-

Statement of Comprehensive Revenue and Expense for the years ended 30 June 2026 – 2034

Statement of Comprehensive Revenue and Expense for the Years Ended 30 June 2026 - 2034 shown in $000s) Annual Plan 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Budget 2032 Budget 2033 Budget 2034 Revenue from continuing operations Rates revenue 239,021 264,596 293,437 325,423 351,126 372,879 397,105 420,945 445,376 471,193 Development and financial contributions 3,850 3,856 3,856 3,856 3,856 3,856 3,856 3,856 3,856 3,856 Subsidies and grants 27,327 35,896 29,800 27,861 28,622 29,368 30,043 30,751 31,436 32,075 Financial revenue 21,847 20,660 21,258 23,672 23,984 24,280 24,561 24,823 25,095 25,351 Other revenue 80,229 90,772 88,828 91,687 94,499 98,732 102,221 105,445 107,475 110,189 Total operating revenue 372,274 415,780 437,179 472,499 502,087 529,115 557,786 585,820 613,238 642,664 Expenses Other expenses 161,955 174,721 179,518 186,428 195,308 200,754 220,022 221,443 227,216 233,072 Personnel expenses 83,879 88,076 90,560 93,067 95,581 97,901 100,051 102,384 104,387 106,429 Audit fees 495 404 584 428 438 630 459 469 672 489 Financial expenses 32,424 29,114 36,286 39,965 43,038 55,940 59,056 59,818 59,934 60,164 Depreciation and amortisation 122,356 123,715 127,897 138,221 144,659 153,673 163,506 169,455 175,155 181,861 Total operating expenses 401,109 416,030 434,845 458,109 479,024 508,898 543,094 553,569 567,364 582,015 Operating surplus/(deficit) from continuing operations -28,835 -250 2,334 14,390 23,063 20,217 14,692 32,251 45,874 60,649 Surplus/(deficit) before taxation -28,835 -250 2,334 14,390 23,063 20,217 14,692 32,251 45,874 60,649 Less taxation -250 -250 -250 -250 -250 -250 -250 -250 -250 -250 Surplus/(deficit) after taxation -28,585 0 2,584 14,640 23,313 20,467 14,942 32,501 46,124 60,899 -

Statement of Other Comprehensive Revenue and Expense for the years ended 30 June 2026 – 2034

Statement of Other Comprehensive Revenue and Expense for the Years Ended 30 June 2026 - 2034 (shown in $000s) Annual Plan 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Budget 2032 Budget 2033 Budget 2034 Other comprehensive revenue and expense Gain/(loss) on property plant and equipment revaluations 67,903 112,130 138,894 101,387 93,320 110,868 80,551 70,801 93,066 66,443 Total other comprehensive revenue and expense 67,903 112,130 138,894 101,387 93,320 110,868 80,551 70,801 93,066 66,443 Net surplus/(deficit) for the year (28,585) - 2,584 14,640 23,313 20,467 14,942 32,501 46,124 60,899 Total comprehensive revenue and expense for the year 39,318 112,130 141,478 116,027 116,633 131,335 95,493 103,302 139,190 127,342 -

Statement of Changes in Equity for the years ended 30 June 2026 – 2034

Statement of Changes in Equity for the Years Ended 30 June 2026 - 2034 (shown in $000s) Annual Plan 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Budget 2032 Budget 2033 Budget 2034 Movements in equity Opening equity 4,538,637 4,553,882 4,666,012 4,807,490 4,923,517 5,040,150 5,171,485 5,266,978 5,370,280 5,509,470 Total comprehensive revenue and expense 39,318 112,130 141,478 116,027 116,633 131,335 95,493 103,302 139,190 127,342 Closing equity 4,577,955 4,666,012 4,807,490 4,923,517 5,040,150 5,171,485 5,266,978 5,370,280 5,509,470 5,636,812 -

Statement of Financial Position for the years ended 30 June 2026 – 2034

Statement of Financial Position for the Years Ended 30 June 2026 - 2034 (shown in $000s) Annual Plan 2025 Forecast 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Budget 2032 Budget 2033 Budget 2034 Current assets Cash and cash equivalents 6,052 11,355 13,357 13,008 12,042 10,863 10,019 9,558 9,626 10,317 9,049 Other current financial assets 10,883 13,426 14,426 15,329 15,464 15,599 15,734 15,869 16,004 16,139 16,274 Trade and other receivables 29,228 32,588 33,245 33,003 34,100 35,569 36,989 38,425 39,834 41,163 42,585 Taxation refund receivable 250 351 250 250 250 250 250 250 250 250 250 Inventories 574 675 675 675 682 689 695 702 709 717 724 Prepayments 1,483 2,109 2,109 2,109 2,130 2,151 2,173 2,195 2,217 2,239 2,261 Total current assets 48,470 60,504 64,062 64,374 64,668 65,121 65,860 66,999 68,640 70,825 71,143 Non-current assets Other non-current financial assets 200,404 205,227 206,560 206,518 207,987 209,497 211,051 212,651 214,296 215,991 217,735 Shares in subsidiary companies 138,889 138,889 141,794 144,710 147,636 150,571 153,515 156,468 159,430 162,401 165,381 Intangible assets 4,553 3,941 5,382 8,028 10,505 11,418 11,481 11,007 10,756 10,393 10,288 Investment property 122,907 111,993 119,563 125,775 128,827 132,432 136,260 141,420 144,764 148,167 151,627 Property, plant and equipment 4,846,708 4,779,821 4,999,123 5,236,670 5,419,627 5,604,701 5,820,587 5,948,382 6,036,619 6,176,142 6,296,913 Total non-current assets 5,313,461 5,239,871 5,472,422 5,721,701 5,914,582 6,108,619 6,332,894 6,469,928 6,565,865 6,713,094 6,841,944 Total assets 5,361,931 5,300,375 5,536,484 5,786,075 5,979,250 6,173,740 6,398,754 6,536,927 6,634,505 6,783,919 6,913,087 Current liabilities Short term borrowings 0 6,764 6,230 9,072 9,991 10,760 13,985 14,764 14,955 14,984 15,041 Trade and other payables 40,425 37,327 40,639 41,779 44,596 46,560 46,510 53,815 51,603 53,039 54,019 Revenue received in advance 5,446 5,658 5,663 5,663 5,663 5,663 5,663 5,663 5,663 5,663 5,663 Employee entitlements 10,066 10,799 11,025 11,306 11,597 11,890 12,160 12,410 12,683 12,916 13,154 Total current liabilities 55,937 60,548 63,557 67,820 71,847 74,873 78,318 86,652 84,904 86,602 87,877 Non-current liabilities Term loans 709,473 662,173 783,173 887,239 960,368 1,035,207 1,125,448 1,159,801 1,155,831 1,164,363 1,164,920 Non-current employee entitlements 1,245 1,246 1,216 1,000 992 984 977 970 964 958 952 Provisions 17,001 22,206 22,206 22,206 22,206 22,206 22,206 22,206 22,206 22,206 22,206 Other non-current liabilities 320 320 320 320 320 320 320 320 320 320 320 Total non-current liabilities 728,039 685,945 806,915 910,765 983,886 1,058,717 1,148,951 1,183,297 1,179,321 1,187,847 1,188,398 Equity Accumulated funds 1,633,599 1,639,216 1,639,016 1,640,750 1,653,687 1,675,246 1,693,910 1,707,002 1,737,609 1,781,794 1,840,712 Revaluation reserves 2,933,277 2,904,062 3,016,192 3,155,086 3,256,473 3,349,793 3,460,661 3,541,212 3,612,013 3,705,079 3,771,522 Restricted reserves 11,079 10,604 10,804 11,654 13,357 15,111 16,914 18,764 20,658 22,597 24,578 Total equity 4,577,955 4,553,882 4,666,012 4,807,490 4,923,517 5,040,150 5,171,485 5,266,978 5,370,280 5,509,470 5,636,812 Total liabilities and equity 5,361,931 5,300,375 5,536,484 5,786,075 5,979,250 6,173,740 6,398,754 6,536,927 6,634,505 6,783,919 6,913,087 The accompanying notes and accounting policies form an integral part of these financial statements. -

