Rates, cents in $ per Capital Value Revenue Sought $ Commercial 0.0087 572,000 Stadium: 10,000+ Seat Capacity 0.0011 3,000 The Tourism/Economic Development targeted rate will be used to fund part of the Economic Development budget.

Warm Dunedin Targeted Rate Scheme

A targeted rate for each rating unit in the Warm Dunedin Targeted Rate Scheme. The revenue sought from this targeted rate is $426,000. The targeted rate scheme provides a way for homeowners to install insulation and/or clean heating. The targeted rate covers the cost and an annual interest rate. The interest rates have been and will be:

- Rates commencing 1 July 2013 and 1 July 2014 8%;

- Rates commencing 1 July 2015 and 1 July 2016 8.3%;

- Rates commencing 1 July 2017 7.8%;

- Rates commencing 1 July 2018 7.2%;

- Rates commencing 1 July 2019 6.8%.

- Rates commencing 1 July 2020 5.7%.

- Rates commencing 1 July 2021 4.4%.

Table 13: Targeted Rate – Warm Dunedin Targeted Rate Scheme

Liability Calculated Revenue Sought $ Per rating unit 426,000 Private Street Lighting

A targeted rate for street lighting in the private streets to which the Council supplies a private street lighting service. The targeted rate will be set on a differential basis based on land use (the categories are “residential”, “lifestyle” and “commercial”).

The rate for the 2023/24 year will be charged on the following basis:

Table 14: Targeted Rate – Private Street Lighting

Categories Liability Calculated Rate $ Revenue Sought $ Residential and Lifestyle For each separately used or inhabited part of a rating unit in a private street the sum calculated on the formula of $156.80 per street light in a private street divided by the number of separately used or inhabited parts of a rating unit in the private street. 156.8 37,000 for each street light Commercial For each rating unit in a private street the sum calculated on the formula of $156.80 per street light in a private street divided by the number of rating units in the private street. 156.8 6,000 for each street light Private Street Lighting Addresses ( opens in new window)

-

Differential Matters and Categories

Where councils assess rates on a differential basis, the definition of differential categories is limited to the list of matters specified in Schedule 2 of the Local Government (Rating) Act 2002. The Council is required to state which matters will be used for definition of the categories, and the category or categories of any differentials.

The differential categories are determined in accordance with the Council’s land use codes and the provision or availability of services. The land use code for each property is available from the Council’s Customer Services Agency and on the website (on a property by property basis) at www.dunedin.govt.nz/services/rates-information.

The Council’s land use codes are based on the land use codes set under the Rating Valuation Rules 2008, which are set out below:

Land Use Code Land Use Description Differential Category 0 Multi–use: Vacant/Indeterminate Commercial 1 Multi–use: Rural Industry Farmland 2 Multi–use: Lifestyle Lifestyle 3 Multi–use: Transport Commercial 4 Multi–use: Community Services Commercial 5 Multi–use: Recreational Commercial 6 Multi–use: Utility Services Commercial 7 Multi–use: Industrial Commercial 8 Multi–use: Commercial Commercial 9 Multi–use: Residential Residential 10 Rural: Multi–use within Rural Industry Farmland 11 Rural: Dairy Farmland 12 Rural: Stock Finishing Farmland 13 Rural: Arable Farming Farmland 14 Rural: Store Livestock Farmland 15 Rural: Market Gardens and Orchards Farmland 16 Rural: Specialist Livestock Farmland 17 Rural: Forestry Farmland 18 Rural: Mineral Extraction Commercial 19 Rural: Vacant Farmland 20 Lifestyle: Multi–use within Lifestyle Lifestyle 21 Lifestyle: Single Unit Lifestyle 22 Lifestyle: Multi–unit Lifestyle 29 Lifestyle: Vacant Lifestyle 30 Transport: Multi–use within Transport Commercial 31 Transport: Road Transport Commercial 32 Transport: Parking Commercial 33 Transport: Rail Transport Commercial 34 Transport: Water Transport Commercial 35 Transport: Air Transport Commercial 39 Transport: Vacant Commercial 40 Community Services: Multi–use within Community Services Commercial 41 Community Services: Educational Commercial 42 Community Services: Medical and Allied Commercial 43 Community Services: Personal and Property Protection Commercial 44 Community Services: Religious Commercial 45 Community Services: Defence Commercial 46 Community Services: Halls Commercial 47 Community Services: Cemeteries and Crematoria Commercial 49 Community Services: Vacant Commercial 50 Recreational: Multi–use within Recreational Commercial 51 Recreational: Entertainment Commercial 52 Recreational: Active Indoor Commercial 53 Recreational: Active Outdoor Commercial 54 Recreational: Passive Indoor Commercial 55 Recreational: Passive Outdoor Commercial 59 Recreational: Vacant Commercial 60 Utility Services: Multi–use within Utility Services Commercial 61 Utility Services: Communications Commercial 62 Utility Services: Electricity Commercial 63 Utility Services: Gas Commercial 64 Utility Services: Water Supply Commercial 65 Utility Services: Sanitary Commercial 66 Utility Services: Other Commercial 67 Utility Services: Post Boxes Commercial 69 Utility Services: Vacant Commercial 70 Industrial: Multi–use within Industrial Commercial 71 Industrial: Food, Drink and Tobacco Commercial 72 Industrial: Textiles, Leather and Fur Commercial 73 Industrial: Timber Products and Furniture Commercial 74 Industrial: Building Materials Other than Timber Commercial 75 Industrial: Engineering, Metalworking, Appliances and Machinery Commercial 76 Industrial: Chemicals, Plastics, Rubber and Paper Commercial 77 Industrial: Other Industries – including Storage Commercial 78 Industrial: Depots, Yards Commercial 79 Industrial: Vacant Commercial 80 Commercial: Multi–use within Commercial Commercial 81 Commercial: Retail Commercial 82 Commercial: Services Commercial 83 Commercial: Wholesale Commercial 84 Commercial: Offices Commercial 85 Commercial: Carparking Commercial 89 Commercial: Vacant Commercial 90 Residential: Multi–use within Residential Residential 91 Residential: Single Unit excluding Bach/Crib Residential 92 Residential: Multi–unit Residential 93 Residential: Public Communal – Unlicensed Commercial 94 Residential: Public Communal – Licensed Commercial 95 Residential: Special Accommodation Residential 96 Residential: Communal Residence Dependent on Other Use Residential 97 Residential: Bach/Crib Residential 98 Residential: Carparking Residential 99 Residential: Vacant Residential In addition to the categories set out above, the Council has established categories for residential institutions, residential heritage bed and breakfasts, the stadium: 10,000+ seat capacity, churches, and schools.