Statement of Cash Flows for the years ended 30 June 2026 – 2034

Statement of Cash Flows for the Years Ended 30 June 2026 - 2034 (shown in $000s) Annual Plan 2025 Forecast 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Budget 2032 Budget 2033 Budget 2034 Cashflow from Operating Activities Cash was provided from operating activities: Rates received 273,912 235,339 264,381 292,327 324,192 350,139 372,042 396,173 420,027 444,436 470,201 Other revenue 121,692 119,056 121,288 119,520 118,487 121,414 126,255 130,466 134,378 137,154 140,432 Interest received 7,878 8,280 8,313 8,752 9,093 9,330 9,550 9,751 9,929 10,115 10,282 Divided received 12,954 12,678 10,815 10,943 12,974 13,007 13,041 13,076 13,112 13,150 13,189 Intra-group tax payment 370 409 351 250 250 250 250 250 250 250 250 416,806 375,762 405,148 431,792 464,996 494,140 521,138 549,716 577,696 605,105 634,354 Cash was applied to: Supplies and employees -265,337 -267,105 -263,344 -266,615 -275,930 -288,340 -295,874 -312,236 -326,083 -330,610 -338,750 Interest paid -32,580 -25,952 -29,447 -36,286 -39,965 -43,038 -55,940 -59,056 -59,817 -59,934 -60,164 -297,917 -293,057 -292,791 -302,901 -315,895 -331,378 -351,814 -371,292 -385,900 -390,544 -398,914 Net cash inflow (outflow) from operations 118,889 82,705 112,357 128,891 149,101 162,762 169,324 178,424 191,796 214,561 235,440 Cashflow from Investing Activities Cash was provided from investing activities: Sale of assets 120 32 120 120 120 120 120 120 120 120 120 Decrease in investments 0 14,698 18,000 0 0 0 0 0 0 0 0 120 14,730 18,120 120 120 120 120 120 120 120 120 Cash was applied to: Increase in investments -5,400 -22,341 -21,905 -2,916 -2,926 -2,934 -2,944 -2,954 -2,961 -2,971 -2,979 Capital expenditure -236,771 -143,994 -227,569 -230,510 -220,390 -235,966 -257,585 -210,404 -184,918 -219,550 -234,406 -242,171 -166,335 -249,474 -233,426 -223,316 -238,900 -260,529 -213,358 -187,879 -222,521 -237,385 Net cash inflow (outflow) from investing activity -242,051 -151,605 -231,354 -233,306 -223,196 -238,780 -260,409 -213,238 -187,759 -222,401 -237,265 Cashflow from Financing Activities Cash was provided from financing activities: Loans raised 120,500 71,700 121,000 104,066 73,129 74,839 90,241 34,353 0 8,531 557 120,500 71,700 121,000 104,066 73,129 74,839 90,241 34,353 0 8,531 557 Cash was applied to: Loans repaid 0 0 0 0 0 0 0 0 -3,969 0 0 0 0 0 0 0 0 0 0 -3,969 0 0 Net cash inflow (outflow) from financing activity 120,500 71,700 121,000 104,066 73,129 74,839 90,241 34,353 -3,969 8,531 557 Net increase/(decrease) in cash held -2,662 2,800 2,003 -349 -966 -1,179 -844 -461 68 691 -1,268 Opening cash balance 8,714 8,555 11,355 13,357 13,008 12,042 10,863 10,019 9,558 9,626 10,317 Closing cash balance 6,052 11,355 13,357 13,008 12,042 10,863 10,019 9,558 9,626 10,317 9,049 -

Income Statement for the years ended 30 June 2026 – 2034

Income Statement for the Years Ended 30 June 2026 - 2034 (shown in $000s) Annual Plan 2025 Budget 2026 Budget 2027 Budget 2028 Budget 2029 Budget 2030 Budget 2031 Budget 2032 Budget 2033 Budget 2034 Revenue Rates revenue 239,021 264,596 293,436 325,423 351,128 372,879 397,105 420,944 445,376 471,194 External revenue 99,326 108,683 107,339 112,610 115,731 120,264 124,033 127,521 129,821 132,789 Grants and subsidies revenue 27,327 35,895 29,799 27,861 28,623 29,367 30,043 30,750 31,436 32,076 Development contributions revenue 3,850 3,856 3,856 3,856 3,856 3,856 3,856 3,856 3,856 3,856 Vested assets 3,000 3,000 2,999 2,999 2,999 2,999 2,999 2,999 2,999 2,999 Internal revenue 40,927 45,587 46,274 46,209 47,491 49,258 53,906 58,619 60,105 61,633 Total revenue 413,451 461,617 483,703 518,958 549,828 578,623 611,942 644,689 673,593 704,547 Expenditure Personnel costs 83,879 88,075 90,560 93,068 95,582 97,900 100,051 102,385 104,388 106,429 Operations and maintenance 89,810 95,571 98,004 99,873 104,724 110,390 118,376 126,229 128,828 132,713 Occupancy costs 35,673 37,763 38,774 40,229 41,941 43,777 45,543 47,272 49,014 50,532 Consumables and general 26,061 29,281 30,596 30,023 31,689 33,781 33,414 34,440 35,847 36,001 Grants and subsidies 10,906 12,512 12,728 16,730 17,391 13,437 23,148 13,971 14,198 14,315 Internal charges 40,927 45,587 46,274 46,209 47,491 49,258 53,906 58,619 60,105 61,633 Depreciation and amortisation 122,356 123,715 127,897 138,221 144,659 153,673 163,506 169,455 175,155 181,861 Interest 32,424 29,113 36,286 39,965 43,038 55,940 59,056 59,817 59,934 60,164 Total expenditure 442,036 461,617 481,119 504,318 526,515 558,156 597,000 612,188 627,469 643,648 Net surplus/(deficit) -28,585 0 2,584 14,640 23,313 20,467 14,942 32,501 46,124 60,899 Expenditure by Activity City Properties 49,521 50,258 53,065 55,455 57,437 60,698 64,291 65,916 67,363 69,894 Community Recreation 45,147 45,804 48,163 51,266 52,517 54,672 56,615 57,498 58,472 59,475 Creative and Cultural Vibrancy 30,858 32,120 33,034 37,432 39,194 36,427 47,133 38,652 39,302 39,900 Governance and Support Services 48,496 53,501 54,676 53,820 56,499 58,155 58,929 60,520 60,910 61,224 Regulatory Services 21,277 22,395 22,970 23,638 24,173 24,810 25,312 25,928 26,419 27,033 Resilient City 11,976 11,996 12,070 11,807 12,091 12,366 12,647 12,926 13,201 13,480 Roading and Footpaths 65,936 67,602 72,222 75,894 78,225 82,342 88,867 94,932 95,799 95,977 Sewerage and Sewage 47,780 54,995 56,836 59,240 63,062 70,845 77,606 83,722 89,254 94,061 Stormwater 16,614 19,326 19,910 20,566 21,772 23,345 24,436 24,886 25,398 26,612 Water Supply 61,649 53,277 56,039 59,289 62,341 65,710 68,062 70,646 73,581 77,295 Waste Minimisation 32,871 37,699 38,779 41,927 45,131 55,371 59,976 62,773 63,634 64,712 Treaty Partnerships 993 921 948 973 997 1,021 1,044 1,067 1,089 1,112 Vibrant Economy 8,918 11,723 12,407 13,011 13,076 12,394 12,082 12,722 13,047 12,873 Total expenditure 442,036 461,617 481,119 504,318 526,515 558,156 597,000 612,188 627,469 643,648 -

Notes to the Financial Statements for the years ended 30 June 2026 – 2034

1 Statement of accounting policies

REPORTING ENTITY

Dunedin City Council (the Council) is a territorial local authority established under the Local Government Act 2002 (LGA) and is domiciled and operates in New Zealand.

The relevant legislation governing the Council's operations includes the LGA and the Local Government (Rating) Act 2002.

These prospective financial statements are for the Dunedin City Council as a separate legal entity. Consolidated prospective financial statements comprising the Council and its subsidiaries have not been prepared as the services which Council provides to the City are fully reflected within the Council’s financial statements.

The Council provides local infrastructure, local public services, and performs regulatory functions to the community. The Council does not operate to make a financial return. Therefore, the Council has designated itself as a public benefit entity (PBE).

The registered address of the Council is 50 The Octagon, Dunedin.

BASIS OF PREPARATION

Statement of compliance

These prospective financial statements have been prepared in accordance with the requirements of the Local Government Act 2002, which includes the requirement to comply with New Zealand Generally Accepted Accounting Practice. The prospective financial statements have been prepared to comply with PBE Standards for a Tier 1 entity, including compliance with PBE FRS 42.

Prospective Financial Statements

The financial statements have been prepared on the going concern basis, and the accounting policies have been applied consistently throughout the year.

These prospective financial statements comply with the requirements of the Local Government Act 2002, Part

6 Section 95 and Part 2 of Schedule 10 which includes the requirement to comply with New Zealand Generally

Accepted Accounting Practice (NZ GAAP) with the exception of the Funding Impact Statements (FIS).

In preparing these prospective statements, estimates and assumptions have been made concerning the future.

The prospective financial statements were issued by Council on 30 June 2025. The Council is responsible for the prospective financial statements including the

appropriateness of assumptions underlying the prospective financial statements and all other disclosures. The prospective financial statements are calculated using forecast results for the 2025 financial year. There is no intention to update the prospective financial statement after the issue date.Presentation currency and rounding

The financial statements are presented in New Zealand dollars because that is the currency of the primary economic environment in which the Council operates. All values are rounded to the nearest thousand dollars ($000).

Standards issued and not yet effective that have been early adopted

There were no standards issued and not yet effective that have been early adopted.

Other changes in accounting policies

The Council has adopted an amendment to PBE IPSAS 1 (Disclosure of Fees for Audit Firms' Services) this includes a requirement to disaggregate the fees into specified categories for fees relating to services provided by the audit or review provider. The amendments to PBE IPSAS 1 aim

to address concerns about the quality and consistency of disclosures about fees paid to its audit or review firm for different types of services. The enhanced disclosures are expected to improve the transparency and consistency of disclosures about fees paid to an entity's audit or review firm. The amendment is effective from 1 July 2024.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Significant accounting policies are included in the notes to which they relate. Significant accounting policies that do not relate to a specific note are outlined below.

Prospective financial statements

The financial statements are forecast using the best information available at the time they were prepared.

Foreign currency transactions

The individual financial statements of Council are presented in the currency of the primary economic environment in which the entity operates (its functional currency). For the purpose of the financial statements the results and financial position are expressed in New Zealand dollars, which is the functional currency of the Council.

Transactions in currencies other than New Zealand dollars are recorded at the rates of exchange prevailing on the dates of the transactions. At each balance sheet date, monetary assets and liabilities that are denominated in foreign currencies are retranslated at the rates prevailing on the balance sheet date. The Council does not hold non- monetary assets and liabilities denominated in foreign currencies.

Goods and services tax

Items in the financial statements are stated exclusive of GST, except for receivables and payables which are presented on a GST-inclusive basis. Where GST is not recoverable as input tax, it is recognised as part of the related asset or expense.

The net amount of GST recoverable from, or payable to, the IRD is included as part of receivables or payables in the statement of financial position.

The net GST paid to, or received from, the IRD, including the GST relating to investing and financing activities, is classified as an operating cash flow in the statement of cash flows.

Critical accounting estimates and assumptions

The Council makes estimates and assumptions concerning the future. The resulting accounting estimates will, by definition, seldom equal the related actual results. The estimates and assumptions that have a significant risk

of causing a material adjustment to carrying amounts of assets and liabilities within the next financial year include:

- landfill provision;

- valuation of property, plant and equipment and investment properties;

- valuation of employee entitlements

2 Rates revenue

(shown in $000s) Approved Budget 2025 Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Rates revenue by type General rates 133,523 144,531 157,980 172,297 189,544 197,671 210,973 225,174 240,135 255,725 Community services rate 5,948 6,203 6,389 6,562 6,726 6,887 7,045 7,200 7,352 7,506 Kerbside recycling rate 13,608 15,697 16,252 16,836 17,448 18,547 19,432 20,074 20,659 21,249 Citywide water rate 32,045 36,852 44,164 51,156 53,899 56,981 59,071 61,403 64,126 67,622 Citywide drainage rate 53,063 61,024 68,422 78,398 83,373 92,681 100,489 107,031 113,041 119,025 Allanton drainage rate 19 19 19 19 19 19 19 0 0 0 Blanket Bay drainage rate 1 1 1 1 1 1 1 1 0 0 Curles Point drainage rate 1 1 1 1 1 1 1 1 0 0 Private street lighting rate 40 40 44 47 50 53 56 60 63 67 Tourism/economic development rate 500 0 0 0 0 0 0 0 0 0 Warm Dunedin rate 273 228 164 106 67 38 18 0 0 0 239,021 264,596 293,436 325,423 351,128 372,879 397,105 420,944 445,376 471,194 Rates revenue by activity City Properties 14,782 12,821 15,348 16,852 17,993 20,425 23,205 24,034 24,705 26,444 Community Recreation 37,909 38,467 40,607 43,506 44,562 46,527 48,282 48,982 49,777 50,597 Creative and Cultural Vibrancy 28,317 29,507 30,342 31,318 32,110 33,526 34,665 35,619 36,205 36,737 Governance and Support Services -2,341 653 1,450 0 59 947 695 986 710 47 Regulatory Services 5,880 6,037 6,215 6,513 6,696 6,988 7,151 7,435 7,602 7,886 Resilient City 10,527 11,600 11,661 11,387 11,660 11,926 12,196 12,466 12,731 12,999 Roading and Footpaths 33,997 38,215 43,714 51,435 63,653 67,641 74,959 85,197 97,470 110,535 Sewerage and Sewage 41,392 47,598 51,850 57,984 61,759 69,498 76,219 82,296 87,795 92,569 Stormwater 11,692 13,446 16,592 20,434 21,635 23,203 24,290 24,736 25,245 26,455 Water Supply 32,045 36,852 44,164 51,156 53,899 56,981 59,071 61,403 64,126 67,622 Waste Minimisation 15,954 17,331 18,657 21,536 23,577 22,517 23,820 24,748 25,474 26,097 Treaty Partnerships 572 921 948 973 997 1,021 1,044 1,067 1,089 1,112 Vibrant Economy 8,295 11,148 11,888 12,329 12,528 11,679 11,508 11,975 12,447 12,094 239,021 264,596 293,436 325,423 351,128 372,879 397,105 420,944 445,376 471,194 Rating base information The number of rating units 61,542 62,045 62,551 63,063 63,528 63,996 64,468 64,945 65,424 65,823 Relevant significant accounting policies

Rates are set annually by resolution from Council and relate to a financial year. All ratepayers are invoiced within the financial year to which the rates have been set. Rates revenue is recognised when payable.

Revenue from water rates by meter is recognised on an accrual basis based on usage. Unbilled usage, as a result of unread meters at year-end, is accrued on an average usage basis. Revenue from rates penalties is recognised when the penalty is imposed.

Rates remissions are recognised as a reduction of rates revenue when the Council has received an application that satisfies its rates remission policy.

3 Development and financial contributions

(shown in $000's) Approved Budget

2025Draft

Budget 2026Draft

Budge 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Development and financial contributions 3,850 3,856 3,856 3,856 3,856 3,856 3,856 3,856 3,856 3,856 3,850 3,856 3,856 3,856 3,856 3,856 3,856 3,856 3,856 3,856 Relevant significant accounting policies

Development and financial contributions are recognised as revenue when the Council provides, or is able to provide, the services for which the contribution was charged. Otherwise, development and financial contributions are recognised as liabilities until such time as the Council provides, or is able to provide, the service.

4 Subsidies and grants

(shown in $000s) Approved Budget 2025 Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Subsidies and grants New Zealand Transport Agency new capital roading subsidies 1,892 6,843 2,355 0 0 0 0 0 0 0 New Zealand Transport Agency renewal roading subsidies 11,840 15,528 14,202 15,799 16,215 16,618 16,977 17,350 17,706 18,034 New Zealand Transport Agency operational roading subsidies 8,719 9,383 9,819 10,159 10,454 10,746 11,014 11,300 11,581 11,845 Government and government agency grants 3,080 3,791 3,063 1,533 1,575 1,614 1,654 1,694 1,734 1,773 Other grants 1,796 350 360 370 379 389 398 406 415 424 27,327 35,895 29,799 27,861 28,623 29,367 30,043 30,750 31,436 32,076 Relevant significant accounting policies

The Council receives funding assistance from the New Zealand Transport Agency Waka Kotahi, which subsidises part of the costs of maintenance and capital expenditure on the local roading infrastructure. The subsidies are recognised as revenue upon entitlement, as conditions pertaining to eligible expenditure have been fulfilled.

Other grants received are recognised as revenue when they become receivable unless there is an obligation in substance to return funds if conditions of the grant are not met. If there is such an obligation, the grants are initially recorded as grants received in advance and recognised as revenue when conditions of the grant are satisfied.

5 Financial revenue

(shown in $000s) Approved Budget 2025 Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Gain on fair value of investments 916 1,333 1,563 1,604 1,646 1,689 1,734 1,781 1,830 1,880 Dividends received - Dunedin City Holdings Limited 11,000 9,000 9,000 11,000 11,000 11,000 11,000 11,000 11,000 11,000 Dividends received - Waipori Fund 1,874 1,735 1,943 1,974 2,007 2,041 2,076 2,112 2,150 2,189 Other dividends received 80 80 0 0 0 0 0 0 0 0 Interest received - Dunedin City Holdings Limited 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 5,902 Interest received - Waipori Fund 1,905 2,245 2,481 2,819 3,052 3,268 3,465 3,640 3,822 3,985 Other interest received 170 365 369 373 377 380 384 388 391 395 21,847 20,660 21,258 23,672 23,984 24,280 24,561 24,823 25,095 25,351 Relevant significant accounting policies

Interest income is accrued on a time basis, by reference to the principal outstanding and at the effective interest rate applicable, which is the rate that exactly discounts estimated future cash receipts through the expected life of the financial asset to that asset’s net carrying amount.