1 Differentials Based on Land Use

The Council uses this matter to:

- differentiate the General Rate

- differentiate the Community Services Rate

- differentiate the Kerbside Recycling Collection Rate

- differentiate the Private Street Lighting Rate

- differentiate the Tourism/Economic Development Rate

- differentiate the Fire Protection Rate.

The differential categories based on land use are:

Residential – includes all rating units used for residential purposes including single residential, multi–unit residential, multi–use residential, residential special accommodation, residential communal residence dependent on other use, residential bach/cribs, residential carparking and residential vacant land.

Lifestyle – includes all rating units with Council land use codes 2, 20, 21, 22 and 29.

Commercial – includes all rating units with land uses not otherwise categorised as Residential, Lifestyle, Farmland, Stadium: 10,000+ Seat Capacity or Residential Heritage Bed and Breakfasts.

Farmland – includes all rating units used solely or principally for agricultural or horticultural or pastoral purposes.

Residential Heritage Bed and Breakfasts – includes all rating units meeting the following description:

- Bed and breakfast establishments; and

- Classified as commercial for rating purposes due to the number of bedrooms (greater than 4); and

- Either:

- the majority of the establishment is at least 80 years old; or

- the establishment has Heritage New Zealand Pouhere Taonga Registration; or

- the establishment is a Dunedin City Council Protected Heritage Building, as identified in the District Plan; and

- The bed and breakfast owner lives at the facility.

Stadium: 10,000+ Seat Capacity – this includes land at 130 Anzac Avenue, Dunedin, Assessment 4026695, Valuation reference 27190–01403.

2 Differentials Based on Land Use and Provision or Availability of Service

The Council uses these matters to differentiate the drainage rate and commercial drainage rate.

The differential categories based on land use are:

Residential – includes all rating units used for residential purposes including single residential, multi–unit residential, multi–use residential, residential special accommodation, residential communal residence dependent on other use, residential bach/cribs, residential carparking and residential vacant land.

Lifestyle – includes all rating units with Council land use codes 2, 20, 21, 22 and 29.

Farmland – includes all rating units used solely or principally for agricultural or horticultural or pastoral purposes.

Commercial – includes all rating units with land uses not otherwise categorised as Residential, Lifestyle, Farmland, Stadium: 10,000+ Seat Capacity, Residential Heritage, Bed and Breakfasts, Residential Institutions, Churches or Schools.

Stadium: 10,000+ Seat Capacity – this includes land at 130 Anzac Avenue, Dunedin, Assessment 4026695, Valuation reference 27190–01403.

Residential Heritage Bed and Breakfasts – includes all rating units meeting the following description:

- Bed and breakfast establishments; and

- Classified as commercial for rating purposes due to the number of bedrooms (greater than 4); and

- Either:

- the majority of the establishment is at least 80 years old; or

- the establishment has Heritage New Zealand Pouhere Taonga Registration; or

- the establishment is a Dunedin City Council Protected Heritage Building, as identified in the District Plan; and

- The bed and breakfast owner lives at the facility.