Dividend income from investments is recognised when the shareholders’ rights to receive payment have been established.

6 Other revenue

(shown in $000s) Approved Budget 2025 Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Rental from investment properties 9,013 9,331 9,611 9,870 10,117 10,360 10,598 10,831 11,058 11,291 Gain on fair value of investment property 0 5,800 2,018 2,051 2,084 2,117 2,152 2,186 2,222 2,258 Regulatory services rendered 5,891 5,891 6,068 6,231 6,387 6,540 6,691 6,838 6,982 7,128 Vested assets 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 Other fees and charges 62,325 66,750 68,131 70,535 72,911 76,715 79,780 82,590 84,213 86,512 80,229 90,772 88,828 91,687 94,499 98,732 102,221 105,445 107,475 110,189 Relevant significant accounting policies

Revenue is measured at the fair value of the consideration received or receivable and represents amounts receivable for goods and services provided in the normal course of business, net of discounts and GST.

The specific policies for significant revenue items included in other revenue are explained below:

Rental from investment and community housing properties

Lease rentals (net of any incentives given) are recognised on a straight line basis over the term of the lease.

Commercial and domestic waste disposal charges

Fees for disposing of waste at the Council's landfill are recognised as waste is disposed by users.

Regulatory services rendered

Fees and charges for building and resource consent services are recognised on a percentage completion basis with reference to the recoverable costs incurred at balance date.

Vested assets

For assets received for no or nominal consideration, the asset is recognised at its fair value when the Council obtains control of the asset. The fair value of the asset is recognised as revenue, unless there is a use or return condition attached to the asset.

Gain on fair value of investment property

Investment properties are held primarily to earn lease revenue and/or for capital growth. All investment properties are measured at fair value, determined annually by an independent registered valuer. Any gain or loss arising is recognised in the surplus or deficit for the period in which the gain or loss arises. Investment properties are not depreciated.

Other fees and charges

Entrance fees are charged to users of the Council's local facilities, such as pools, museum exhibitions and Dunedin Chinese Garden. Revenue from entrance fees is recognised upon entry to such facilities.

Infringement fees and fines which mostly relate to traffic and parking infringements, and library overdue book fines, are recognised when the infringement notice is issued or when the fines/penalties are otherwise imposed.

Rental income from operating leases, such as social housing, is recognised on a straight line basis over the term of the relevant lease.

Revenue from the sale of goods is recognised when significant risks and rewards of owning the goods are transferred to the buyer, when the revenue can be measured reliably and when management effectively ceases involvement or control.

Revenue from other services rendered is recognised when it is probable that the economic benefits associated with the transaction will flow to the entity. The stage of completion at balance date is assessed based on the value of services performed to date as a percentage of the total services to be performed.

7 Other expenses

(shown in $000s) Approved Budget 2025 Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Operations and maintenance 89,810 95,262 97,248 99,612 104,682 110,462 118,557 126,516 129,216 133,203 Occupancy costs 35,673 37,326 38,317 39,749 41,433 43,235 44,968 46,666 48,371 49,858 Consumables and general 25,566 28,183 29,458 28,652 29,988 31,792 32,064 32,765 33,947 34,242 Grants and subsidies 10,906 13,031 12,962 13,559 13,485 13,796 14,022 14,361 14,605 14,958 161,955 173,802 177,985 181,572 189,588 199,285 209,611 220,308 226,139 232,261 Relevant significant accounting policies

General grants

Non-discretionary grants are grants that awarded if the grant application meets the specified criteria and are recognised as expenditure when an application that meets the specified criteria for the grant has been received.

Discretionary grants are grants where the Council has no obligation to award on receipt of the grant application and are recognised as expenditure when approved by the Council and the approval has been communicated to the applicant.

Operating lease expenses

An operating lease is a lease that does not transfer substantially all the risks and rewards incidental to ownership of an asset. Lease payments under an operating lease are recognised as an expense on a straight-line basis over the lease term. Lease incentives received are recognised in the surplus or deficit as a reduction of rental expense over the lease term.

Research and development

Expenditure on research activities is recognised as an expense in the period in which it is incurred.

8 Personnel expenses

Relevant significant accounting policies

Salaries and wages are recognised as an expense as employees provide services

9 Audit fees

(shown in $000s) Approved

Budget 2025Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Fees paid to Audit New Zealand on behalf of the Auditor-General for; Audit of the financial report* 350 404 416 428 438 449 459 469 479 489 Audit of the long-term plan 145 0 168 0 0 181 0 0 193 0 Other audit or review related services 0 0 0 0 0 0 0 0 0 0 495 404 584 428 438 630 459 469 672 489 *the fee for the audit of the financial report includes the fee for the audit of the summary annual report

10 Financial expenses

(shown in $000s) Approved

Budget 2025Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Interest paid to subsidiaries 32,424 29,114 36,286 39,965 43,038 55,940 59,056 59,818 59,934 60,164 32,424 29,114 36,286 39,965 43,038 55,940 59,056 59,818 59,934 60,164 Relevant significant accounting policies

Borrowing costs directly attributable to the acquisition, construction or production of qualifying assets, which are assets that necessarily take a substantial period of time to get ready for their intended use or sale, are added to the cost of those assets, until such time as the assets are substantially ready for their intended use or sale.

All other borrowing costs are recognised as an expense in the financial year in which they are incurred.

11 Depreciation and amortisation

(shown in $000s) Approved Budget 2025 Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Depreciation and amortisation expense by group of activity City Properties 15,080 15,068 16,232 17,762 18,586 19,532 22,127 22,943 23,691 24,791 Community Recreation 7,833 7,988 8,940 11,059 11,364 11,844 12,898 12,894 12,953 13,420 Creative and Cultural Vibrancy 1,326 1,712 1,779 1,869 1,712 2,078 2,017 2,073 2,108 2,134 Governance and Support Services 3,051 2,969 3,009 3,221 3,846 4,439 4,484 4,343 4,308 4,270 Regulatory Services 15 19 20 17 17 20 9 12 17 17 Resilient City 78 32 16 17 18 17 20 22 24 26 Roading and Footpaths 30,226 32,125 33,006 34,169 34,898 35,827 36,546 37,343 38,107 38,912 Sewerage and Sewage 22,156 24,400 24,617 25,861 27,281 29,322 31,900 34,293 36,641 38,567 Stormwater 9,770 11,242 11,396 11,864 12,576 13,282 13,985 14,435 14,820 15,371 Water Supply 31,596 26,365 26,900 28,554 30,184 31,483 32,782 34,097 35,362 36,820 Waste Minimisation 1,192 1,768 1,957 3,806 4,156 5,815 6,724 6,983 7,108 7,520 Treaty Partnerships 0 0 0 0 0 0 0 0 0 0 Vibrant Economy 33 27 25 22 21 14 14 17 16 13 122,356 123,715 127,897 138,221 144,659 153,673 163,506 169,455 175,155 181,861 12 Total group expenditure

(shown in $000s) Approved Budget 2025 Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034City Properties 49,521 50,258 53,065 55,455 57,437 60,698 64,291 65,916 67,363 69,894 Community Recreation 45,147 45,804 48,163 51,266 52,517 54,672 56,615 57,498 58,472 59,475 Creative and Cultural Vibrancy 30,858 32,120 33,034 37,432 39,194 36,427 47,133 38,652 39,302 39,900 Governance and Support Services 48,496 53,501 54,676 53,820 56,499 58,155 58,929 60,520 60,910 61,224 Regulatory Services 21,277 22,395 22,970 23,638 24,173 24,810 25,312 25,928 26,419 27,033 Resilient City 11,976 11,996 12,070 11,807 12,091 12,366 12,647 12,926 13,201 13,480 Roading and Footpaths 65,936 67,602 72,222 75,894 78,225 82,342 88,867 94,932 95,799 95,977 Sewerage and Sewage 47,780 54,995 56,836 59,240 63,062 70,845 77,606 83,722 89,254 94,061 Stormwater 16,614 19,326 19,910 20,566 21,772 23,345 24,436 24,886 25,398 26,612 Water Supply 61,649 53,277 56,039 59,289 62,341 65,710 68,062 70,646 73,581 77,295 Waste Minimisation 32,871 37,699 38,779 41,927 45,131 55,371 59,976 62,773 63,634 64,712 Treaty Partnerships 993 921 948 973 997 1,021 1,044 1,067 1,089 1,112 Vibrant Economy 8,918 11,723 12,407 13,011 13,076 12,394 12,082 12,722 13,047 12,873 Total expenditure per activity 442,036 461,617 481,119 504,318 526,515 558,156 597,000 612,188 627,469 643,648 Less: Internal expenditure -40,927 -45,587 -46,274 -46,209 -47,491 -49,258 -53,906 -58,619 -60,105 -61,633 Total expenditure per financial statements 401,109 416,030 434,845 458,109 479,024 508,898 543,094 553,569 567,364 582,015 13 Equity

(shown in $000s) Forecast 2025 Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Accumulated Funds Opening balance 1,651,592 1,639,216 1,639,016 1,640,750 1,653,687 1,675,246 1,693,910 1,707,002 1,737,609 1,781,794 Surplus/(deficit) -12,072 0 2,584 14,640 23,313 20,467 14,942 32,501 46,124 60,899 Net transfers from/(to) restricted reserves -304 -200 -850 -1,703 -1,754 -1,803 -1,850 -1,894 -1,939 -1,981 Closing balance 1,639,216 1,639,016 1,640,750 1,653,687 1,675,246 1,693,910 1,707,002 1,737,609 1,781,794 1,840,712 Revaluation reserves Opening balance 2,686,878 2,904,062 3,016,192 3,155,086 3,256,473 3,349,793 3,460,661 3,541,212 3,612,013 3,705,079 Property plant and equipment revaluations 217,184 112,130 138,894 101,387 93,320 110,868 80,551 70,801 93,066 66,443 Closing balance 2,904,062 3,016,192 3,155,086 3,256,473 3,349,793 3,460,661 3,541,212 3,612,013 3,705,079 3,771,522 Restricted reserves Opening balance 10,300 10,604 10,804 11,654 13,357 15,111 16,914 18,764 20,658 22,597 Net transfers from/(to) accumulated funds 304 200 850 1,703 1,754 1,803 1,850 1,894 1,939 1,981 Closing balance 10,604 10,804 11,654 13,357 15,111 16,914 18,764 20,658 22,597 24,578 4,553,882 4,666,012 4,807,490 4,923,517 5,040,150 5,171,485 5,266,978 5,370,280 5,509,470 5,636,812 Activity and output group

(shown in $000s)Purpose Opening Balance 2025 Transfers Inwards

2025-34Transfers Outwards

2025-34Closing Balance 2034 Roading and footpaths Transport Roading property reserve for property purchases 174 6,518 -6,486 206 Sewerage and sewage Wastewater Water development and operational reserves 49 23,040 -23,031 58 Waste Management Landfills Waste minimisation projects 300 23,992 -11,911 12,381 Community recreation Cemeteries and Crematorium To maintain cemeteries and specific burial plots and mausoleums 2,190 414 0 2,604 Dunedin Botanic Garden Aviary Bird Fund operations reserve 30 5 0 35 Clive R. B. Lister Capital to maintain the Clive Lister Garden 274 50 0 324 Mediterranean Garden development reserve 17 3 0 20 Parks and Recreation Reserve of development contributions for playgrounds, specific Parks and Subdivision reserves -125 2,505 -2,529 -149 To maintain specific reserve areas 1,336 244 0 1,580 City properties Investment Property Endowment property investment reserve 1,227 224 0 1,451 Holding Property Air Development to develop the Taieri aerodrome 423 77 0 500 Community Housing Operational housing reserve 2,355 3,087 -2,658 2,784 Creative and cultural vibrancy Dunedin Public Art Gallery Art Gallery funded operations reserves 1,110 202 0 1,312 Libraries and City of Literature To extend the Reed and other library collections 836 153 0 989 Toitū Otago Settlers Museum Museum funded operations reserves 3 1 0 4 Regulatory Services Animal Services Dog Control operations reserve 15 3 0 18 Governance and Support Services Finance Insurance reserve 353 64 0 417 Other Hillary Commission General Subsidies Reserve 37 7 0 44 10,604 60,589 -46,615 24,578 Equity is the community's interest in the Council and is measured as the difference between total assets and total liabilities. Equity is disaggregated and classified into components. The components are accumulated funds, revaluation reserves and restricted reserves.

Relevant significant accounting policies

Restricted reserves are a component of equity generally representing a particular use to which various parts of equity have been assigned. Reserves may be legally restricted or created by the Council.

Restricted reserves include those subject to specific conditions accepted as binding by the Council and which may not be revised by the Council without reference to the Courts or a third party. Transfers from these reserves may be made only for certain specified purposes or when certain specified conditions are met.

Also included in restricted reserves are reserves restricted by Council decision. The Council may alter them without reference to any third party or the Courts. Transfers to and from these reserves are at the discretion of the Council.

14 Cash and cash equivalents

Relevant significant accounting policies

Cash and cash equivalents include cash on hand, deposits held at call with banks, other short-term highly liquid investments with original maturities of three months or less, and bank overdrafts. Bank overdrafts are shown within borrowings in current liabilities in the statement of financial position.

15 Trade and other receivables and term receivables

Relevant significant accounting policies

Trade and other receivables are stated at cost less any allowances for estimated irrecoverable amounts. The carrying amount of trade and other receivables approximates their fair value.

Normally no interest is charged on the accounts receivable although in specific instances interest may be charged.

The Dunedin City Council does not provide for any impairment on rates receivable as it has various powers under the Local Government (Rating) Act 2002 to recover any outstanding debts. These powers allow the Council to commence legal proceedings to recover any rates that remain unpaid four months after the due date for payment. If payment has not been made within three months of the Court's judgement, then the Council can apply to the Registrar of the High Court to have the judgement enforced by sale or lease of the rating unit.

Rates are "written-off":

- when remitted in accordance with the Council's rates and remission policy; and

- in accordance with the write-off criteria of sections 90A (where rates cannot be reasonably recovered) and 90B (in relation to Māori freehold land) of the Local Government (Rating) Act 2002.

Other receivables are written-off when there is no reasonable expectation of recovery.

16 Other financial assets

(shown in $000s) Forecast 2025 Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Other current financial assets Waipori Fund interest bearing securities 13,426 14,426 15,329 15,464 15,599 15,734 15,869 16,004 16,139 16,274 13,426 14,426 15,329 15,464 15,599 15,734 15,869 16,004 16,139 16,274 Other non-current financial assets Waipori Fund interest bearing securities 54,736 56,068 57,632 58,786 59,981 61,220 62,505 63,835 65,215 66,644 Waipori Fund equity investments 38,010 38,011 36,405 36,720 37,035 37,350 37,665 37,980 38,295 38,610 Other shares 481 481 481 481 481 481 481 481 481 481 Advances to subsidiaries 112,000 112,000 112,000 112,000 112,000 112,000 112,000 112,000 112,000 112,000 205,227 206,560 206,518 207,987 209,497 211,051 212,651 214,296 215,991 217,735 218,653 220,986 221,847 223,451 225,096 226,785 228,520 230,300 232,130 234,009 Relevant significant accounting policies

Investments are recognised and derecognised on a trade date where a purchase or sale of an investment is under a contract whose terms require delivery of the investment within the timeframe established by the market concerned, and are initially measured at cost, including transaction costs.

Investments in debt and equity securities are financial instruments classified as held for trading and are measured at fair value in the surplus or deficit at balance date. Any resultant gains or losses are recognised in the surplus or deficit for the period.

Loans and advances are financial instruments that are measured at amortised cost using the effective interest method. This type of financial instrument includes deposits, term deposits, inter company loans, community loans and mortgages.

17 Accounts payable, accrued expenditure and employee entitlements

Relevant significant accounting policies

Trade and other payables are stated at cost.

Current portion employee entitlements

Employee benefits that are expected to be settled wholly before twelve months after the reporting period in which the employees render the related service are measured based on accrued entitlements at current rates of pay.

These include salaries and wages accrued up to balance date and annual leave earned to but not yet taken at balance date.

The Council recognises a liability for sick leave to the extent that absences in the coming year are expected to be greater than the sick leave entitlements earned in the coming year.

The current portion of the retirement gratuities provision has been calculated on an actuarial basis and is based on the reasonable likelihood that it will be earned by employees and paid by the Council.

Non-current portion employee entitlements

Employee benefits that are not expected to be settled wholly before twelve months after the end of the reporting period in which the employees render the related service, such as long service leave and retirement gratuities, have been calculated on an actuarial basis. The calculations are based on:

- likely future entitlements accruing to employees, based on years of service, years to entitlement, the likelihood that employees will reach the point of entitlement, and contractual entitlement information; and

- the present value of the estimated future cash flows.

Entitlements to the non-current portion of accrued long service leave and retirement gratuities are calculated on an actuarial basis and are based on the reasonable likelihood that they will be earned by employees and paid by the Council.