Residential Institutions – includes only rating units with Council land use codes 95 and 96.

Churches – includes all rating units used solely or principally as places of religious worship.

Schools – includes only rating units used for schools that do not operate for profit.

The differential categories based on provision or availability of service are:

Connected – any rating unit that is connected to a public sewerage drain.

Serviceable – any rating unit that is not connected to a public sewerage drain but is capable of being connected to the sewerage system (being a property situated within 30 metres of a public drain).

3 Differentials Based on Provision or Availability of Service

The Council uses these matters to differentiate the water rates.

The differential categories based on provision or availability of service are:

Connected – any rating unit that is supplied by the water supply system

Serviceable – any rating unit that is not supplied but is capable of being supplied by the water supply system (being a rating unit situated within 100 metres of the nearest water supply).

-

Minimum Rates and Low Value Rating Units

Minimum Rates

Where the total amount of rates payable in respect of any rating unit is less than $5.00, the rates payable in respect of the rating unit shall be such amount as the Council determines, but not exceeding $5.00.

Low Value Rating Units

Rating units with a capital value of $8,500 or less will only be charged the general rate.

-

Separately Used or Inhabited Part of a Rating Unit

A separately used or inhabited part of a rating unit includes any portion inhabited or used by the owner/a person other than the owner, and who has the right to use or inhabit that portion by virtue of a tenancy, lease, licence, or other agreement.

This definition includes separately used parts, whether or not actually occupied at any particular time, which are provided by the owner for rental (or other form of occupation) on an occasional or long term basis by someone other than the owner.

For the purpose of this definition, vacant land and vacant premises offered or intended for use or habitation by a person other than the owner and usually used as such are defined as ‘used’.

For the avoidance of doubt, a rating unit that has a single use or occupation is treated as having one separately used or inhabited part.

-

Lump Sum Contributions

No lump sum contributions will be sought for any targeted rate.

-

Rating by Instalment

All rates to be collected by the Council will be payable by four instalments according to the following schedule.

The City is divided into four areas based on Valuation Roll Numbers, as set out below:

Table 15: Rating Areas

Valuation Roll Numbers:

Area 1 Area 2 Area 3 Area 3 continued 26700 26990 26500 27550 26710 27000 26520 27560 26760 27050 26530 27600 26770 27060 26541 27610 26850 27070 26550 27760 26860 27080 26580 27770 26950 27150 26590 27780 26960 27350 26620 27790 26970 27360 26640 27811 26980 27370 26651 27821 27160 27380 26750 27822 27170 27500 26780 27823 27180 27510 27250 27831 27190 27520 27260 27841 27200 27851 27270 27871 27861 27280 27911 27880 27450 27921 27890 27460 27931 27901 27470 27941 28000 28010 28020 Area 4 comprises ratepayers with multiple assessments who pay on a schedule.

-

Due Dates for Payment of Rates

All rates, with the exception of water rates which are charged based on water meter consumption, will be payable in four instalments, due on the dates shown below:

Table 16: Due Dates

Due Dates Area 1 Areas 2 and 4 Area 3 Instalment 1 1/09/2023 8/09/2023 22/09/2023 Instalment 2 24/11/2023 1/12/2023 15/12/2023 Instalment 3 16/02/2024 23/02/2024 8/03/2024 Instalment 4 17/05/2024 24/05/2024 7/06/2024 Water meter invoices are sent separately from other rates. Where water rates are charged based on metered consumption using a meter other than a Smart Water Meter, invoices are sent on a quarterly or monthly basis and the due date for payment shall be on the 20th of the month following the date of the invoice as set out in the table below:

Date of Invoice Date for Payment Jul-23 20-Aug-23 Aug-23 20-Sep-23 Sep-23 20-Oct-23 Oct-23 20-Nov-23 Nov-23 20-Dec-23 Dec-23 20-Jan-24 Jan-24 20-Feb-24 Feb-24 20-Mar-24 Mar-24 20-Apr-24 Apr-24 20-May-24 May-24 20-Jun-24 Jun-24 20-Jul-24 Where water rates are charged based on consumption calculated using a Smart Water Meter, invoices will be sent out on a monthly basis, with the due date for payment being on the 20th of the month.