18 Term loans

Relevant significant accounting policies

Borrowings are initially recorded net of directly attributable transaction costs. Finance charges, premiums payable on settlement or redemption and direct costs are accounted for on an accrual basis to the surplus or deficit using the effective interest method.

19 Provisions

Relevant significant accounting policies

A provision is recognised in the balance sheet when the Council has a present legal or constructive obligation as a result of a past event, and it is probable that an outflow of economic benefits will be required to settle the obligation.

Provisions for restructuring costs are recognised when the Council has a detailed formal plan for the restructuring that has been communicated to affected parties.

20 Property, plant and equipment

Relevant significant accounting policies

Property, plant and equipment are those assets held by the Council for the purpose of carrying on its business activities on an ongoing basis.

Operationalassets

These include land, buildings, improvements, library books, plant and equipment, and motor vehicles.

Land and buildings

Land and buildings are stated at revalued amounts being fair value at date of valuation less any subsequent accumulated depreciation and subsequent accumulated

impairment losses. The revaluations are performed by an independent valuer on a three-yearly cycle.

Fixed plant and equipment

Fixed plant and equipment is stated at cost, less any subsequent accumulated depreciation and any accumulated impairment losses.

Vehicles, mobile plant

Motor vehicles and other mobile plant and equipment are stated at cost less any subsequent accumulated depreciation and any accumulated impairment losses.

Office equipment

Office equipment and fittings are stated at cost less any subsequent accumulated depreciation less any accumulated impairment losses.

Librarycollection

Library collections are stated at cost less any subsequent accumulated depreciation and any impairment losses.

Infrastructural assets

Infrastructure assets are the fixed utility systems owned by the Council. Each asset type includes all items that are required for the network to function; for example, sewer reticulation includes reticulation piping and sewer pump stations.

Land is stated at revalued amounts being fair value at date of valuation less any subsequent accumulated impairment losses. The revaluations are performed by an independent valuer on a three yearly cycle.

Landfill assets being earthworks, plant and machinery and the estimate of site restoration, are stated at cost less any accumulated depreciation and any accumulated impairment losses.

Roadways and bridges have been stated at their revalued amounts being fair value based on depreciated replacement cost as at the date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Roadways and bridges are valued annually by an independent valuer.

Plant and facilities have been stated at their revalued amounts being fair value based on depreciated replacement cost as at the date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Plant and facilities are valued annually externally by an independent valuer. Additions are recorded at cost and depreciated.

Reticulation assets, being the reticulation system and networks of water and drainage, have been stated at their revalued amounts being fair value based on depreciated replacement cost as at the date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Reticulation assets are valued annually externally by an independent valuer.

Restricted assets

Restricted assets are parks and reserves owned by the Council which cannot be disposed of because of legal or other restrictions, and provide a benefit or service to the community.

Land, buildings and structures are stated at revalued amounts being fair value at date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. The revaluations are performed by an independent valuer on a three yearly cycle.

Hard surfaces and reticulation systems are stated at revalued amounts being fair value at date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. The revaluations are performed by an independent valuer on a three yearly cycle.

Road reserve land is stated at revalued amounts being fair value at date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Revaluations are performed by an independent valuer on a three yearly cycle.

Playground and soft-fall areas are stated at revalued amounts being fair value at date of valuation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Revaluations are performed by an independent valuer on a four yearly cycle.

Fixed plant and equipment has been stated at their deemed cost being fair value at the date of valuation based on depreciated replacement cost less any subsequent accumulated depreciation and subsequent accumulated impairment losses.

Additions are recorded at cost and depreciated.

Heritage assets

These include, but are not limited to, assets held by the Council subject to deeds of agreement, terms and conditions of bequests, donations, trusts or other restrictive legal covenants. The Council’s control of these assets is restricted to a management/custodial role.

Heritage assets included are the Art Gallery Collection at the Dunedin Public Art Gallery, the Theomin Collection at Olveston, the Toitū Otago Settlers Museum and the monuments, statues and outdoor art as well as land and buildings of the railway station and Olveston.

Except land and buildings, all other heritage assets are stated at cost less any subsequent accumulated depreciation and accumulated impairment losses.

Vested assets

Vested assets are fixed assets given to the Council by a third party and could typically include water, drainage and roading assets created in the event of a subdivision.

Vested assets also occur in the event of the donation of heritage or art assets by third parties. The value of assets vested are recorded at fair value which could include

as sale or acquisition the cost price to the third party to create or purchase that asset and equates to its fair value at the date of acquisition. Vested assets, other than those pertaining to collections, are subsequently depreciated.

Revaluations

Revaluations are performed with sufficient regularity such that the carrying amount does not differ materially from that which would be determined using fair values at the balance sheet date.

Revaluation increases and decreases relating to individual assets within a class of assets are offset. Revaluation increases and decreases in respect of assets in different classes are not offset.

Where the carrying amount of a class of assets is increased as a result of a revaluation, the net revaluation increase is credited to the revaluation reserve. The net revaluation increase shall be recognised in the surplus or deficit to the extent that it reverses a net revaluation decrease of the same class of assets previously recognised in the surplus or deficit. A net revaluation decrease for a class of assets is recognised in the surplus or deficit, except to the extent it reverses a revaluation increase previously recognised in the revaluation

reserve to the extent of any credit balance existing in the revaluation reserve in respect of the same class of asset.

Derecognition

Items of property, plant and equipment are derecognised upon disposal or when no future economic benefits are expected to arise from the continued use of the asset.

Any gain or loss arising on derecognition of the asset (calculated as the difference between the net disposal proceeds and the carrying amount of the item) is included in the surplus or deficit in the year the item is derecognised.

Depreciation

Depreciation has been charged so as to write off the cost or valuation of assets, other than land, properties under construction and capital work in progress, on the straight line basis (SL). Rates used have been calculated to allocate the asset’s cost or valuation less estimated residual value over their estimated remaining useful lives.

Where parts of an item of property, plant and equipment have different useful lives, they are accounted for as

Depreciation rates and methods used are as follows:

Rate Method Infrastructure assets Roadways and bridges 1% to 25% SL Water reticulation 1% to 10% SL Sewerage reticulation 1% to 3% SL Stormwater reticulation 1% to 3% SL Water treatment plants and facilities 1% to 8% SL Sewerage treatment plants and facilities 1% to 8% SL Stormwater treatment plants and facilities 1% to 7% SL Landfill provision capitalised 6% SL Landfill plant and facilities 3% to 20% SL Heritage assets 0% to 6% SL Operational assets Buildings and structures 1% to 26% SL Plant and equipment 1% to 50% SL Motor vehicles 20% SL Office equipment and fittings 2% to 50% SL Library collections 20% SL Restricted assets Buildings and structures 0% to 50% SL Plant and equipment 2% to 25% SL Hard surfaces 2% to 33% SL Playground and soft-fall areas 3% to 11% SL 21 Investment property

(shown in $000s) Approved Budget 2025 Draft

Budget 2026Draft

Budget 2027Draft

Budget 2028Draft

Budget 2029Draft

Budget 2030Draft

Budget 2031Draft

Budget 2032Draft

Budget 2033Draft

Budget 2034Rental from investment properties 9,013 9,331 9,611 9,870 10,117 10,360 10,598 10,831 11,058 11,291 Investment property operating expenses -3,974 -4,130 -4,284 -4,425 -4,585 -4,748 -4,916 -5,079 -5,245 -5,395 5,039 5,201 5,327 5,445 5,532 5,612 5,682 5,752 5,813 5,896 Plus internal rental for car-park buildings 1,082 1,113 1,146 1,177 1,207 1,236 1,264 1,292 1,319 1,347 Less internal management fees and salaries -528 -528 -543 -558 -572 -586 -599 -612 -625 -638 554 585 603 619 635 650 665 680 694 709 Net income 5,593 5,786 5,930 6,064 6,167 6,262 6,347 6,432 6,507 6,605 Relevant significant accounting policies

Investment property is property held to earn rentals and/ or for capital appreciation. All investment properties are stated at fair value, as determined annually by independent valuers at the balance sheet date.

Gains or losses arising from changes in the fair value of investment properties are recognised in the surplus or deficit for the period in which the gain or loss arises.

22 Financial Instruments

Financial assets and financial liabilities are recognised on the statement of financial position when the Council becomes a party to the contractual provisions of the instrument.

Financial liabilities and equity instruments are classified according to the substance of the contractual arrangements entered into. An equity instrument is any contract that evidences a residual interest in the assets of the Council after deducting all of its liabilities.

Under PBE IPSAS 41, all the financial assets and liabilities are measured at amortised cost, fair value through profit or loss, or fair value through other comprehensive income on the basis of the Council’s business model for managing the financial instrument and the contractual cash flow characteristics of the financial instrument.

The Council enters into derivative financial instruments to manage its exposure to interest rate risks. Interest rate swap contracts are used to hedge these exposures. Interest rate swaps are fair valued using forward interest rates extracted from observable yield curves.

LGFA Borrower Notes are measured at amortised cost in accordance with PBE IPSAS 41.

The Council does not use derivative financial instruments for speculative purposes. However, any derivatives that do not qualify for hedge accounting, under the specific NZ IFRS rules, would be accounted for as trading instruments with fair value gains/losses being taken directly to the Statement of Comprehensive Revenue and Expense.

Derivative financial instruments are recognised at fair value on the date the derivative is entered into and are subsequently re-measured to their fair value. The fair value on initial recognition is the transaction price. Subsequent fair values are based on independent prices quoted in active markets.

The accounting for subsequent changes in fair value depends on whether the derivative is designated as a hedging instrument, and if so, the nature of the item being hedged. The Council designates certain derivatives as either:

- hedges of the fair value of recognised assets or liabilities or a firm commitment (fair value hedges), or

- hedges of a particular risk associated with the cash flows of recognised assets and liabilities and highly probable forecast transactions (cash flow hedges).

The fair value of interest rate swaps is calculated based on pricing using independent data. Those quotes are tested for reasonableness by discounting estimated future cash flows based on the terms and maturity of each contract and using market interest rates for a similar instrument at the measurement date.

The gain or loss from re-measuring the hedging instrument at fair value, along with the changes in the fair value on the hedged item attributable to the hedged risk, is recognised in the surplus or loss. Fair value hedge accounting is applied only for hedging fixed interest risk on borrowings.

If the hedge relationship no longer meets the criteria for hedge accounting, the adjustment to the carrying amount of a hedged item for which the effective interest method is used is amortised to the surplus or loss over the period to maturity.

Changes in the fair value of derivative financial instruments that are designated and effective as hedges of future cash flows are recognised directly in equity with any ineffective portion recognised immediately in the Statement of Comprehensive Revenue and Expense. If the cash flow hedge of a firm commitment or forecasted transaction results in the recognition of an asset or a liability, then, at the time the asset or liability is recognised, the associated gains or losses on the derivative that had previously been recognised in equity are included in the initial measurement of the asset or liability. For hedges that do not result in the recognition of an asset or a liability, amounts deferred in equity are recognised in the Statement of Comprehensive Revenue and Expense in the same period in which the hedged item affects net surplus or loss.

Changes in the fair value of derivative financial instruments that do not qualify for hedge accounting are recognised in the Statement of Comprehensive Revenue and Expense as they arise. Derivatives not designated into an effective hedge relationship are classified as current assets or liabilities.

Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated, or exercised, or no longer qualifies for hedge accounting. At that time, any cumulative gain or loss on the hedging instrument recognised in equity is retained in equity until the forecast transaction occurs. If a hedged transaction is no longer expected to occur, the net cumulative gain or loss recognised in equity is transferred to the income statement for the period.

Derivatives embedded in other financial instruments or other host contracts are treated as separate derivatives when their risks and characteristics are not closely related to those of host contracts and the host contracts are not carried at fair value with unrealised gains or losses reported in the income statement.

For an effective hedge of an exposure to changes in the fair value, the hedged item is adjusted for changes in fair value attributable to the risk being hedged with the corresponding entry in the Statement of Comprehensive Revenue and Expense via other comprehensive income.

Gains or losses from re-measuring the derivative, or for non-derivatives the foreign currency component of its carrying amount, are recognised in the Statement of Comprehensive Revenue and Expense via other comprehensive income.

The fair value of a hedging derivative is classified as a non-current asset or liability if the remaining maturity of the hedge relationship is more than twelve months and as a current liability if the remaining maturity of the hedge relationship is less than twelve months.

Changes in the fair value of derivative financial instruments that do not qualify for hedge accounting are recognised in the Statement of Comprehensive Revenue and Expense as they arise. Derivatives not designated into an effective hedge relationship are classified as current assets or liabilities.

-

Prospective Information for the years ended 30 June 2026 – 2034

The Council has not presented group prospective financial statements. The prospective financial statements are for core Council only.

The main purpose of prospective financial statements in the 9 year Plan is to provide users with information about the core services that the Council intends to provide ratepayers, the expected cost of those services and, as a consequence, how much the Council requires by way of rates to fund the intended levels of service.

The level of rates funding required is not affected by subsidiaries except to the extent that the Council obtains distributions from, or further invests in, those subsidiaries. Such effects are included in the prospective financial statements of the Council.

The forecast financial statements have been prepared in accordance with the Local Government Act 2002.

The Local Government Act 2002 requires a council to, at all times, have a long-term plan under Section 93, which covers a period of not less than 10 consecutive financial years; and includes the information required by Part 1 of Schedule 10.

Under Section 93 of the Local Government Act 2002, the purpose of a long term plan is to:

- describe the activities of the local authority; and

- describe the community outcomes of the local authority's district or region; and

- provide integrated decision-making and co-ordination of the resources of the local authority; and

- provide a long-term focus for the decisions and activities of the local authority; and

- provide a basis for accountability of the local authority to the community.

The Council adopted the 9 year plan on 30 June 2025.

The Council is responsible for the forecast financial statements including the appropriateness of the underlying assumptions and other disclosures.

Nature of Prospective Information

The forecast financial statements are prepared in accordance with Tier 1 Public Benefit Entity Financial Reporting Standard 42. They are prepared on the basis of best-estimate assumptions as to future events, which the Council expects to take place in June 2025.

Cautionary Note

The forecast financial statements are prospective financial information. Actual results are likely to vary from the information presented, and the variations may be material.

The following assumptions, which have a high level of uncertainty, could lead to a material difference to the prospective financial statements. The uncertainties could lead to additional rates revenue and/or debt to the extent that budgets cannot be reprioritised.

- Projected usually resident population growth - potential impacts of higher or lower than anticipated population growth are an increase or decrease in demand for services and infrastructure creating potential for under or overspend of the 9 year plan budget.

- Projected visitor numbers - the potential impact of lower or higher than anticipated visitor growth could impact on the Dunedin economy and timing/demand for infrastructure.

- Climate change - the ability to meet the DCC organisation's emissions by 42% by 2031."

The following assumption, which has a high level of uncertainty, could lead to a material difference to the prospective financial statements. The uncertainty could lead to assets being transferred to a new entity. This would impact on operating revenues, operating costs, assets, debt, the Financial Strategy and the Infrastructure Strategy.

- Proposed 3 Waters reform - Local Water Done Well

Extent to which Prospective Information Incorporates Actual Results

The period covered by the 9 year plan contains no actual operating results, but the forecast balance sheet is extrapolated from the audited Statement of Financial Position included in the Dunedin City Council Annual Report as at 30 June 2024.

Basis of Underlying Assumptions

The 9 year plan brings together summary information from several vastly detailed and comprehensive strategic planning processes. There are a number of Council strategies, plans and policies that guide the Council’s decision-making and influence the content of this plan.

All Council groups of activities have prepared Group Management Plans. These plans have been prepared using standard templates and business assumptions. The most significant business assumption is the provision of the same level of service, which implies there will be no termination of service for any activity.

-

10 Year Plan Disclosure Statement for the years ended 30 June 2026 – 2034

What is the purpose of this Statement?

The purpose of this statement is to disclose the Council's planned financial performance in relation to various benchmarks to enable the assessment of whether the Council is prudently managing its revenues, expenses, assets, liabilities, and general financial dealings.

The Council is required to include this statement in its long-term plan in accordance with the Local Government (Financial Reporting and Prudence) Regulations 2014 (the regulations). Refer to the regulations for more information, including definitions of some of the terms used in this statement.