-

Example Rate Accounts

Capital Value New Capital Value Old CV Increase 2022/23 Rates 2023/24 Rates Increase Increase % Residential Example 490,000 345,000 42.00% 2,493 2,675 182 7.30% Mode Value 530,000 390,000 35.90% 2,641 2,778 137 5.20% Median Value 590,000 420,000 40.50% 2,739 2,932 193 7.00% Average Value 652,000 472,000 38.10% 2,910 3,091 181 6.20% Example 740,000 540,000 37.00% 3,133 3,316 183 5.90% Example 910,000 690,000 31.90% 3,626 3,753 127 3.50% Example 1,050,000 770,000 36.40% 3,888 4,112 224 5.80% Commercial Example 360,000 235,000 53.20% 3,606 4,196 590 16.40% Median Value 680,000 485,000 40.20% 6,637 7,220 583 8.80% Example 1,580,000 1,148,000 37.60% 14,675 15,724 1,049 7.10% Average Value 2,140,000 1,600,000 33.80% 20,154 21,015 861 4.30% Example 3,150,000 2,280,000 38.20% 28,398 30,558 2,160 7.60% Example 6,740,000 4,530,000 48.80% 55,675 64,480 8,805 15.80% Example 7,890,000 5,440,000 45.00% 66,707 75,346 8,639 13.00% Example 10,300,000 7,290,000 41.30% 89,134 98,117 8,983 10.10% Farmland (General and Community Services Rates only) Median Value 800,000 583,500 37.10% 1,636 1,754 118 7.20% Average Value 1,690,000 1,320,000 28.00% 3,571 3,581 10 0.30% Example 1,952,500 1,520,000 28.50% 4,097 4,120 23 0.60% Example 3,720,000 2,660,000 39.80% 7,092 7,749 657 9.30% Example 6,690,000 5,250,000 27.40% 13,895 13,846 -49 -0.40% Example 10,020,000 7,250,000 38.20% 19,150 20,683 1,533 8.00% Example 13,100,000 10,300,000 27.20% 27,162 27,006 -156 -0.60% Lifestyle (General and Community Services Rates only) Example 625,000 353,500 76.80% 1,206 1,635 429 35.50% Example 790,000 560,000 41.10% 1,851 2,038 187 10.10% Median Value 1,140,000 730,000 56.20% 2,381 2,891 510 21.40% Average Value 1,154,000 750,000 53.90% 2,444 2,925 481 19.70% Mode Value 1,200,000 650,000 84.60% 2,131 3,037 906 42.50% Example 1,410,000 940,000 50.00% 3,036 3,549 513 16.90% Definitions

- Mode – this is the most frequently occurring capital value.

- Median – this capital value is the one in the middle of the list of individual capital values. Half of the values are above this amount, and half below.

- Average – this is the capital value calculated if the whole value in each category was divided by the number of properties in each category.

- Example – these properties provide additional example rate accounts.

-

Mix of Funding Mechanisms by Group Activity

The following funding mechanisms are applied to the Council’s group activities. All mechanisms that have been used are in accordance with the Revenue and Financing Policy.

Reserves and Recreational Facilities Community and Planning Ara Toi (libraries and museums) Water Supply Waste Management Sewerage and Sewage Stormwater Property Regulatory Services Economic Development Roading and Footpaths Governance and Support Services General Rate * * * * * * * * Community Services Rate * Kerbside Recycling Rate * City–wide Water Rates * City–wide Drainage Rates * * Allanton Drainage Rate * Blanket Bay Drainage Rate * Curles Point Drainage Rate * Private Street Lighting Rate * Tourism/

Economic Development Rate* Warm Dunedin Rate * Revenue * * * * * * * * * * * * * Loans Raised * * * * * * * * * * * * Sale of Assets * * Reduction in Loans and Advances * Dunedin City Holdings Limited Interest and Dividend * Waka Kotahi NZTA Income * * * Cash * * * * * * * * * * * * Development Contributions * * * * * * Revenue includes fees and charges, subsidies, capital revenue, interest and dividends (other than Dunedin City Holdings Limited dividends). Revenue also includes water rates based on quantity of water and any lump sum payments for the Blanket Bay and Curles Point drainage system.

-

Funding Principles

The Dunedin City Council, in adopting the rating method, takes into consideration the following funding principles:

- That, in so far as possible, the rating method should be simple, efficient and understandable.

- People who benefit (including secondary beneficiaries) should contribute to costs.

- Capital value is the primary method of determining the rating method. Capital value is based on market value and reflects the property valuation.

- Property rates are a mechanism, which contains principles of public benefit taxation. Rates are not a user–pays mechanism.

- The application of funding mechanisms should not distort markets.

- The funding of activities and services should have regard to the interests of residents and ratepayers, including future ratepayers.

- The funding of services and activities should not make these unaffordable.

- People who pollute or damage the environment should bear the cost of redress.

- To promote fairness and equity in rating, fixed charges may be used.

- Where changes are contemplated to the rating method, transition arrangements may be used.

- Specific rating areas may be considered on a case–by–case basis.