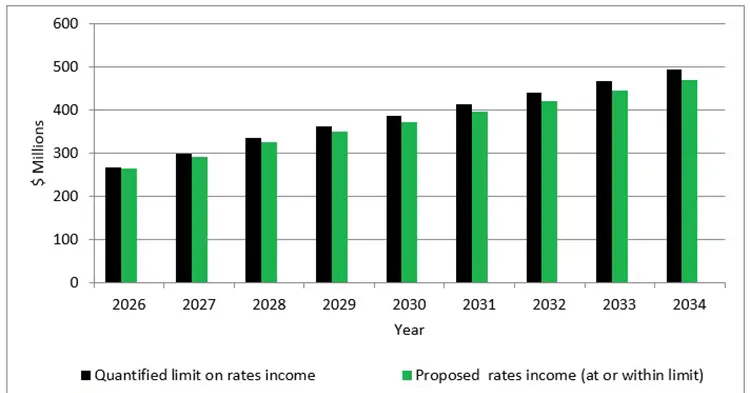

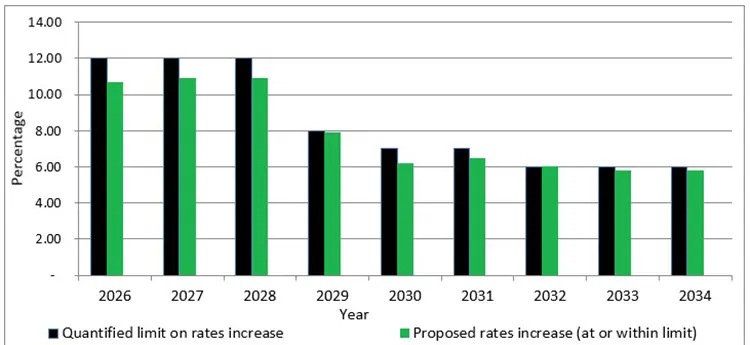

Rates Affordability Benchmark

The Council meets the rates affordability benchmark if –

- Its planned rates income equals or is less than each quantified limit on rates; and

- Its planned rates increases equal or are less than each quantified limit on rates increases.

Rates (Income) Affordability

The following graph compares the Council's planned rates with a quantified limit on rates contained in the financial strategy included in the Council's long-term plan. The quantified limit is $268 million for the 2025/26 year.

Year Quantified limit on rates income Proposed rates income (at or within limit) 2026 268 265 2027 300 293 2028 336 325 2029 363 351 2030 388 373 2031 415 397 2032 440 421 2033 467 445 2034 495 471 Rates (Increases) Affordability

The following graph compares the Council's planned rates increases with a quantified limit on rates increases contained in the financial strategy included in the Council's long term plan. The quantified limit is 12.0% for the 2025/26 year. Please refer to the financial strategy for the quantified limits for the remaining eight years.

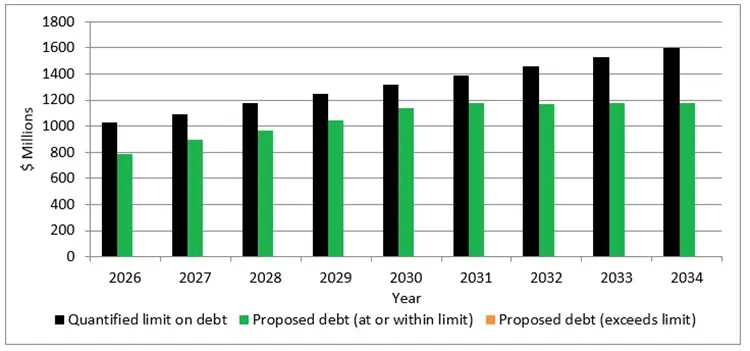

Year Quantified limit on rates increase Proposed rates increase (at or within limit) 2026 12.0 10.7 2027 12.0 10.9 2028 12.0 10.9 2029 8.0 7.9 2030 7.0 6.2 2031 7.0 6.5 2032 6.0 6.0 2033 6.0 5.8 2034 6.0 5.8 Debt Affordability Benchmark

The Council meets the debt affordability benchmark if its planned borrowing is within each quantified limit on borrowing.

The following graph compares the Council's planned debt with a quantified limit on borrowing contained in the financial strategy included in the Council's long term plan. The quantified limit is $1,026 million for the 2025/26 year. Please refer to the financial strategy for the quantified limits for the remaining nine years.

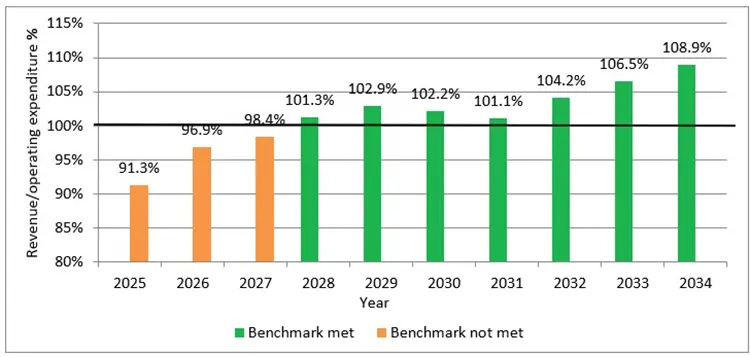

Year Quantified limit on debt Proposed debt (at or within limit) 2026 1026 789 2027 1089 896 2028 1177 970 2029 1251 1046 2030 1318 1139 2031 1390 1175 2032 1460 1171 2033 1528 1179 2034 1602 1180 Balanced Budget Benchmark

The following graph displays the Council's planned revenue (excluding development contributions, financial contributions, vested assets, gains on derivative financial instruments and revaluations of property, plant or equipment) as a proportion of planned operating expenses (excluding losses on derivative financial instruments and revaluations of property, plant or equipment).

The Council meets the balanced budget benchmark if its planned revenue equals or is greater than its planned operating expenses.

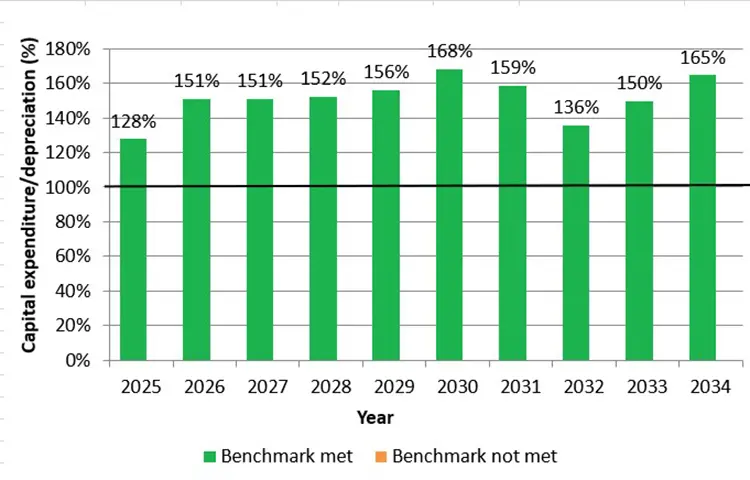

Year Benchmark met Benchmark not met 2025 91.3% 2026 96.9% 2027 98.4% 2028 101.3% 2029 102.9% 2030 102.2% 2031 101.1% 2032 104.2% 2033 106.5% 2034 108.9% Essential Services Benchmark

The following graph displays the Council's planned capital expenditure on network services as a proportion of expected depreciation on network services.

The Council meets the essential services benchmark if its planned capital expenditure on network services equals or is greater than expected depreciation on network services.

Year Benchmark met Benchmark not met 2025 128% 2026 151% 2027 151% 2028 152% 2029 156% 2030 168% 2031 159% 2032 136% 2033 150% 2034 165% Debt Servicing Benchmark

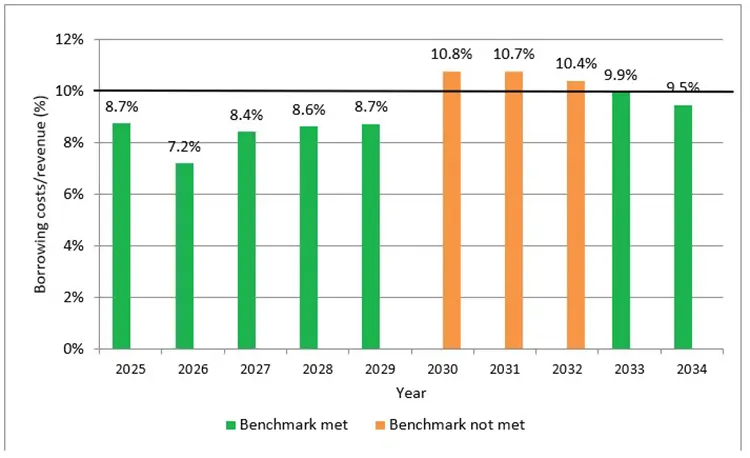

The following graph displays the Council's planned borrowing costs as a proportion of planned revenue (excluding development contributions, financial contributions, vested assets, gains on derivative financial instruments, and revaluations of property, plant or equipment).

Because Statistics New Zealand projects the Council's population will grow more slowly than the national population is expected to grow, it meets the debt servicing benchmark if its planned borrowing costs equal or are less than 10% of its revenue.

Year Benchmark met Benchmark not met 2025 8.7% 2026 7.2% 2027 8.4% 2028 8.6% 2029 8.7% 2030 10.8% 2031 10.7% 2032 10.4% 2033 9.9% 2034 9.5%

Current Alerts and Notices (View all)

Financial statements and disclosures | he pūroko tahua, tūhurataka

Last updated: 11 Dec 2025 9:00am